13 May 2016

Shire

of Esperance

Ordinary

Council

NOTICE

OF MEETING AND AGENDA

An Agenda Briefing Session of the Shire of Esperance will

be held at Council Chambers on 17 May 2016 commencing at 1pm to brief Council

on the matters set out in the attached agenda.

An Ordinary Council meeting of the Shire of Esperance

will be held at Council Chambers on 24 May 2016 commencing at 4pm to consider

the matters set out in the attached agenda.

W M (Matthew) Scott

Chief Executive Officer

DISCLAIMER

No responsibility whatsoever is implied or accepted by the

Shire of Esperance for any act, omission or statement or intimation occurring

during Council or Committee meetings. The Shire of Esperance disclaims any

liability for any loss whatsoever and howsoever caused arising out of reliance

by any person or legal entity on any such act, omission or statement or

intimation occurring during Council or Committee meetings. Any person or legal

entity who acts or fails to act in reliance upon any statement, act or omission

made in a Council or Committee meeting does so at that person’s or legal

entity’s own risk.

In particular and without derogating in any way from the

broad disclaimer above, in any discussion regarding any planning application or

application for a licence, any statement or intimation of approval made by a

member or officer of the Shire of Esperance during the course of any meeting is

not intended to be and is not to be taken as notice of approval from the Shire

of Esperance. The Shire of Esperance warns that anyone who has any application

lodged with the Shire of Esperance must obtain and should only rely on written

confirmation of the outcome of the application, and any conditions attaching to

the decision made by the Shire of Esperance in respect of the application.

ETHICAL DECISION

MAKING AND CONFLICTS OF INTEREST

Council is committed to a code of conduct and all decisions

are based on an honest assessment of the issue, ethical decision-making and

personal integrity. Councillors and staff adhere to the statutory requirements

to declare financial, proximity and impartiality interests and once declared

follow the legislation as required.

ATTACHMENTS

Please be advised that in order

to save printing and paper costs, all attachments referenced in this paper are

available in the original Agenda document for this meeting.

Disclosure of Financial, Proximity

or Impartiality Interests

Disclosure of Financial, Proximity

or Impartiality Interests

Local

Government Act 1995 – Section 5.65, 5.70 and 5.71 and Local

Government (Administration) Regulation 34C

Agenda Briefing ¨

Ordinary Council Meeting ¨

Both Meetings ¨

Name of Person Declaring the Interest:

Name of Person Declaring the Interest:

Position:

Date

of Meeting:

Position:

Date

of Meeting:

This form is provided to

enable members and officers to disclose an Interest in the matter in accordance

with the regulations of Section 5.65, 5.70 and 5.71 of the Local Government Act

and Local Government (Administration) Regulation 34C.

|

Interest

Disclosed

Item

No: Item

No:

Subject: Subject:

Nature of Interest:

Type of Interest:

Financial

Proximity

Impartiality

|

|

Interest

Disclosed

Item

No: Item

No:

Subject: Subject:

Nature of Interest:

Type of

Interest:

Financial

Proximity

Impartiality

|

|

Interest

Disclosed

Item

No: Item

No:

Subject: Subject:

Nature of Interest:

Type of

Interest:

Financial

Proximity

Impartiality

|

Signature: Date:

Signature: Date:

|

Office Use Only:

Entered

into interest Register: Entered

into interest Register:

Officer

Date

|

Declaration of

Interest (Notes for Your Guidance)

Declaration of

Interest (Notes for Your Guidance)

A member who has a Financial

Interest in any matter to be discussed

at a Council or Committee Meeting, which will be attended by the member, must

disclose the nature of the interest:

a) In a written notice

given to the Chief Executive Officers before the Meeting or;

b) At the Meeting,

immediately before the matter is discussed.

A member, who makes a

disclosure in respect to an interest, must not:

c) Preside at the part

of the Meeting, relation to the matter or;

d) Participate in, or

be present during any discussion or decision-making procedure relative to the

matter, unless to the extent that the disclosing member is allowed to do so

under Section 5.68 or Section 5.69 of the Local Government Act 1995.

Notes on Financial Interest (For your Guidance)

The following notes are a

basic guide for Councillors when they are considering whether they have a Financial Interest in a matter.

1. A Financial Interest

requiring disclosure occurs when a Council decision might advantageously or

detrimentally affect the Councillor or a person closely associated with the

Councillor and is capable of being measured in money terms. There are

expectations in the Local

Government Act 1995 but they should not be relied on without advice, unless the

situation is very clear.

2. If a Councillor is a

member of an Association (which is a Body Corporate) with not less than 10

members i.e sporting, social, religious ect, and the Councillor is not a holder

of office of profit or a guarantor, and has not leased land to or from the

club, i.e, if the Councillor is an ordinary member of the Association, the

Councillor has a common and not a financial interest in any matter to that

Association.

3. If an interest is

shared in common with a significant number of electors and ratepayers, then the

obligation to disclose that interest does not arise. Each case need to be

considered.

4. If in doubt declare.

5. As stated in (b)

above, if written notice disclosing the interest has not been given to the

Chief Executive Officer before the meeting, then it must be given when the matter arises in the Agenda, and

immediately before the matter is discussed.

6. Ordinarily the

disclosing Councillor must leave the meeting room before discussion commences.

The only exceptions are:

6.1 Where the Councillor

discloses the extent of the interest, and

Council carries a motion under s.5.68(1)(b)(ii) of the Local Government Act; or

6.2 Where the Minister

allows the Councillor to participate under s.5.69(3) of the Local Government

Act, with or without conditions.

Interests Affecting Proximity

1) For the purposes of this subdivision, a person has a

proximity interest in a matter if the matter concerns;

a)

a proposed change to a planning scheme affecting land that

adjoins the person’s land;

b)

a proposed change to the zoning or use of land that adjoins

the person’s land; or

c)

a proposed development (as defined in section 5.63(5)) of

land that adjoins the person’s land.

2) In this section, land (the proposal land) adjoins a

person’s land if;

a)

The proposal land, not being a thoroughfare, has a common

boundary with the person’s land;

b)

The proposal land, or any part of it, is directly across a

thoroughfare from, the person’s land; or

c)

The proposal land is that part of a thoroughfare that has a

common boundary with the person’s land.

3) In this section a reference to a person’s land is a

reference to any land owned by the person or in which the person has any estate

or interest.

Interests Affecting Impartiality

Definition: An

interest that would give rise to a reasonable belief that the impartiality of

the person having the interest would be adversely affected, but does not

include an interest as referred to in Section 5.60 of the ‘Act’.

A member who has an Interest

Affecting Impartiality in any

matter to be discussed at a Council or Committee Meeting, which will be

attended by the member, must disclose the nature of the interest;

a) In a written notice

given to the Chief Executive Officers before the Meeting or;

b) At the Meeting,

immediately before the matter is discussed.

Impact of an Impartiality Closure

There are very different

outcomes resulting from disclosing an interest affecting impartiality compared

to that of a financial interest. With the declaration of a financial interest,

an elected member leaves the room and does not vote.

With the declaration of

this new type of interest, the elected member stays in the room, participates

in the debate and votes. In effect then, following disclosure of an interest

affecting impartiality, the member’s involvement in the Meeting continues

as if no interest existed.

SHIRE OF ESPERANCE

AGENDA

Ordinary

Council Meeting

TO BE HELD IN Council Chambers ON 24 May 2016

COMMENCING

AT 4pm

1. OFFICIAL OPENING

2. ATTENDANCE

Members

Cr V Brown President Rural

Ward

Cr N Bowman Deputy

President Rural Ward

Cr J Parsons Town

Ward

Cr P Griffiths Town

Ward

Cr K Hall Town

Ward

Cr L McIntyre Town

Ward

Cr R Padgurskis Town

Ward

Cr B Stewart, JP Town

Ward

Cr B Parker Rural

Ward

Shire

Officers

Mr W

M (Matthew) Scott Chief

Executive Officer

Mr S

Burge Director

Corporate Resources

Mr

M Walker Acting

Director Asset Management

Mr T

Sargent Director

External Services

Mr

R Hindley Executive

Manager – Statutory Division

Miss

S Fitzgerald Administration

Officer

Members

of the Public & Press

3. APOLOGIES & NOTIFICATION OF

GRANTED LEAVE OF ABSENCE

4. APPLICATIONS FOR LEAVE OF ABSENCE

5. ANNOUNCEMENTS BY THE PERSON PRESIDING

WITHOUT DISCUSSION

6. DECLARATION OF MEMBERS INTERESTS

6.1 Declarations

of Financial Interests – Local Government Act Section 5.60a

6.2 Declarations

of Proximity Interests – Local Government Act Section 5.60b

6.3 Declarations

of Impartiality Interests – Admin Regulations Section 34c

7. PUBLIC QUESTION TIME

8. PUBLIC ADDRESSES / DEPUTATIONS

9. Petitions

10. CONFIRMATION OF MINUTES

|

That

the Minutes of the Ordinary Council Meeting of the 26 April 2016 be confirmed

as a true and correct record.

Voting Requirement Simple Majority

|

11. DELEGATES’ REPORTS WITHOUT

DISCUSSION

12. MATTERS REQUIRING A DETERMINATION OF

COUNCIL

12.1 External Services - Statutory Division

Item: 12.1.1

Local

Emergency Management Arrangements

|

Author/s

|

Lonica Collins

|

Community Emergency Services Coordinator

|

|

Authorisor/s

|

Terry Sargent

|

Director External Services

|

File Ref: D16/10809

Applicant

Local Emergency Management Committee

Location/Address

Shire of Esperance

Executive Summary

For Council to consider adopting the revised Shire of

Esperance Local Emergency Management Arrangements.

Recommendation in Brief

That Council adopts the revised Shire of Esperance

Local Emergency Management Arrangements as attached.

Background

The Local Emergency Management Arrangements provide a

generic guide for the initial response to a large scale emergency within the

Shire. These Arrangements are written by the Shire in consultation with the

responding agencies.

It is a legislative requirement that every Shire has a

set of Arrangements in place and they be updated periodically. The current

Arrangements were completed in 2014 and have been revised since the fires in

November 2015.

Officer’s Comments

The existing Local Management Arrangements were completed in

2014 to meet the requirements of the newly implemented Emergency Management Act

2005.

Following the response phase a review of the Local

Emergency Management Arrangements were undertaken with a subsequent revision

that took into account the lessons learnt following the November 2015 fires.

This allowed the Local Emergency Management Arrangements to include current

best practice standards developed in consultation with the State Emergency

Management Committee, with further changes including the updating of contact

details for varying organisation’s as well as some small minor changes to

wording.

The Shire of Esperance Local Emergency Management

Arrangements was presented to the LEMC at the meeting held on 13 April 2016 for

consideration. Following comments in relation to minor matters, not affecting

the major content or layout of the plan, these comments were taken into account

and the required amendments incorporated within the Local Emergency Management

Arrangements. The LEMC endorsed the Local Emergency Management Arrangements for

Council to consider adopting the document. Once adopted the Local Emergency

Management Arrangements document will be forwarded to the District Emergency

Management Committee and State Emergency Management Committee of endorsement.

Consultation

Emergency response agencies

Local Emergency Management Committee (LEMC)

Statutory Implications

Emergency Management Act 2005

Section 41

Strategic Implications

Strategic Community Plan 2012-2022

Social

1.5 Create and maintain a safe environment

for the community.

Attachments

|

a.

|

Local Emergency Management

Committee - Minutes - April 2016

|

|

|

b.

|

Local Emergency Management

Arrangements - Under Separate Cover

|

|

|

Officer’s Recommendation

That Council

1. Adopt the Shire of

Esperance Local Emergency Management Arrangements as attached; and

2. Refer the Shire of

Esperance Local Emergency Management Arrangements to the State Emergency

Management Committee (SEMC) for endorsement.

Simple

Majority

|

Item: 12.1.2

Adoption

of Local Recovery Plan

|

Author/s

|

Amelia Rolton

|

Personal Assistant - Asset Management

|

|

Authorisor/s

|

Mathew Walker

|

Acting Director Asset Management

|

File Ref: D16/5729

Applicant

Internal

Executive Summary

As part of an overall review of the Shire of Esperance Local

Emergency Management Arrangements (LEMA) shire staff completed a review prior

to the November 2015 Fires. Following the initial Recovery phase a further

review and subsequent rewrite of the Local Recovery Plan was undertaken.

This report recommends Council adopt the Shire of Esperance

Local Recovery Plan.

Recommendation in Brief

That Council adopts the Shire of Esperance Local

Recovery Plan and forwards a copy to the State Emergency Management Committee

(SEMC) for endorsement.

Background

Recovery is

about more than replacing what was.

Recovery is

about enabling and supporting community sustainability during and after a

disaster. The recovery process must begin during the response phase in order to

both identify community needs as affected by the disaster or response

activities and to begin planning for the transition from response to recover.

Recovery can also provide opportunity to improve community resilience to

disaster by “enhancing social infrastructure, natural and built

environments, and economies” (Community Recovery Handbook 2 p17)

Effective

and lasting recovery occurs when a community works together and recognises the

personal, social, financial, health, industry and economic factors that need to

be considered and planned for. Comprehensive recovery requires private, health,

infrastructure, lifeline services, government and non-government sectors to

work together as a community is affected and supported at different levels by

each of these sectors.

Successful

recovery:

§ Is based on an understanding of the

community context

§ Acknowledges the complex and dynamic

nature of emergencies and communities

§ Is responsive and flexible, engaging

communities and empowering them to move forward

§ Requires a planned, coordinated and

adaptive approach based on continuing assessment of impacts and needs

§ Is built on effective communication

with affected communities and other stakeholders

§ Recognises, supports and builds upon

community, individual and organisational capacity.

(Community

Recovery Handbook 2 pp 34-37)

Under Section 36(b) of the Emergency Management Act

2005, it is a function of local government to management recovery following

an emergency affecting the community in its district. Recovery management is

the coordinated process of supporting ‘emergency affected communities in

the reconstruction and restoration of physical infrastructure, the environment

and community, psychosocial, and economic wellbeing’ (Emergency

Management Act 2005.) Local Governments are to ensure the preparation and

maintenance of local recovery arrangements. This includes the preparation of a

Local Recovery Plan for inclusion in the Local Emergency Management

Arrangements as detailed in State Emergency Management Policy (SEMP) 2.5.

Officer’s Comment

The implementation of successful Recovery needs to be

managed and planned for in a structured manner. This Local Recovery Plan covers

how to provide a coordinated approach to the management of supporting disaster

affected communities in the reconstruction of physical infrastructure and

restoration of emotional, social, economic and physical well-being.

A Local Recovery Plan should be practical, easy to use

and must be easily accessible to community members and emergency managers. The Plan

is a part of the Local Emergency Management Arrangements, and the LEMC should

be engaged in its development.

The Local Recovery Plan has been developed to clearly

identify recovery management arrangements and operational considerations. It

identifies any agreements that have been made between the Shire of Esperance

and emergency management agencies and it referred to other appropriate

documents where necessary.

The Local Recovery Plan was compiled in 2015, and was

in draft form at the time of the November 2015 fires. As the draft plan was

completed and more current than the current 2007 document it was to replace,

the draft Local Recovery Plan was used to guide the recovery process.

Following the initial recovery phase a further review

of the Local Recovery Plan was undertaken with a subsequent revision that took

into account the lessons learnt following the November 2015 fires. This allowed

the Local Recovery Plan to include current best practice standards developed in

consultation with the State Emergency Management Committee.

The Shire of Esperance Local Recovery Plan was

presented to the LEMC at the meeting held on 13 April 2016 for consideration.

Following comments in relation to minor matters, not affecting the major

content or layout of the plan, these comments were taken into account and the

required amendments incorporated within the Local Recovery Plan. The LEMC

decided to defer endorsing the plan until the 4 May 2016, to allow members to

have sufficient time to undertake a review of the document. On 4 May 2016 the

LEMC endorsed the Shire of Esperance Local Recovery Plan for presentation to

Council for adoption subject to consideration of any final comments from

committee members.

Consultation

State Emergency Management Committee (SEMC)

Esperance Local Emergency Management Committee (LEMC)

Department of Fire and Emergency Services (DFES)

Financial Implications

While adoption of the Shire of Esperance Local

Recovery Plan would have negligible financial implications it is acknowledged that

the practical application of the plan following an incident/emergency could

present major financial implications.

Statutory Implications

The Emergency Management Act 2005 states

Section 36b

“It is a function of a local government to manage

recovery following an emergency affecting the community in its district”

Section 41 (4)

“Local Emergency Management Arrangements are to include

a recovery plan and the nomination of a recovery coordinator”

Strategic Implications

Strategic Community Plan 2012 – 2022

Social

1.1 Create and maintain a

safe environment for the community

Civic Leadership

4.5 Create and maintain a

safe environment for the community

Attachments

|

a.

|

Shire of Esperance Draft Local

Recovery Plan - Under Separate Cover

|

|

|

Officer’s Recommendation

That Council

1. Adopt the Shire of

Esperance Local Recovery Plan as attached; and

2. Refer the Shire of

Esperance Local Recovery Plan to the State Emergency Management Committee

(SEMC) for endorsement.

Voting Requirement Simple Majority

|

12.2 External

Services - Commercial Division

12.3 External Service - Community Division

12.4 Asset Management

12.5 Corporate Resources

Item: 12.5.1

Transfer

of Management Order - Reserve 27099 - Grass Patch Primary School

|

Author/s

|

Jennifer Parry

|

Manager Corporate Support

|

|

Authorisor/s

|

Shane Burge

|

Director Corporate Resources

|

File Ref: D16/9559

Applicant

Grass Patch Community Development Association Inc.

Location/Address

Reserve 27099, Lot 67 Freeman Street, Grass Patch

Executive Summary

For Council to consider supporting the Grass Patch

Community Development Association in their application to the Department of

Education seeking management for the premises known as Grass Patch Primary

School on Reserve 27099, Lot 67 Freeman Street Grass Patch.

Recommendation in Brief

That Council provides written support for the Grass

Patch Community Development Association’s application to the Department

of Education, for a transfer of management to the Association for the premises

known as Grass Patch Primary School, Reserve 27099, Lot 67 Freeman Street Grass

Patch, subject to approval by the Minister for Lands.

Background

A letter from the Grass Patch Community Development

Association (CDA) was received on 23 March 2016 regarding a request to the

Department of Education to consider transferring the management of the premises

to the Grass Patch CDA for an initial term of 5 years.

Officer’s Comment

Following the recent closure of Grass Patch Primary

School, Grass Patch CDA have requested for a transfer of management so that

they can continue to use the land and associated buildings for community

purposes. The Grass Patch CDA would like to retain the use of the building for

the next 5 years, in which time they will review the possibilities for future

use of the building.

The Association has confirmed that they are aware of

the financial implications of the building maintenance and they are confident

they have adequate funding to meet building maintenance requirements.

Consultation

Department of Lands

Department of Education

Statutory Implications

Land Administration Act 1997 – Section 18 Crown Land

Transactions that require Ministers Approval

Policy Implications

COR 004: Building and Property Leases

Strategic Implications

Strategic Community Plan 2012 - 2022

Civic Leadership

Be innovative in the

management of Shire operations, services, staff and resources to create a

resilient and financially stable Shire

A Shire that is

progressive, sustainable, resilient and adaptive to changes

Corporate Business Plan 2013/2014 – 2016/2017

Action 4.5.12 Manage Shire leases and insurances

Attachments

|

a.

|

Letter seeking Council Support -

Transfer of management - Grass Patch CDA

|

|

|

Officer’s Recommendation

That Council provide written support for Grass Patch

Community Development Association’s application to the Department of

Education, for a transfer of management to the Association for the premises

known as Grass Patch Primary School, Reserve 27099, Lot 67 Freeman Street

Grass Patch, subject to approval by the Minister for Lands.

Voting Requirement Simple Majority

|

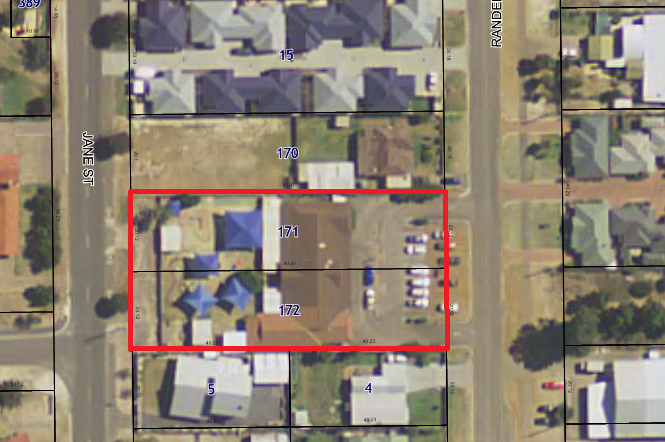

Item: 12.5.2

Request

for new Lease - Lingalonga Early Years Learning Centre

|

Author/s

|

Jennifer Parry

|

Manager Corporate Support

|

|

Authorisor/s

|

Shane Burge

|

Director Corporate Resources

|

File Ref: D16/9854

Applicant

Linglonga Early Years Learning Centre Inc.

Location/Address

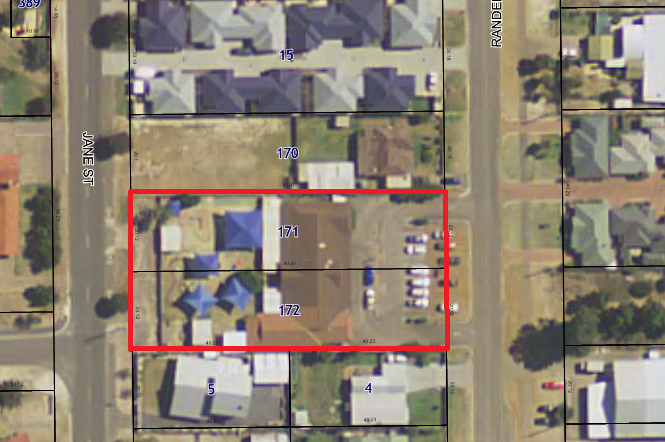

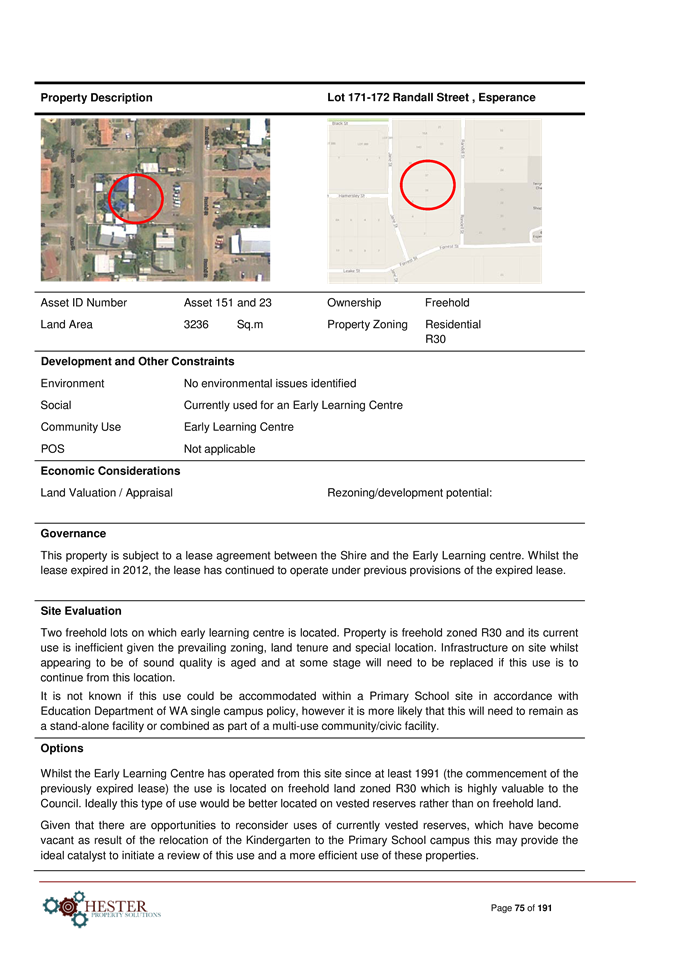

Lot 171 and Lot 172, Randall Street Esperance

Executive Summary

For Council to consider granting a new lease to

Linglonga Early Years Learning Centre Inc. (Linglonga) for Lot 171 and Lot 172,

Randall Street, Esperance.

Recommendation in Brief

That Council agrees to lease Lot 171 and Lot 172

Randall Street to Linglonga Early Years Learning Centre Inc. for a term of 5

years, with three (3) additional options of 5 years each subject to certain

conditions.

Background

The current lease between the Shire and Linglonga for

Lot 171 and Lot 172 Randall Street commenced 5 August 1991. The lease term was

for 21 years, and expired on 4 August 2012; the lease contained a ‘hold

over’ clause which has allowed for continuation on a monthly tenancy

under all other terms and conditions of the lease.

Forming part of the current lease is a Deed of Trust

between Linglonga, the Shire and the Lotteries Commission. The Lotteries

Commission provided the funding for the construction of the Lingalonga premises

on Shire freehold land.

Lotterywest have been contacted and a request made for

the Deed of Trust to be repealed as it is a Deed in Perpetuity and does not end

with the current lease. The Deed has now been in place for 25 years.

Lotterywest have advised that they would be willing to repeal the Deed but feel

that they have a duty of care to Linglonga and will only do so (repeal) if a

new lease is in place ensuring Linglonga’s immediate future. Lotterywest

have agreed to repeal the Deed following the Council Resolution to grant a new

lease to Linglonga, consequently allowing the new lease to be created without

the Deed of Trust.

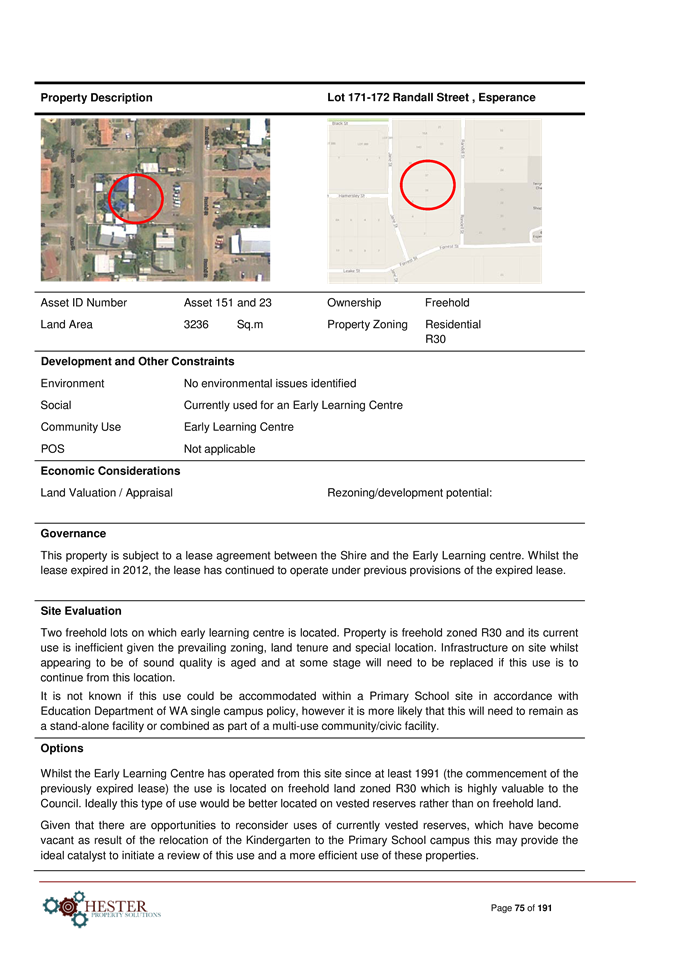

Officer’s Comment

Officers did not pursue the lease renewal previously

as possible future options for the land were being considered by the Shire of

Esperance Land Use Group (following the information received in the Hester

Solutions Public Land Strategy Report) for recommendation to Senior Management.

Deliberations on this and other matters by the Land Use Group have stalled

leading Manager Corporate Support to request the future intentions for the land

from Linglonga. Their response is the request for a new lease in the letter

attached.

In accordance with the Public Land Strategy Report

released in 2014, the property is freehold zoned R30 and its current use is

deemed inefficient due to the prevailing zoning, land tenure and special

location. As the land is zoned R30 and is deemed highly valuable to Council,

and the strategy identifies there could be a possible opportunity for

rezoning/development (See attachment A for full summary), an initial lease term

of 5 years, with three (3) further options of 5 years each is recommended. It

is proposed that a redevelopment clause should also be included in the lease

providing Council with an option should the opportunity arise to develop this

land as recommended in the Public Land Strategy Report.

Linglonga Management Committee has adhered to their

obligations with regards to insurance, building maintenance & upgrades,

compliance and utility costs in the past. All negotiations with Linglonga have

been amiable and no reason can be found as to why a new lease would not be

granted.

Consultation

Lotterywest (previously the Lotteries Commission)

Shire Planning Services

Hester Property Solutions

Landgate

Financial Implications

The rent on this property will be $100.00 (ex GST) p.a. as

and when demanded. A lease preparation fee of $100.00 (ex GST) will be charged

for this lease.

Asset Management Implications

Infrastructure on the site is currently of sound condition;

Linglonga will be responsible for all utility costs, building repairs,

maintenance and rates.

Statutory Implications

Local Government Act 1995 – Section 3.58 Disposing of

property

Local Government (Functions and General) Regulation 1996

– Section 30 Disposing of property excluded from Local Government Act

Section 3.58

Local Government Act 1995 – Section 9.49A Execution of

documents

Policy Implications

This report relates to Council Policy COR 004: Building and

Property Leases

Strategic Implications

Strategic Community Plan 2012 - 2022

Civic Leadership

Be innovative in the

management of Shire operations, services, staff and resources to create a

resilient and financially stable Shire

A Shire that is

progressive, sustainable, resilient and adaptive to changes

Corporate Business Plan 2013/2014 – 2016/2017

Action 4.5.13 Manage Shire leases and insurance

Attachments

|

a.

|

Shire of Esperance Public Land

Strategy - Lot 171-172 Randall Street Esperance

|

|

|

b.

|

Lingalonga Early Years Learning

Centre - Request for new lease

|

|

|

Officer’s Recommendation

That Council agrees to lease Lot

171 & Lot 172 Randall Street Esperance to Linglonga Early Years Learning

Centre Inc. subject to;

1. Lotterywest

repeal of the Deed of Trust (Landgate Registration No F292229) between the

Shire of Esperance, Esperance Child Care Centre (Linglonga) Inc and the

Lotteries Commission;

2. The

leased area being Lot 171 and Lot 172 on Plan 222409, Randall Street

Esperance, described and defined in the lease and displayed clearly in an

attachment to the lease document;

3. All

terms and conditions be as per Council Standard Sporting and Community Group

Lease, including a redevelopment clause;

4. The

term of the lease be for an initial term of 5 years, with three (3)

additional 5 year options, commencing 1 July 2016;

5. The

lease rental be $100.00 (ex GST) p.a.;

6. The

Lessee be responsible for all operational costs and charges in relation to

utilities, building maintenance and insurance of the premises; and

7. Authorise

the CEO to execute the lease.

Voting Requirement Simple Majority

|

Item: 12.5.3

Short

Term Loan Facility Extension Request

|

Author/s

|

Beth O'Callaghan

|

Manager Financial Services

|

|

Authorisor/s

|

Shane Burge

|

Director Corporate Resources

|

File Ref: D16/10239

Applicant

Corporate Resources

Location/Address

Internal

Executive Summary

For Council to consider refinancing loan 288 which

matures on the 30 June 2016.

Recommendation in Brief

That Council request a 3 year extension until the 30

June 2019 to the Short Term Loan Facility agreement held with WA Treasury

Corporation for the Flinders Estate sub division to a maximum amount of

$6,500,000.

Background

The Shire obtained a $9,200,000 Short Term Loan

Facility with WA Treasury Corporation (WATC) in June 2008 to facilitate the

Shark Lake Industrial Park (SLIP) and Flinders Stage 2 sub division. The

facility provided for a term of 2 years with repayments to be sourced

exclusively from land sales. At the time of borrowing $1.2m was in relation

to the Shark Lake Industrial Park and $8m was for Flinders Stage 2 sub

division.

The repayment of the facility was initially delayed as

a result of the Shire not being in a position to offer all the lots at initial

auction. A three year extension of the facility was sourced in June 2010

in a hope that the sale of lots would clear the debt by 30 June 2013. A

depressed real estate market over those years saw slow sales in the Flinders

Estate and no sales within the Shark Lake Industrial Park.

In March 2013 Council resolved to seek a 3 year

extension until 30 June 2016 to the Short Term Loan Facility for $6,500,000 and

refinance the Shark Lake Industrial Park portion of the Short Term Loan

Facility to a principle and interest loan over a 20 year period for $1,108,000.

Since March 2013 sales have continued within

Flinders. The net sale proceeds have been utililised to repay the

debt. The expected outstanding balance of the Short Term Loan Facility at

30 June 2016 is $684,976. The current short term borrowing facility is a

suitable credit facility for the Flinders Estate as it allows the Shire to

repay the debt in line with sales.

Officer’s Comment

The current Short Term Loan Facility will expire on 30

June 2016 and the WATC has requested from the Shire as to its intentions with

this facility post 30 June 2016. As the facility can be drawn up to

$6,500,000 Council can use this facility to fund further stages of sub division

developments at Flinders Estate. After development the net sales can

repay the debt as done previously. Alternatively Council could opt to

reduce the facility to a lesser amount.

As a further stage of Flinders is proposed to be

developed in the near future from borrowings this facility is a suitable

finance option that has proved flexible and appropriate in the past and would

allow some certainty for Council in financing the future stage development over

the next 3 years.

Consultation

WA Treasury Corporation

Financial Implications

The current interest rate on the short term facility is 2.45%

per annum or amounts to approximately $45 per day on the current outstanding

balance.

Statutory Implications

Local Government Act 1995 – Section 6.20 – Power

to Borrow

Strategic Implications

Strategic Community Plan 2012 - 2022

Civic Leadership

Be innovative in the

management of Shire operations, services, staff and resources to create a

resilient and financially stable Shire.

Attachments

Nil

|

Officer’s Recommendation

That Council

1. Request

a 3 year extension until the 30 June 2019 to the Short Term Loan Facility

agreement held with WA Treasury Corporation for the Flinders Estate sub

division to a maximum amount of $6,500,000.

2. Provides local public

notice in accordance with Section 6.20(2) of the Local Government Act

1995.

Voting Requirement Absolute

Majority

|

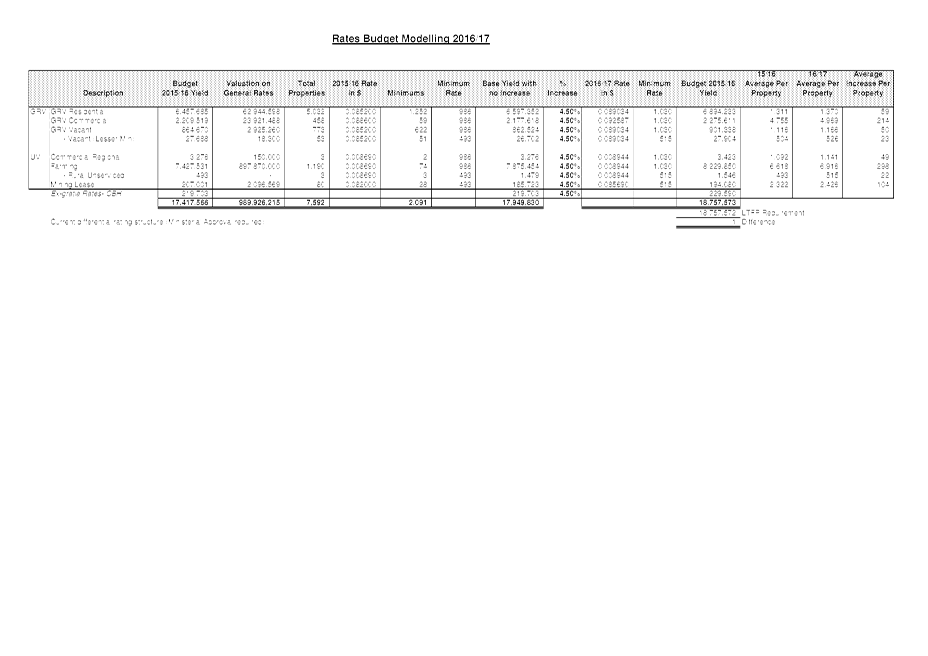

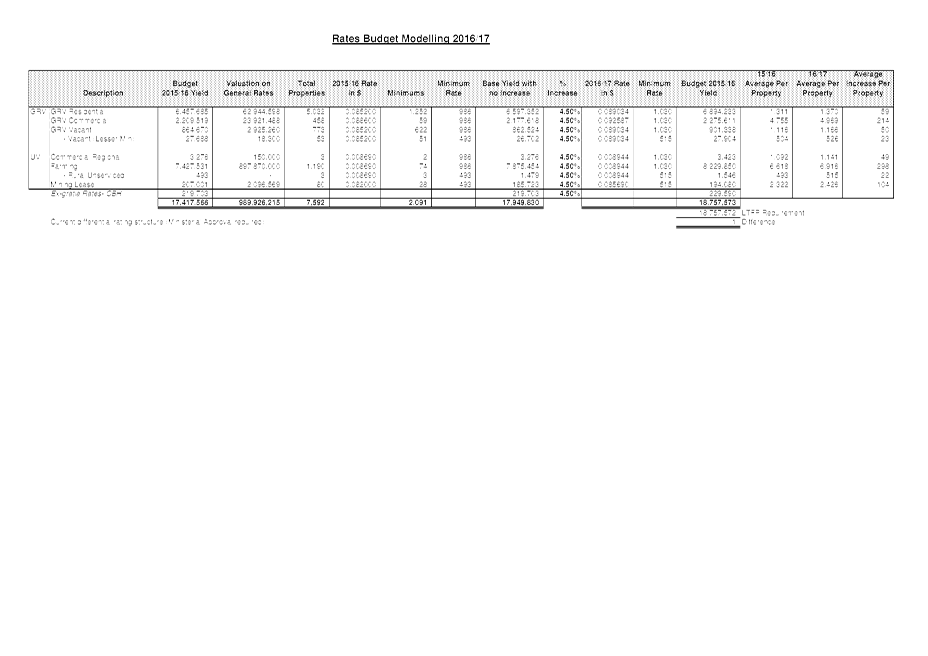

Item: 12.5.4

Notice

of Intention to Impose Differential Rates for the 2016/17 Financial Year

|

Author/s

|

Shane Burge

|

Director Corporate Resources

|

|

Authorisor/s

|

Matthew Scott

|

Chief Executive Officer

|

File Ref: D16/10553

Applicant

Internal

Location/Address

Shire of Esperance

Executive Summary

For Council to consider advertising proposed differential

rates in preparation for the adoption of the 2016/2017 budget.

Recommendation in Brief

That Council endorse the differential

rates as proposed for the 2016/2017 budget along with the objects and reasons,

seek public submission and Ministerial approval for those rates that are more

than twice the lowest differential rate.

Background

In preparation for the implementation

of the 2016/17 Budget Council must determine the rates and the minimum rates

for differential rating categories that are proposed to be used in the

following budget. There is a requirement under Section 6.36 of the Local

Government Act 1995 that if the Shire is intending on implementing a

differential rate that it gives local public notice of its intention to do so.

Once endorsed the differential rates must be advertised for a period of a

minimum of 21 days providing for public submissions.

A number of workshops were held with

Council during March and April in regards to proposed rates for the 2016/17

financial year whilst discussing the Long Term Financial Plan. During the

review of the Long Term Financial Plan it became apparent that a significant

amount more money needs to be spent on transport infrastructure to maintain a

reasonable and sustainable level of service. Rates increases would be used as one

of the tools to assist in closing the asset management gap and ensuring the

Shire of Esperance remains sustainable into the future.

The review or the long term financial plan has an objective

of closing the asset management gap over an approximate 10 year period and

increasing rates to be closer and more consistent with the average of similar

local governments in WA.

Officer’s Comment

The Local Government Act allows for differential rates

to be applied to overcome an issue where the land use within the rating

category is completely different and therefore valuations are significantly

different. To ensure equity with the rating system it is proposed to again

propose a differential rate for those properties used predominantly for mining

purposes within the UV category.

The current rating structure also has a differential

rate within the GRV category on those properties that are used predominantly

for commercial purposes that is 4% higher than the uniform GRV rate in the

dollar. This 4% premium on commercial properties generates approximately

$97,993 additional income than it would if it was rated on the same GRV

“rate in the dollar” as residential properties. It is proposed that

this rating structure for the 2016/17 year continues with commercial properties

rated 4% higher than GRV Residential properties.

Valuations are reviewed by the Valuer General and have

different valuation periods for the two different rating categories. UV

properties are re-valued every year and properties within the GRV category are

re-valued every 3-5 year.

As 2016 is not a revaluation year for GRV properties

it is expected that any rate increases can be controlled by Council to a far

greater extent through any changes to the “rate in the dollar” than

if it was a revaluation year.

The Long Term Financial Plan has determined that the

rates yield required to ensure a balanced budget whilst allocating an

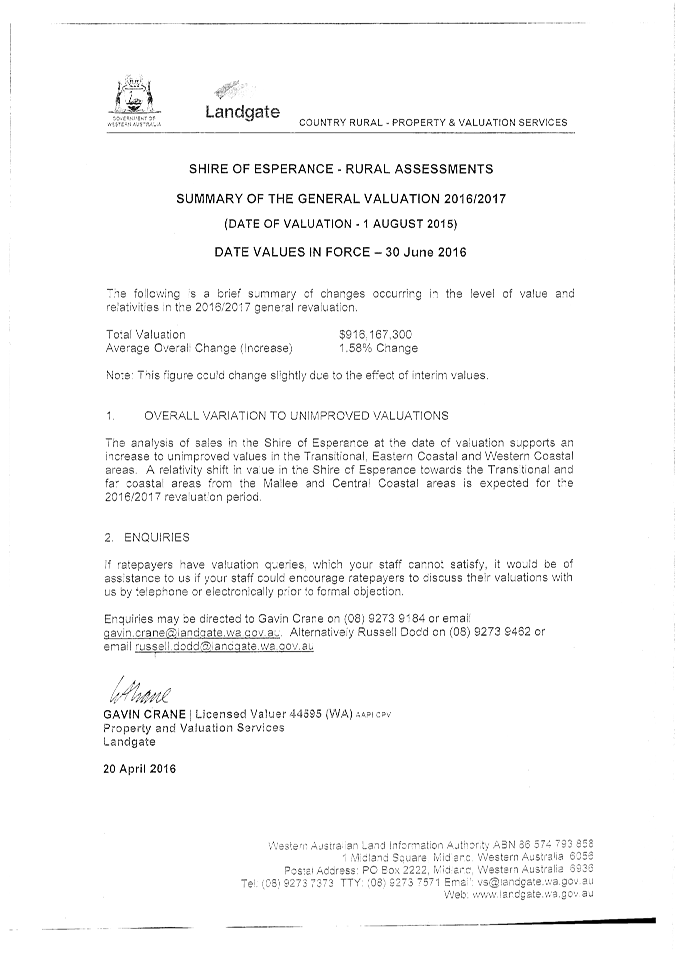

additional $500,000 towards rural road re-sheeting requires an increase in

yield on average of approximately 4.5%.

UV rates have been revalued and the assessment from

the Valuer General (see attached) is that valuations have increased on average

by 1.58%. To ensure the valuation increase is factored into the proposed

“rate in the dollar”, the yield is proposed at 4.5% for the UV category

but the “rate in the dollar” has only increased by 2.9%.

The recommended increase of 4.5% is lower than the

previously adopted long term plan being 6.5%. This is due mainly in part to the

lower inflation figures for contracts and materials, identified operational

cost savings that are proposed to flow through to the 2016/17 budget and

employment expenses expected to increase at a lower rate than previously

expected due to current employment conditions.

Gross

Rental Valuation Category

It is proposed that the rate yield in the uniform GRV

category be increased by 4.5%. In addition it is proposed that a differential

rate be maintained on the commercial/industrial category that is 4% higher than

the uniform GRV rate.

Unimproved

Category

It

is proposed that the UV category be increased by 4.5% (taking into account the

valuation increase) and it is again proposed that a differential rate be

retained within the mining category to raise additional revenue to fund the

additional impacts to the Shire. The reason that it is rated higher is to

reflect the higher road infrastructure maintenance costs to the Council as a

result of frequent heavy vehicle use over extensive lengths of the Shire road

network.

Consultation

No community consultation has been undertaken in relation to

this report. Statutory consultation is required by Section 6.36 of the Local

Government Act 1995 if the recommendation is adopted. The proposed

differential rate will also need be referred to the Department of Local

Government for ratification by the Minister.

Financial Implications

It is estimated that the proposed rates will yield an amount

of $18,757,573.

Asset Management Implications

The additional income that is proposed to be yielded from the

rates increase that is over and above the normal operational and capital

allocations is proposed to be spent on the rural road network and assisting in

closing the asset management gap within this area.

Statutory Implications

Section 6.33,6.35 and 6.36 of the Local Government Act 1995.

Strategic Implications

Strategic Community Plan 2012-2022

Civic Leadership

4.5 Be innovative in the management

of Shire operations, services, staff and resources to create a resilient and

financially stable Shire.

Attachments

|

a.

|

Objects and Reasons for Proposed

Differential Rates

|

|

|

b.

|

Rates Model

|

|

|

c.

|

UV Revaluation Advice

|

|

|

Officer’s Recommendation

That Council

1. Endorse

the following differential rates across all categories to form the basis of

proposed rate setting for the 2016/2017 budget.

|

Differential

Rate Category

|

Cents

in the Dollar

|

Minimum

Rate

|

|

GRV

Residential

|

0.089034

|

$1030

|

|

GRV

Commercial

|

0.092595

|

$1030

|

|

GRV

Vacant

|

0.089034

|

$1030

|

|

- Vacant (Lesser Minimum)

|

0.089034

|

$515

|

|

UV

Commercial

|

0.008944

|

$1030

|

|

UV Rural

|

0.008944

|

$1030

|

|

- UV Rural (Lesser Service)

|

0.008944

|

$515

|

|

UV Mining

|

0.085690

|

$515

|

2. Adopt

the objects and reasons for each of the proposed differential rates and minimum

payments (as attached).

3. Authorise

the Chief Executive Officer to advertise the differential rate and call for

submissions in accordance with the Local Government Act 1995, Section 6.36

for a minimum of 21 days.

4. Authorise

the Chief Executive Officer to seek Ministerial approval under Section 6.33

of the Local Government Act 1995 to impose differential rates for

those rates that are more than twice the lowest differential rate.

Voting requirement Simple Majority

|

Item: 12.5.5

Schedule

of Fees and Charges 2016/17

|

Author/s

|

Beth O'Callaghan

|

Manager Financial Services

|

|

Authorisor/s

|

Shane Burge

|

Director Corporate Resources

|

File Ref: D16/10719

Applicant

Corporate Resources

Location/Address

Internal

Executive Summary

To present the draft Schedule of Fees and Charges for 2016/17

for consideration and inclusion within the 2016/17 draft budget.

Recommendation in Brief

That Council endorse the attached Schedule of Fees and

Charges to be included within the 2016/17 budget.

Background

Similar to previous years a draft copy of the Fees and

Charges is presented to Council prior to draft budget day for review and

consideration.

The Fees and Charges as presented are the current

figures used to determine the draft 2016/17 budget. Fees and Charges that

are new or have been varied since the 2015/16 budget have a diamond indicator

for easy identification to the right of the fee.

Officer’s Comment

Some fees are set by regulatory bodies such as the

Builders Registration Board; by other regulations and acts; and others are

included within leases, licenses or agreements which have a base fee

established and then adjusted annually by the CPI or other agreed formula.

The Schedule of Fees and Charges document contains a

column named Statutory Fee Indicator. This identifies if the fee is set

by a regulatory body.

Similar to previous years a Pricing Policy has been

included at the front of the Schedule of Fees and Charges. It outlines

the Pricing Principles used as a guide to determine the fees and charges each

year.

It is proposed that the fees will be adopted formally

by Council and come into force with the adoption of the budget. An

endorsement of the fees prior to the budget adoption will allow staff to advise

people or organisations who may be effected by any changes prior to their

implementation.

There was a workshop with Council during May to go

through the proposed changes.

Consultation

Internal consultation with each Department was

undertaken in relation to this item.

Workshop with Council.

Financial Implications

Within the 2015/16 budget fees and charges constituted $9m or

27% of the Shire’s operating revenue for the year.

Statutory Implications

Section 6.16 of the Local Government Act 1995 provides

authority for local governments to impose fees and charges when adopting the

annual budget.

Fees and charges may be adopted outside of the annual budget

but these require prior public advertising before implementation.

Strategic Implications

Strategic Community Plan 2012 - 2022

Civic Leadership

Be innovative in the

management of Shire operations, services, staff and resources to create a

resilient and financially stable Shire

A Shire that is

progressive, sustainable, resilient and adaptive to changes

Attachments

|

a.

|

Schedule of Fees & Charges

2016/17 - Under Separate Cover

|

|

|

Officer’s Recommendation

That Council endorse the attached

Schedule of Fees and Charges to be included within the 2016/17 budget.

Voting Requirement Simple Majority

|

Item: 12.5.6

Long

Term Financial Plan Review

|

Author/s

|

Shane Burge

|

Director Corporate Resources

|

|

Authorisor/s

|

Matthew Scott

|

Chief Executive Officer

|

File Ref: D16/10720

Applicant

Shire of Esperance

Location/Address

N/A

Executive Summary

For Council to consider adopting the revised Long Term

Financial Plan 2016/17 – 2025/26.

Recommendation in Brief

That Council adopt the revised Long Term Financial

Plan 2016/17 – 2025/26

Background

In February 2009, the Minister for Local Government

announced a package of statewide-ranging local government reform strategies that

were aimed at achieving greater capacity for local government to better plan,

manage and deliver services to their communities with a focus on social,

environmental and economic sustainability.

One of the requirements was to develop and review a

long term financial plan (LTFP) that is a ten year rolling plan that informs

the Corporate Business Plan to activate Strategic Community Plan priorities.

From these planning processes, annual budgets that are aligned with strategic

objectives can be developed.

The LTFP indicates a local government’s long

term financial sustainability, allows for early identification of financial

issues and their longer term impacts, shows the linkages between specific plans

and strategies, and enhances the transparency and accountability of the Council

to the community.

The LTFP is a high level document that should be

supported by detailed information based upon assumptions, projected income and

expenditure, capital work schedules, key performance indicators and scenario

modeling.

Forecasts should underpin the LTFP and aim to quantify

the future impacts of current decisions and identify the available options to

close the gap between revenues and expenditure. Forecasting informs decision

making and priority setting and assists in the management of the local

government’s response to community growth or contraction. It will also

assist in the management of cash flows and funding requirements, community

assets and risk. There should be a high level of accuracy in the forecasts for

the first 2 – 3 years, a good level of accuracy for years 4 and 5 and a

reasonable level of accuracy for the remaining 5 years of the plan.

Officer’s Comment

The following information explains the major financial

assumptions applicable to the Long Term Financial Plan and the major

assumptions that have been used to develop the plan.

Employment Expenses

Increases in employment expenses have three main elements.

These are

1. increases contained in the enterprise agreement

2. increases and movements of levels within the current

workforce

and;

3. additional positions that are required to meet the

strategic direction of the Council and the growth of the community.

Employee costs are estimated to increase by 3% during 2016/17

and then 2.9% thereafter. Note that this increase is reflective of the Shires

contribution to employment expenses and does not take into account any

increases or decreases in fully funded positions such as Homecare.

Materials and Contracts

Increases in Materials and contracts are in line with the

Local Government Cost Index of 2.5% plus an additional 0.2% to take into

account the estimated growth in the Shire of Esperance.

Utility Charges

Utility charges have been factored in to increase by 3% for

the life of the plan.

Loan Borrowings and Repayments

Loan repayments are calculated on loan schedules that are

currently in existence and the estimation of any future loan borrowings. The

LTFP has proposed loan borrowings of $4m for a new waste facility, $1m for a

replacement Jetty and $3m for a future stage of Flinders Estate. The existing

short term borrowings for Flinders Estate is proposed repaid in line with sales

of the Flinders land. An assumption has been made that existing sales of land

will be sufficient to fully repay the existing balance of the loan within the

next year.

Reserve Transfers

Transfer to Reserves are in line with existing reserve

calculations that are contained within the 2015/16 budget and increased by 3%

to take into account inflation factors. In areas such as the airport or waste

management these transfers could change if their net operating results changed.

Continual scrutiny and review of the fees being charged in these areas are

essential to ensure sufficient money is being captured in the reserves to pay

for large capital expenditure in future years. Interest on Reserve holdings has

been calculated at 2.5% and reinvested into the reserve.

Rate Revenue

Rate yield increases are forecast for 4.5% for 2016/17 and

for the following 9 years of the plan. It is estimated that the additional

income that is generated that is higher than normal operational requirements

will be spent on closing the asset management gap that the Shire currently has.

Council has a revenue strategy that has recommendations regarding future rate

increases to assist in closing the asset management gap specifically within the

transport area. It should be noted that the previous adopted long term plan had

rate increases of 6.5% for the same timeframe. Revised economic and employment

conditions along with a number of operational savings have been identified

which has meant expected rates increases have decreased by 2%.

Operating Grants

An increase of 2.5% has been allowed for in the LTFP. Advice

from the Grants Commission is that after their methodology review the General

Purpose portion from the Financial Assistance Grants will initially continue to

increase before levelling out in later years, although the pool of funds

available from the Commonwealth Government to the WA State Government is

proposed to be frozen over the next 2 years, 2.5% increase has been allowed for

in later years due to the unknown nature of this income type.

Fees and Charges

Fees and Charges that Council has discretion over has been

increased by 8% for the 2016/17 year to take into account the net operational

effect taking back the caravan park operations will have. Increases of 3% per

annum for the remaining term of the plan.

Capital Grants

Road grants from the Regional Roads Group have been estimated

at the existing levels, averaged from the past two years. Regional Road Group

is a competitive process and application has to be made each year for specific

projects, the allocations can therefore fluctuate significantly. Roads to

Recovery grants have been maintained for the life of this plan although there

is a large Roads to Recovery program that is more than 3 times the normal

allocation for the 2016/17 year.

A large number of the capital projects are reliant upon grants

from external sources. Projects in relation to the Waste Facility, Indoor

Sports Stadium and Tanker Jetty Replacement are heavily reliant upon receiving

grant funding from external grant funds. If the funding from these sources does

not eventuate the projects may need to be reviewed or alternate funding

sourced.

Capital Expenditure

Capital Expenditure is in line with existing Asset Management

Plans and has been increased by 3% in line with expected inflation figures- the

asset management plans that were used in the development of the Plan has been

Fleet, Footpaths, Waste and Airport.

Road expenditure is in line with existing annual allocations

and increased by 3% in line with expected inflation. Additional expenditure is

expected to be increased over the life of the plan to help address the asset

management gap in the transport area and more specifically rural road

re-sheeting. For the 2016-17 year this additional money that is proposed to be

spent on rural road re-sheeting amounts to $500,000.

The 10 year capital works program has been developed in two

formats showing both a source of funding format and also whether the asset is

renewal, upgrade or new. As identified in the capital grants section a number

of key infrastructure projects are heavily reliant upon external grant funds.

If external funding from these projects does not eventuate to the amounts as

indicated in the plan then the scope of each capital project will need to be

revisited or the project postponed until further funding is sourced.

Consultation

The Corporate Business Plan and Strategic Community Plan have

been referenced and consulted in developing the plan.

A number of workshops were held with Council to go through a

number of scenarios and assumptions.

Financial Implications

Although the adoption of the Long Term Financial Plan does

not have any financial implications, the annual budget will be drafted in line

with the Long Term Financial Plan.

The LTFP also documents the implications of sustainability

for the Shire over a 10 year period and the implications from a financial

perspective of the assumptions that underpin the plan.

Asset Management Implications

The Long Term Financial Plan sets out the strategies

to close the life cycle gap and still ensure service delivery is maintained at

an acceptable level to the community.

Statutory Implications

Section 5.56(1) and (2) of the Local Government Act 1995

requires that each local government is ‘to plan for the future of the

district’, by developing plans in accordance with the regulations. Local

Government (Administration) Regulations 1996 Section 19 outlines what is

required of Planning for Future documents.

Strategic Implications

Strategic Community Plan 2012 - 2022

Civic Leadership

Be innovative in the

management of Shire operations, services, staff and resources to create a

resilient and financially stable Shire

A Shire that is

progressive, sustainable, resilient and adaptive to changes

Corporate Business Plan 2013/2014 – 2016/2017

4.5.1.3 Annual

Review of Long Term Financial Plan

Attachments

|

a.

|

Long Term Financial Plan - Under

Separate Cover

|

|

|

Officer’s Recommendation

That Council

1. Adopt

the Long Term Financial Plan 2016/17 – 2025/26.

2. Request

the Chief Executive Officer give local public notice of the reviewed plan as

per the requirements of the Local Government Act 1995.

Voting Requirement Absolute

Majority

|

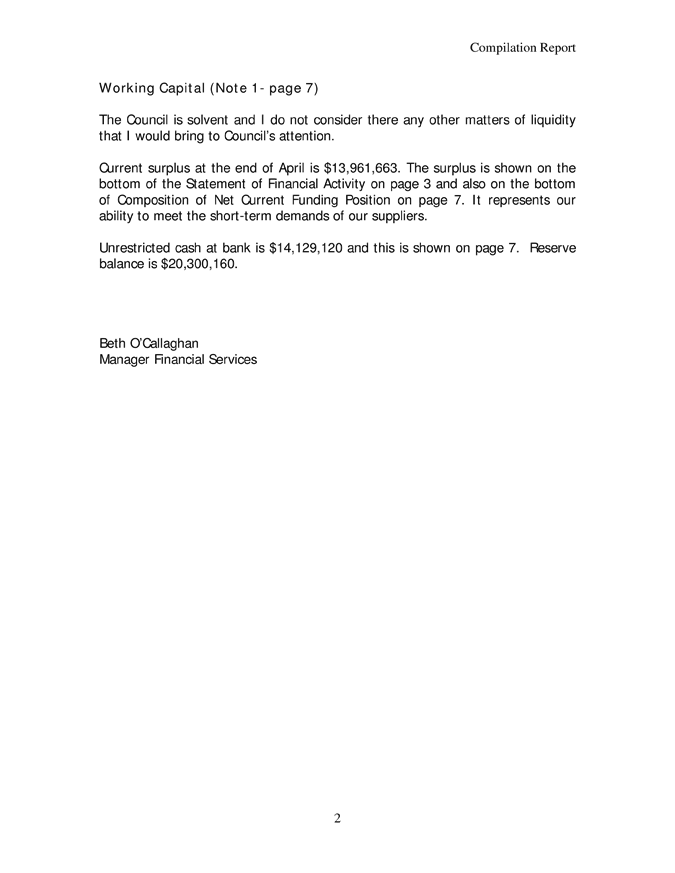

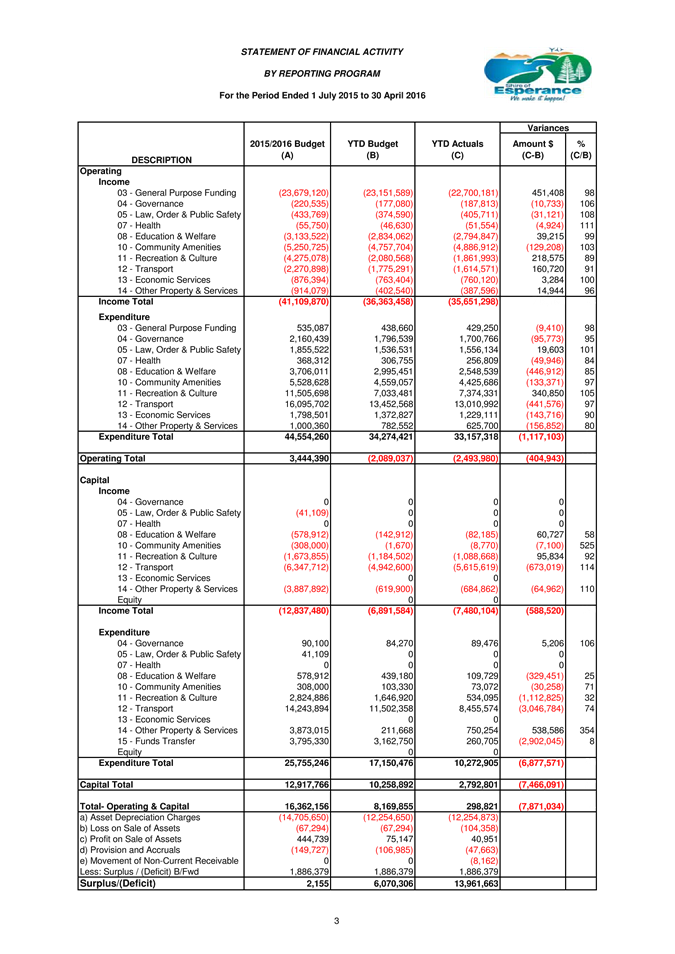

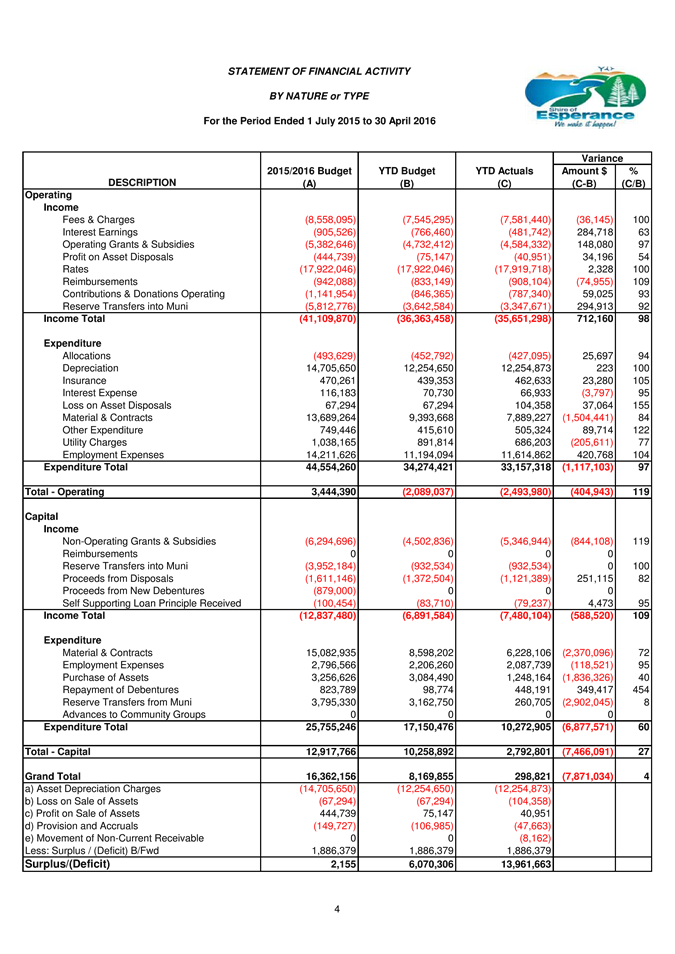

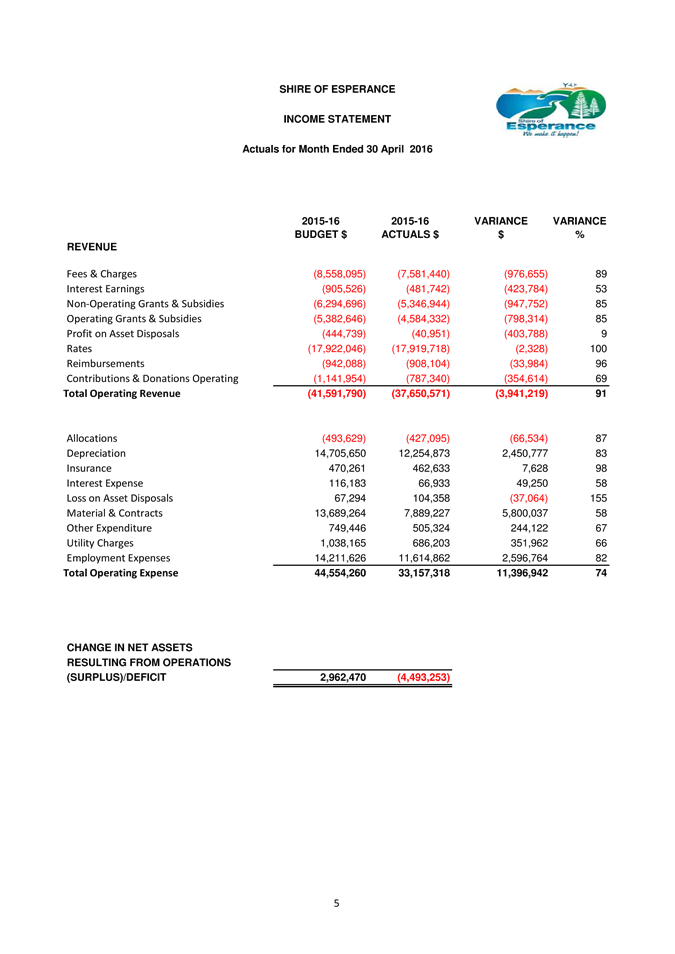

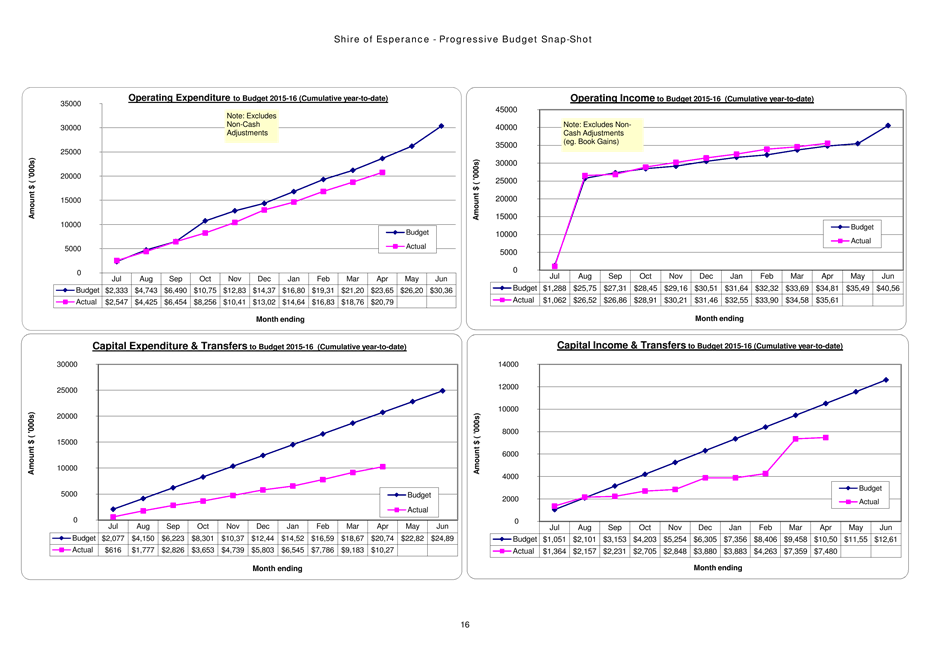

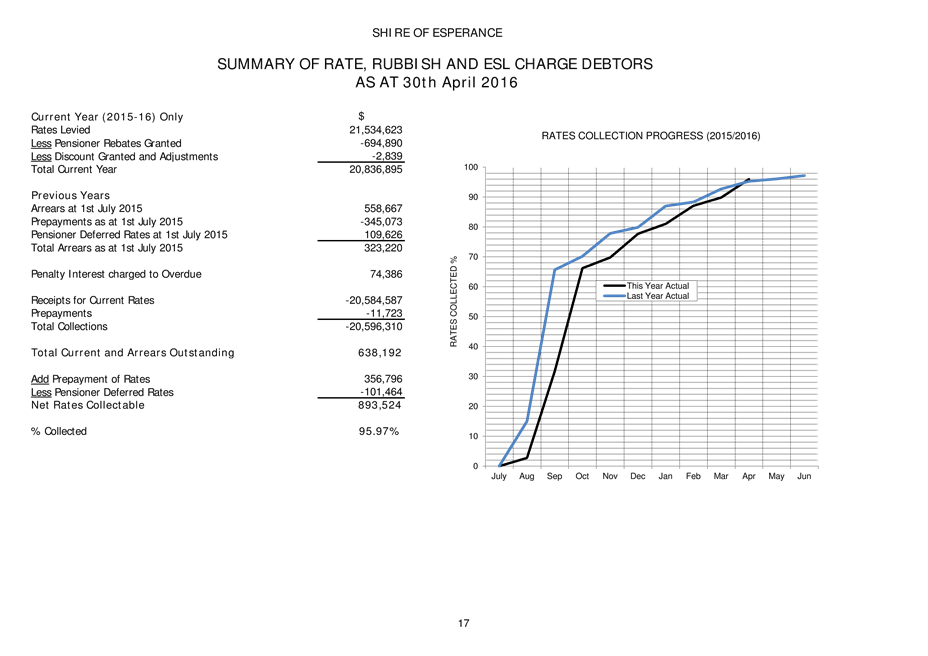

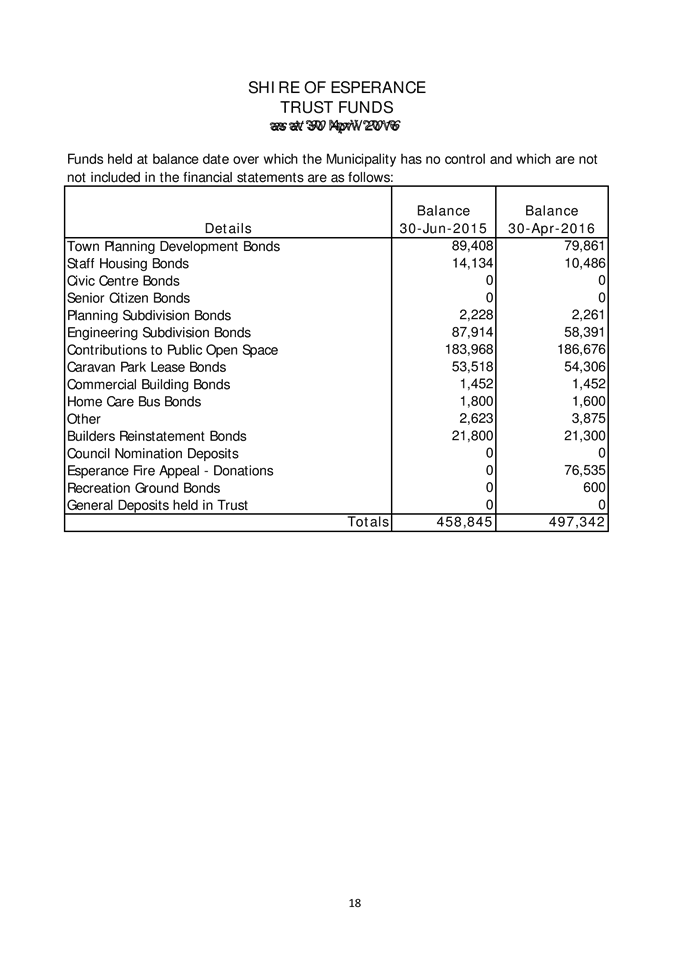

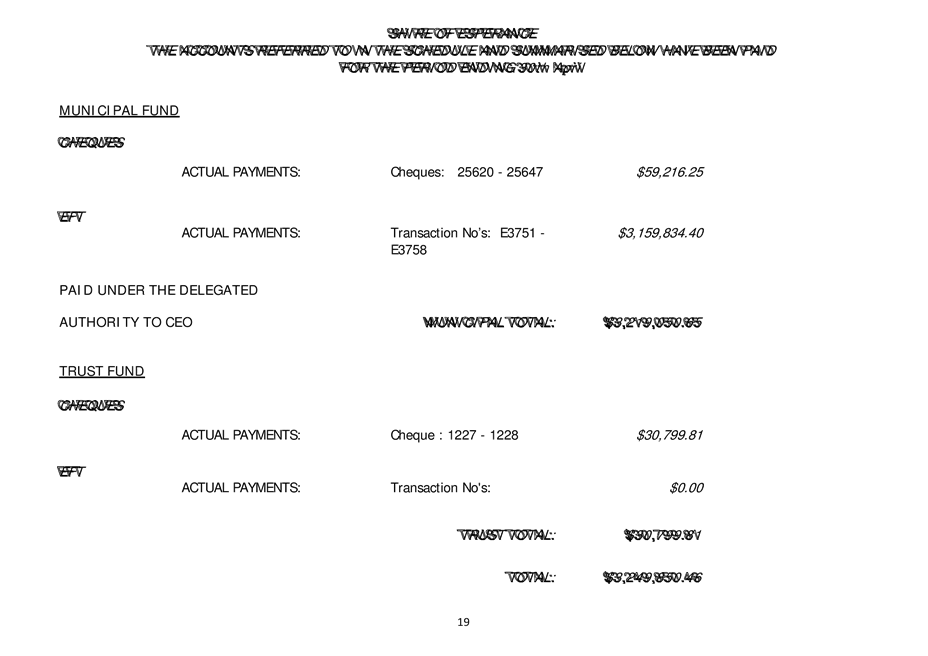

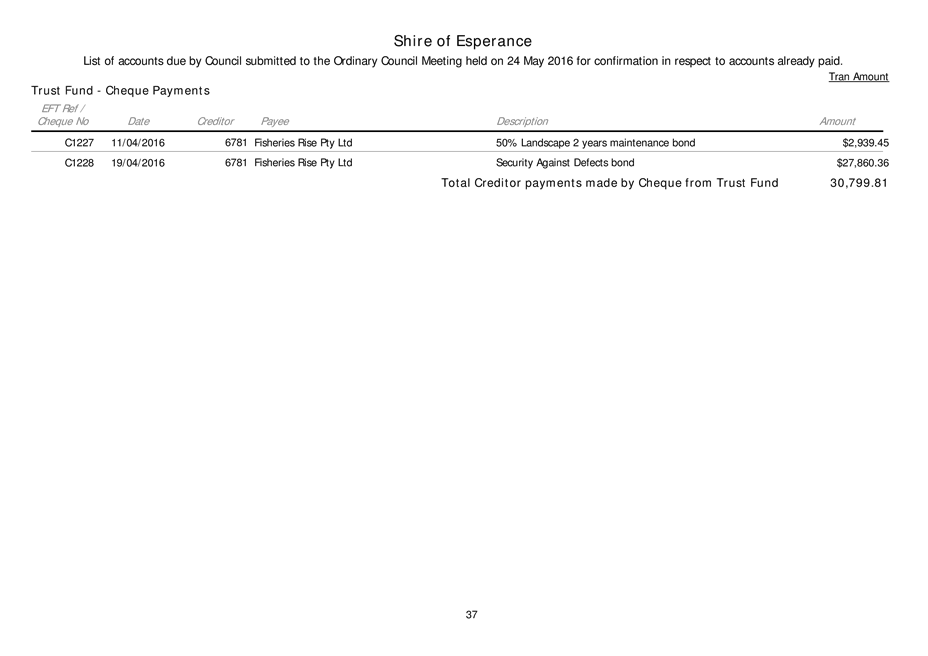

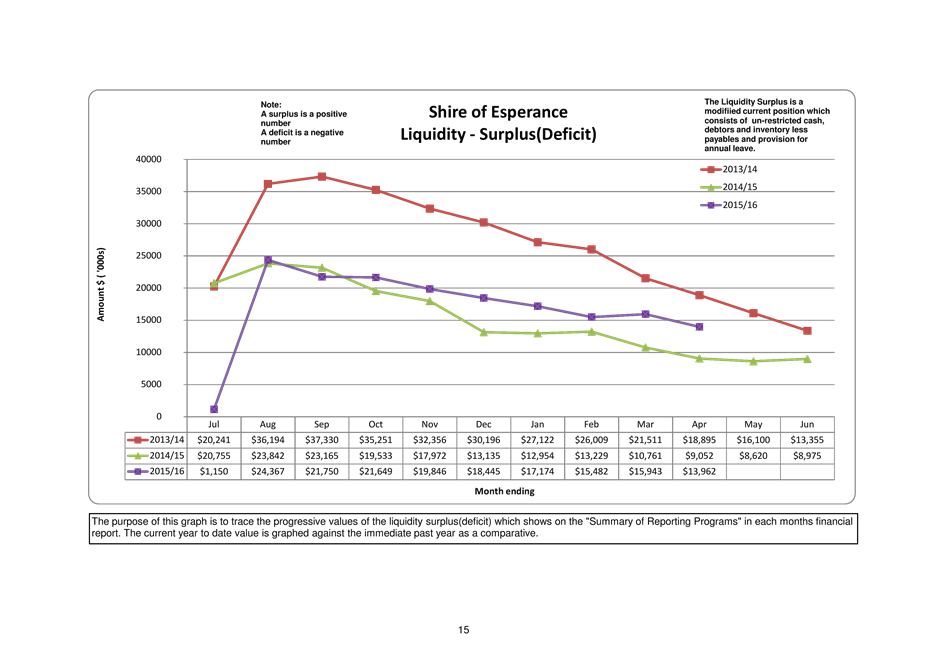

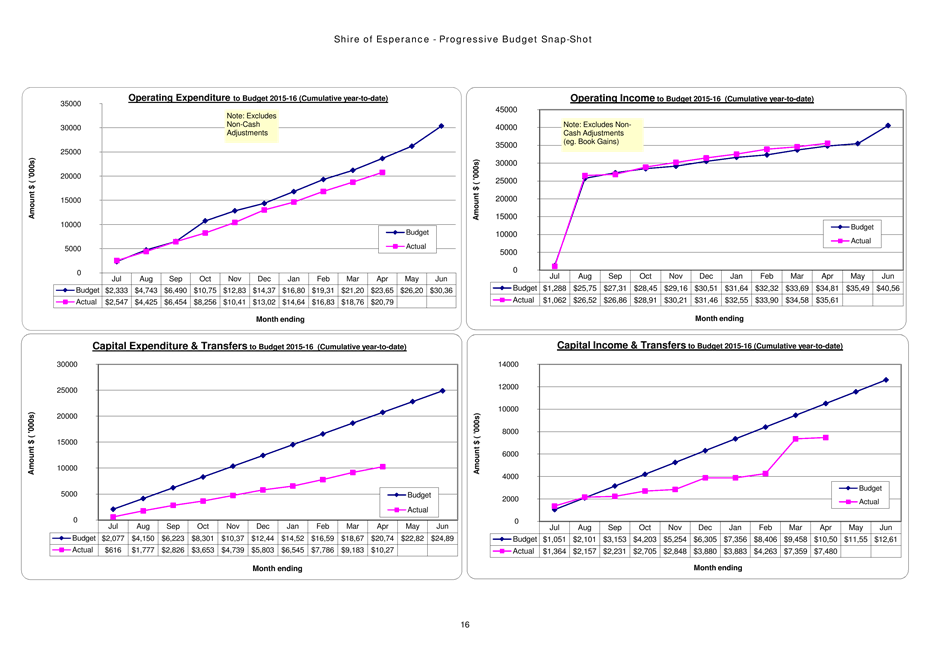

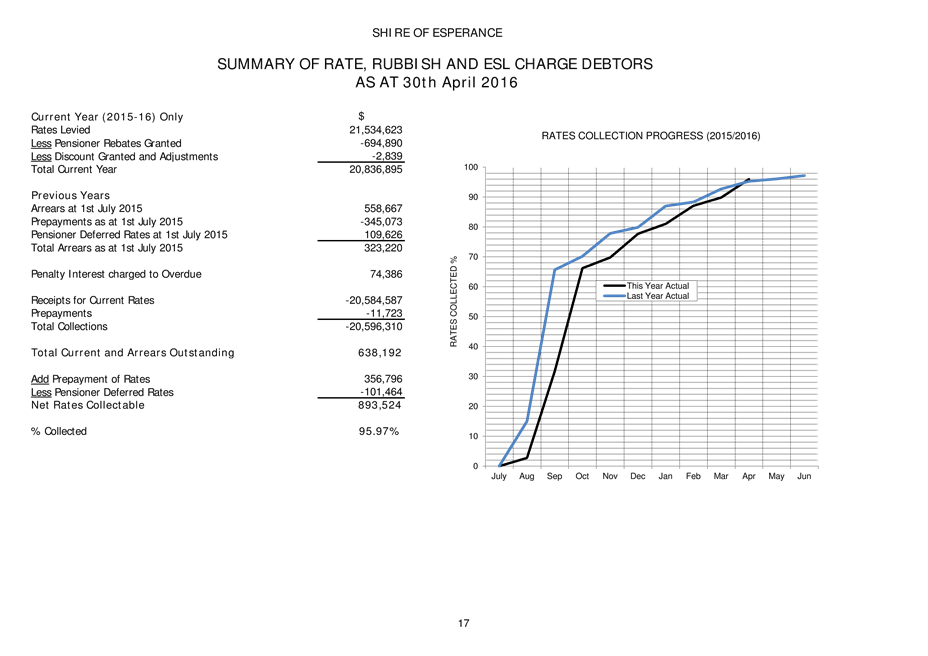

Item: 12.5.7

Financial

Services Report - April 2016

|

Author/s

|

Beth O'Callaghan

|

Manager Financial Services

|

|

Authorisor/s

|

Shane Burge

|

Director Corporate Resources

|

File Ref: D16/11357

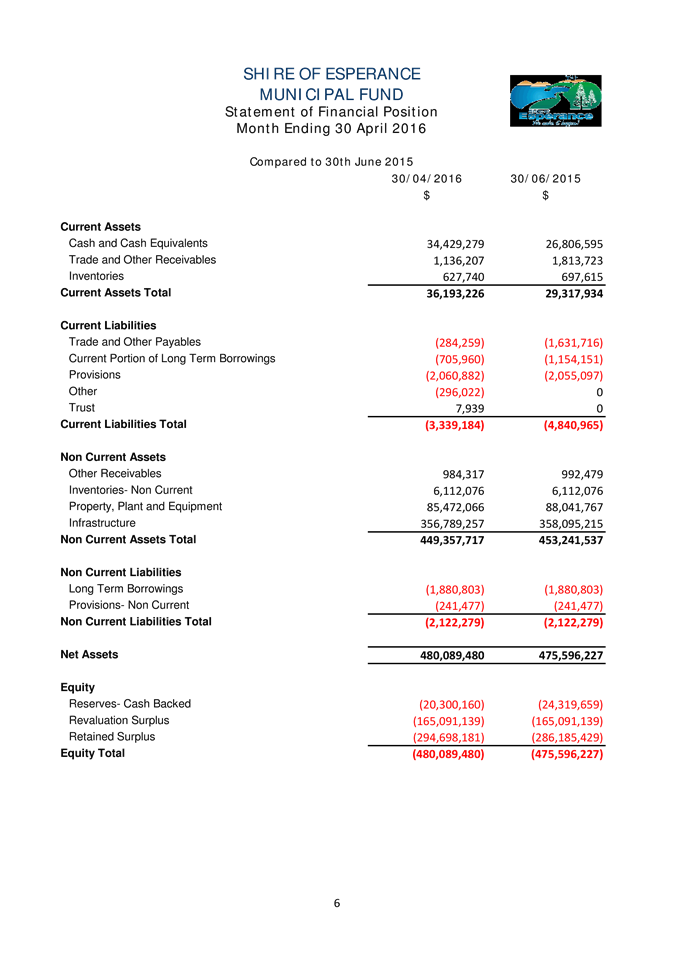

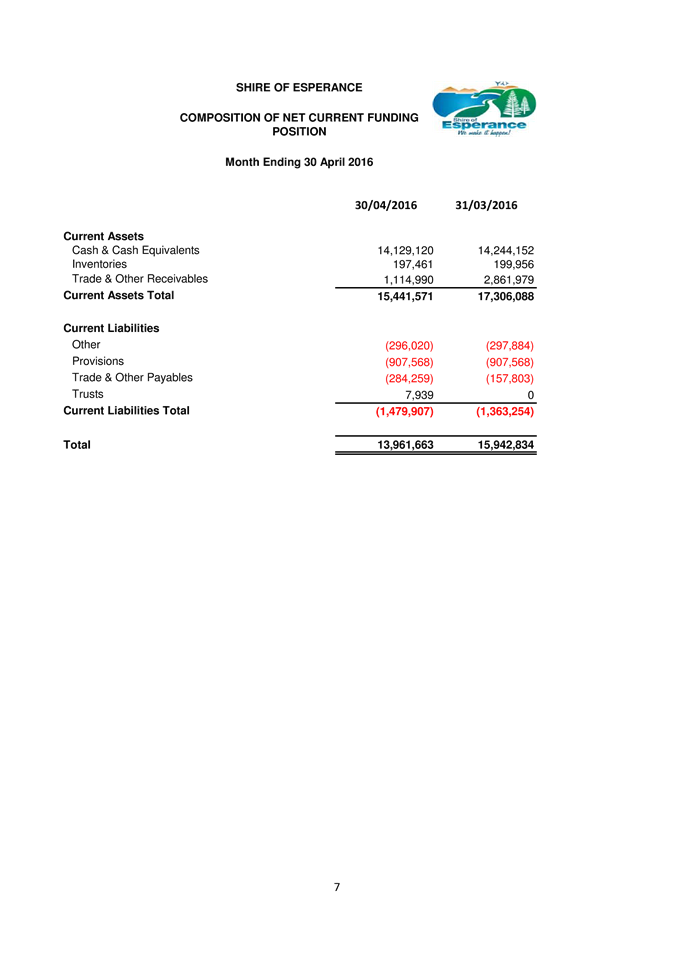

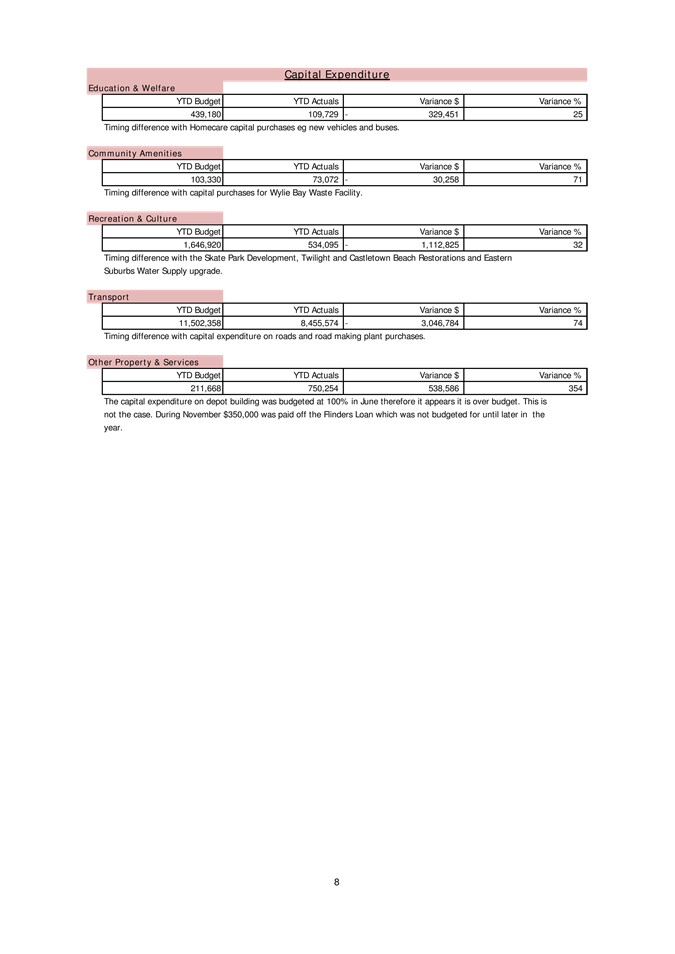

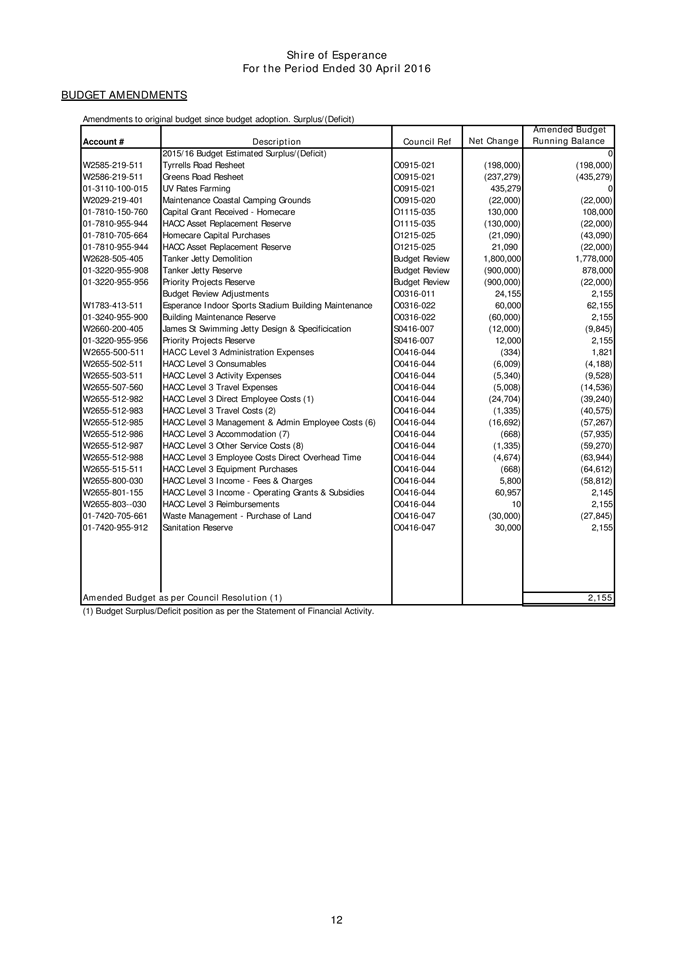

Attachments

|

a.

|

Monthly Financial Report - April

2016

|

|

|

Officer’s Recommendation

That the report entitled Monthly

Financial Management Report (incorporating the Statement of Financial

Activity) for the month of April as attached be received.

Voting Requirement Simple Majority

|

12.6 Executive Services

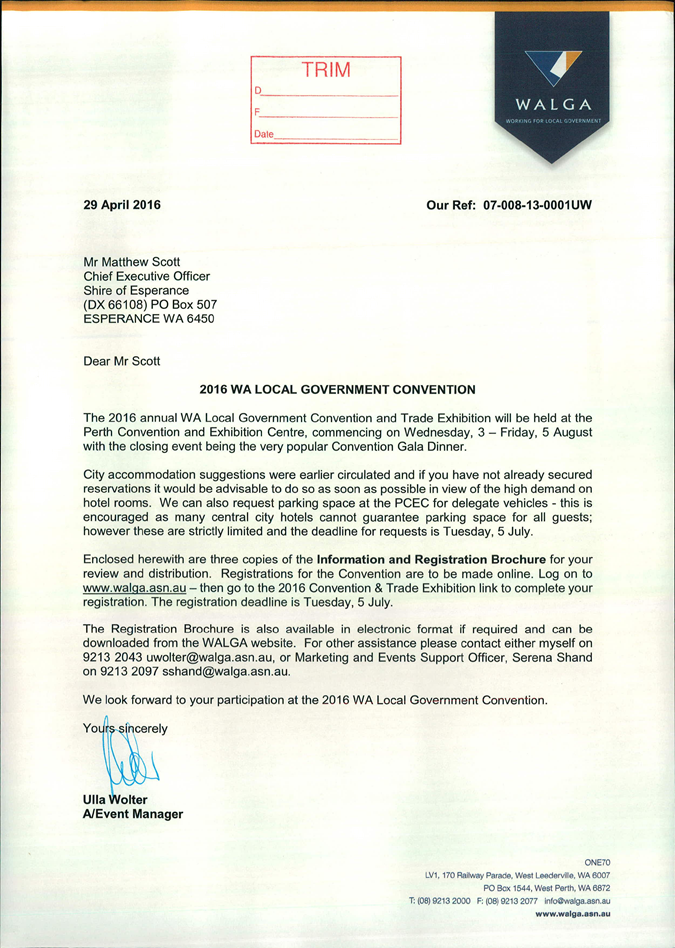

Item: 12.6.1

WALGA

Annual General Meeting and WA Local Government Convention 2016

|

Author/s

|

Helen Hall

|

Executive Assistant

|

|

Authorisor/s

|

Matthew Scott

|

Chief Executive Officer

|

File Ref: D16/9256

Applicant

Executive Services

Location/Address

Internal

Executive Summary

For Council to nominate two (2) Council voting delegates for

the 2016 WALGA Annual General Meeting, to be held in Perth on the 3 August

2016, as part of the Annual Local Government Convention.

Recommendation in Brief

That Council nominate Councillors __________________________ as the Shire’s Voting

Delegates for the WALGA Annual General Meeting to be held in Perth on 3 August

2016. Councillor/s_____________________________________________ and the

CEO will attend the 2016 Western Australian Local Government Convention held in

Perth on 4 and 5 August 2016.

Background

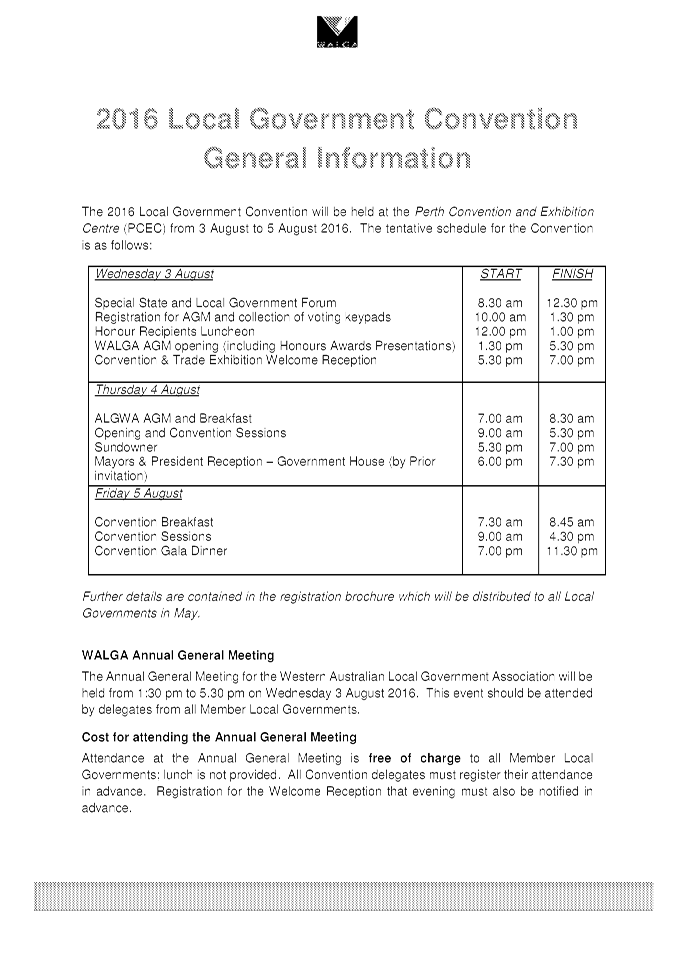

The 2016 WA Local Government Convention & Trade

Exhibition (Local Government Week) will be held Wednesday, 3 August –

Friday 5 August 2016 at the Perth Convention & Exhibition Centre (PCEC).

As per previous Local Government Weeks, WALGA will hold its Annual General

Meeting, to discuss and consider local government industry issues. Each

member Council of WALGA has the ability to elect two (2) voting delegates to

participate at the WALGA Annual General Meeting (non-voting delegates are also

able and encouraged to attend).

Officer’s Comment

Attendance

at the annual WA Local Government Convention is open to all Councillors.

Registration fees, travel and accommodation expenses will be paid by Council in

advance for any Elected Member(s) choosing to attend the WA Local Government

Convention. This year’s convention theme is “Local

Impact”. Convention information & registration pamphlets have

already been distributed to all Councillors.

As

a member of WALGA, it is important that Council also attend WALGA’s

Annual General Meeting, requiring the election of voting delegates by

Council.

Financial Implications

The costs associated for this conference can be

accommodated within 2015/16 budget: Members of

Council Travel, Accommodation and Conference expenses. Anticipated costs are approximately

$3,625 per delegate comprising registration of $1,475; airfares in the vicinity

of $500 and accommodation of approximately $800 per delegate plus meals and

other miscellaneous expenses.

Policy Implications

Council Policy EXEC-007: Elected Member Entitlements

Strategic Implications

Strategic Community Plan 2012-2022

Civic Leadership

4.5 Be innovative in the management of the Shire operations,

services, staff and resources to create a resilient and financially stable

Shire.

Attachments

|

a.

|

Notification - 2016 WA Local

Government Convention

|

|

|

b.

|

WALGA - Local Government Convention

- Local Impact - 2016

|

|

|

c.

|

WALGA - Notice of AGM - 3 August

2016

|

|

|

Officer’s Recommendation

1. That

Council nominate Councillors _____________ and ________________ as the

Shire’s Voting Delegates for the WALGA Annual General Meeting to be

held in Perth on 3 August 2016.

2. That

Councillor/s_________________________________________________ and the CEO to

attend the 2016 Western Australian Local Government Convention held in Perth

on 4 and 5 August 2016.

Voting Requirement Simple

Majority

|

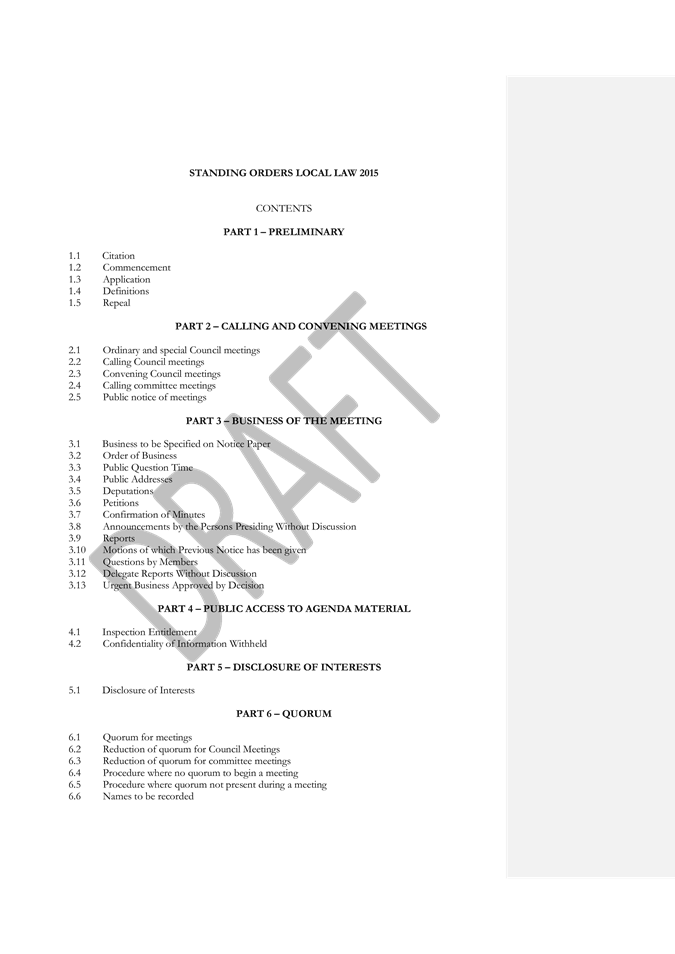

Shire

of Esperance Standing Orders Local Law 2015

|

Author/s

|

Karen Naylor

|

Project Reporting Officer

|

|

Authorisor/s

|

Matthew Scott

|

Chief Executive Officer

|

File Ref: D16/10622

Applicant

Internal

Location/Address

The Shire of Esperance

Executive Summary

For Council to continue the review of the Shire’s

suite of Local Laws. This report item refers to the proposed draft Standing

Orders Local Law 2015 and incorporates minor changes suggested by the

Department of Local Government and Communities.

Recommendation in Brief

That Council:

1. Endorse

the draft Shire of Esperance Standing Orders Local Law 2015.

2. Requests the

CEO undertake all the required statutory advertising.

Background

Council endorsed the draft Standing Orders Local Law 2015

(refer Point 5) at a meeting held on the 26th May 2015, Council

resolved as follows:

“That Council, as a

result of the full review of Local Laws:

1. Accepts that

the following Local Laws remain unchanged;

· Bushfire Brigades Local Law 2002

· Health Local Law 2002;

2. Repeals the

following Local Laws;

· Fencing Local Law 2002;

· Pest Plants Local Law 1979;

· Signs Local Law 2004; and the

· Standing Orders 2001

3. Endorse

the Shire of Esperance Amendment Local Law, as detailed in Appendix A, with

reference to the following Local Laws;

· Cemeteries Local Law 2002

· Dogs Local Law 2002; and the

· Extractive Industries Local Law 2001

4. Endorse

the new Shire of Esperance Fencing Local Law 2015 as detailed in Appendix B.

5. Endorse

the new Shire of Esperance Standing Orders Local Law 2015 as detailed in

Appendix C.

6. Endorse

the new Shire of Esperance Cats Local Law 2015 as detailed in Appendix D.

7. Requests the CEO

undertake all the required statutory advertising relating to points 1-6

above.”

The proposed Fencing,

Standing Orders and General Amendment Local Laws were subsequently advertised

pursuant to Section 3.12(3) of the Local Government Act 1995, inviting

submissions closing on 28th August 2015.

Council resolved to make the draft Standing Orders Local Law

2015 (refer Point 4) at a meeting held on the 22nd September 2015,

Council resolved as follows:

That Council, as a result of the full review of Local

Laws:

1. Council

notes that no submissions have been received that require consideration in

accordance with Section 3.12(4) of the Local Government Act 1995.

2. Resolves

to make the Shire of Esperance Amendment Local Law 2015 as detailed in Appendix

A.

3. Resolves

to make the Shire of Esperance Fencing Local Law 2015 as detailed in Appendix

B.

4. Resolves

to make the Shire of Esperance Standing Orders Local Law 2015 as detailed in

Appendix C.

5. Requests the

CEO undertake all the required statutory advertising relating to points 2-4

above.

Section 3.12(4) of the Local

Government Act 1995 requires Council to consider any submissions received prior

to resolving to make a local law. No public submissions were received during

the advertising period.

As per 3.12(3)(b) a copy of

the proposed Local Law was sent to the Minister for Local Government and

Communities and a response was received from the Minister detailing some

suggested changes to the draft local law. These changes have been incorporated

into the draft document and included as an attachment to the report item.

Officer’s Comment:

The suggestions provided by the Department of Local

Government and Communities refer to Appendix B, assisted the Shire with

drafting matters in relation to the local law and have been included in the

draft Shire of Esperance Standing Orders Local Law 2015 as detailed in Appendix

A.

Notice is given, pursuant to

Section 3.12(2) of the Local Government Act 1995 that the Shire of

Esperance proposes to make the following Local Laws:

· Standing Orders Local Law 2015

The

purpose of the Standing Orders Local Law 2015 is to replace

the Standing Orders Local Law 2001. This proposed replacement allows for the

extended time and number of Public addresses, a provision for electronic

petitions, amending the time applicable to motions, management of briefing

sessions, establish what constitutes a disturbance and the means of dealing

with the disturbance and provision to call a meeting to hear public submissions

outside of an OCM and the provision to manage briefings and other informal

meetings.

The

effect of this local law will be to more accurately reflect current

legislation and operational practices as applied by the Council in the conduct

of Council, Committee and other meetings.

Consultation

WALGA

With Council during briefing sessions.

Community submissions during the review process.

Financial Implications

The financial implications arising from this report will be

restricted to advertising costs and resource time during the review process.

Statutory Implications

The statutory implications associated with this item are:

· Local Government Act 1995 (s3.12 and s3.16)

Strategic Implications

Strategic Community Plan 2012-2022

Civic Leadership

Strategy 4.2 Maintain a clear, transparent and ethical

decision making process

Strategy 4.3 Ensure open and consistent communication between

the Shire and the community

Corporate Business Plan 2015/2016 – 2018/2019

Action 4.2.1.2 Review Shires suite of Local Laws

Action 4.3.1.2 Manage Corporate Reporting

Attachments

|

a.

|

Local Law - Standing Orders Local

Law 2015 - Draft (DLGC recommendations)

|

|

|

b.

|

Letter DLGC - Changes to Shire of

Esperance Standing Orders Local Law 2015

|

|

|

Officer’s Recommendation

That Council, as a

result of the full review of Local Laws:

1. Endorse

the Shire

of Esperance Standing Orders Local Law 2015.

2. Requests the CEO

undertake all the required statutory advertising.

Voting Requirement Absolute

Majority

|

|

Item: 12.6.2

|

Attachment a.: Local Law - Standing Orders Local

Law 2015 - Draft (DLGC recommendations)

|

Item: 12.6.3

Information

Bulletin - April 2016

|

Author/s

|

Sarah Fitzgerald

|

Administation Officer

|

|

Authorisor/s

|

Matthew Scott

|

Chief Executive Officer

|

File Ref: D16/11371

Applicant

Internal

Strategic Implications

Strategic Community Plan 2012 - 2022

Civic Leadership

Ensure open and

consistent communication between the Shire and the community

A community who is aware

of Council decisions and activities

Attachments

|

a.

|

Information Bulletin - April 2016

|

|

|

b.

|

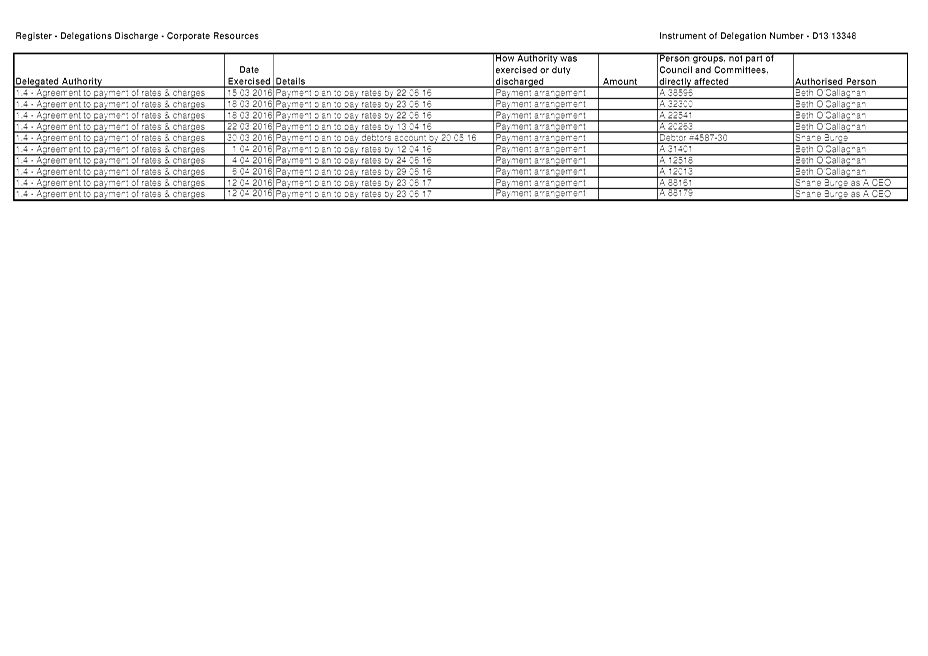

Register - Delegations Discharge

– Corporate Resources

|

|

|

c.

|

Minutes - GVROC Meeting - 22 April

2016 - Under Separate Cover

|

|

|

d.

|

Interplan report - April 2016 -

Under Separate Cover

|

|

|

e.

|

Letter - Thank you -

Goldfields-Esperance Regional Investment Blueprint

|

|

|

Officer’s Recommendation

That Council accepts the

Information Bulletin for February 2016 including;

1. Register

- Delegations Discharge – Corporate Resources

2. Minutes

- GVROC Officers Technical Working Group Meeting - 18 March 2016

3. Interplan

report – January 2016

4. Letter

– Thank you – Goldfields-Esperance Regional Investment Blueprint

Voting Requirement Simple Majority

|

13. Reports Of Committees

Item: 13.1

Minutes

of Committees

|

Author/s

|

Lynda Horn

|

Community Support Officer

|

|

Authorisor/s

|

Terry Sargent

|

Director External Services

|

File Ref: D16/10674

Attachments

|

a.

|

Lake Monjingup Community

Development Group – 27 April 2016

|

|

|

b.

|

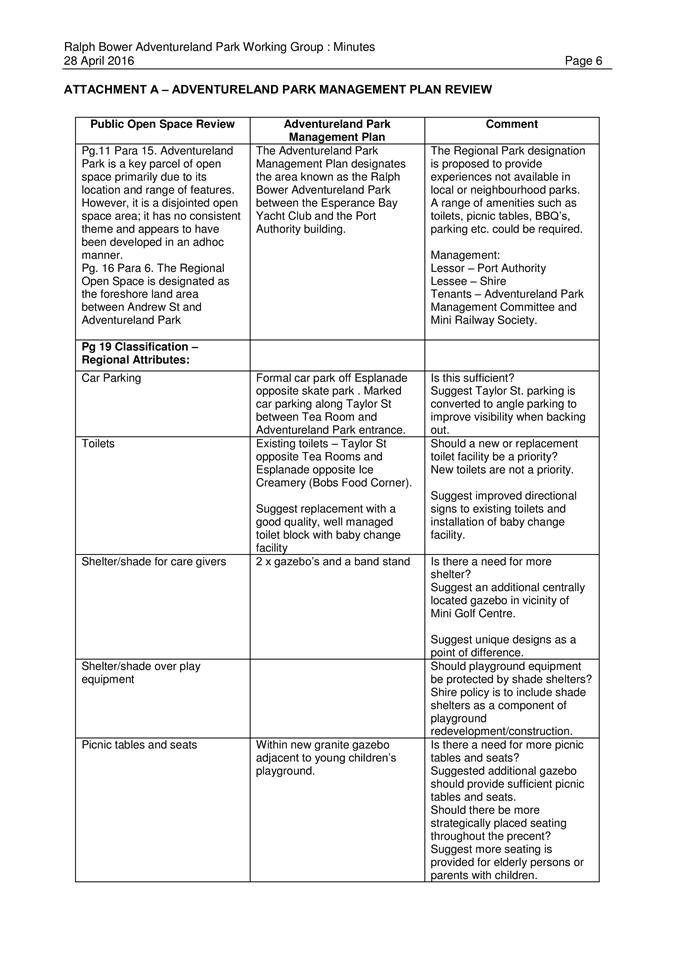

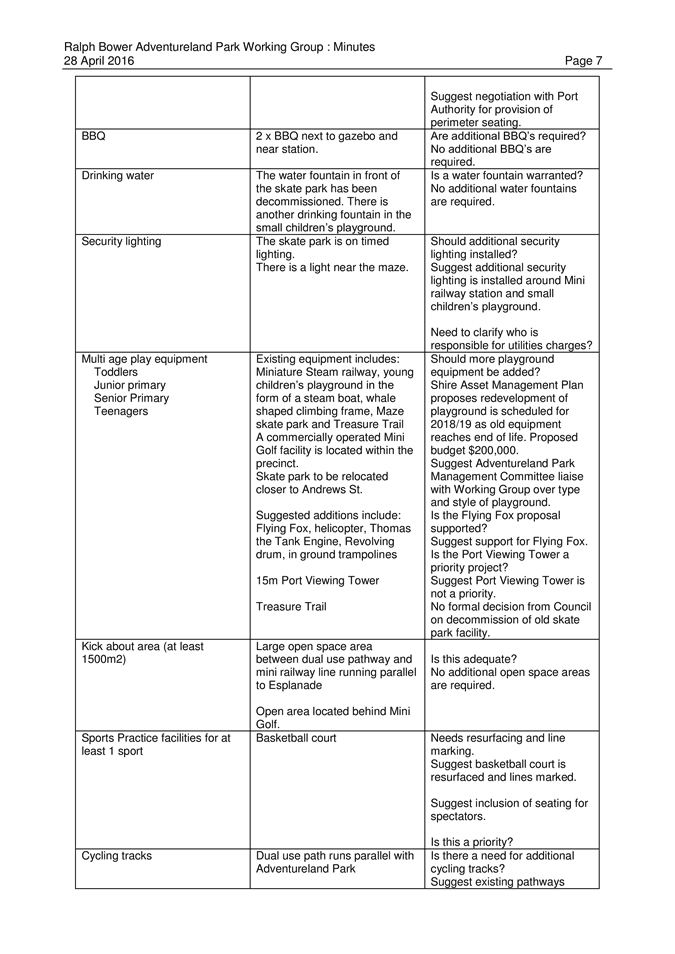

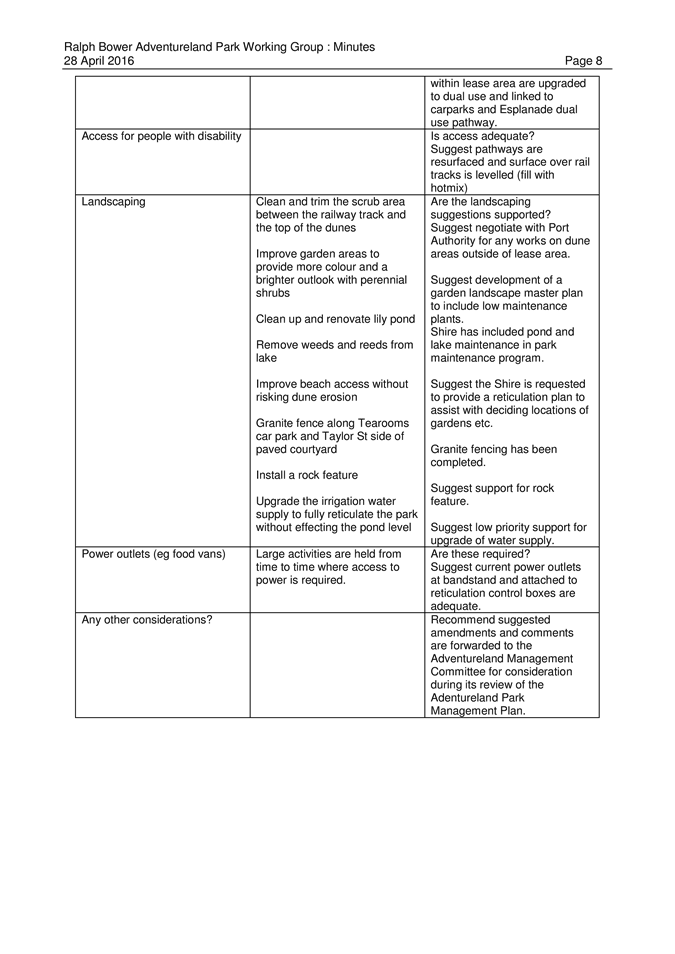

Ralph Bower Adventureland Park

Working Group – 28 April 2016

|

|

|

c.

|

Greater Sports Ground Redevelopment

Committee – 4 May 2016

|

|

|

Officer’s Recommendation

That Council receive the following

committee minutes:

1. Lake

Monjingup Community Development Group – 27 April 2016

2. Ralph

Bower Adventureland Park Working Group – 28 April 2016

3. Greater

Sports Ground Redevelopment Committee – 4 May 2016

Voting Requirement Simple Majority

|

14. Motions of which Notice has been Given

15. MEMBERS QUESTIONS WITH OR WITHOUT

NOTICE

16. URGENT BUSINESS APPROVED BY DECISION

17. MATTERS BEHIND CLOSED DOORS

Officer’s Comment:

It

is recommended that the meeting is behind closed doors for the following items,

in accordance with section 5.23(2) of the Local Government Act 1995.

Item: 17.1

Lease

amendment request - Lot 47 Shark Lake Rd Monjingup

Confidential

Item

This report is considered

confidential in accordance with the Local Government Act 1995, as it relates to

a matter that if disclosed, would reveal information that has a commercial

value to a person, where the information is held by, or is about, a person

other than the local government (Section 5.23(2)(e)(ii)).

Item: 17.2

Legal Proceedings

Recommendation - Council Endorsement Request - Lot 643 (73) Norseman Rd

Castletown

Confidential

Item

This report is considered

confidential in accordance with the Local Government Act 1995, as it relates to

the personal affairs of any person (Section 5.23(2)(b)); and legal advice

obtained, or which may be obtained, by the local government and which relates

to a matter to be discussed at the meeting (Section 5.23(2)(d)); and a matter

that if disclosed, would reveal information that has a commercial value to a

person, where the information is held by, or is about, a person other than the

local government (Section 5.23(2)(e)(ii)); and a matter that if disclosed,

would reveal information about the business, professional, commercial or

financial affairs of a person, where the information is held by, or is about, a

person other than the local government (Section 5.23(2)(e)(iii)); and a matter

that if disclosed, could be reasonably expected to impair the effectiveness of

any lawful method of procedure for preventing, detecting, investigating or

dealing with any contravention or possible contravention of the law (Section

5.23(2)(f)(i)).

18. PUBLIC QUESTION TIME

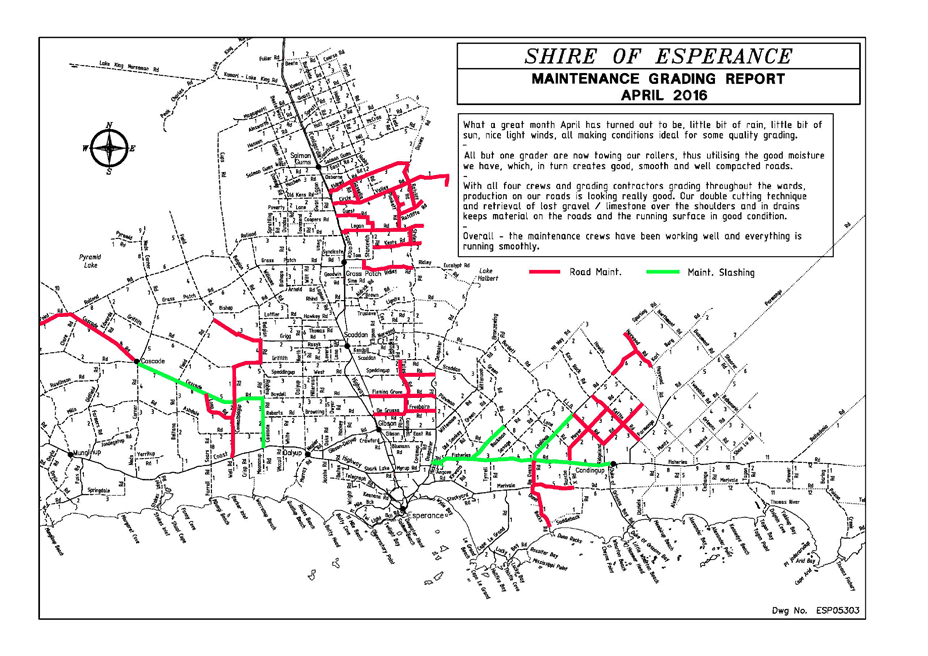

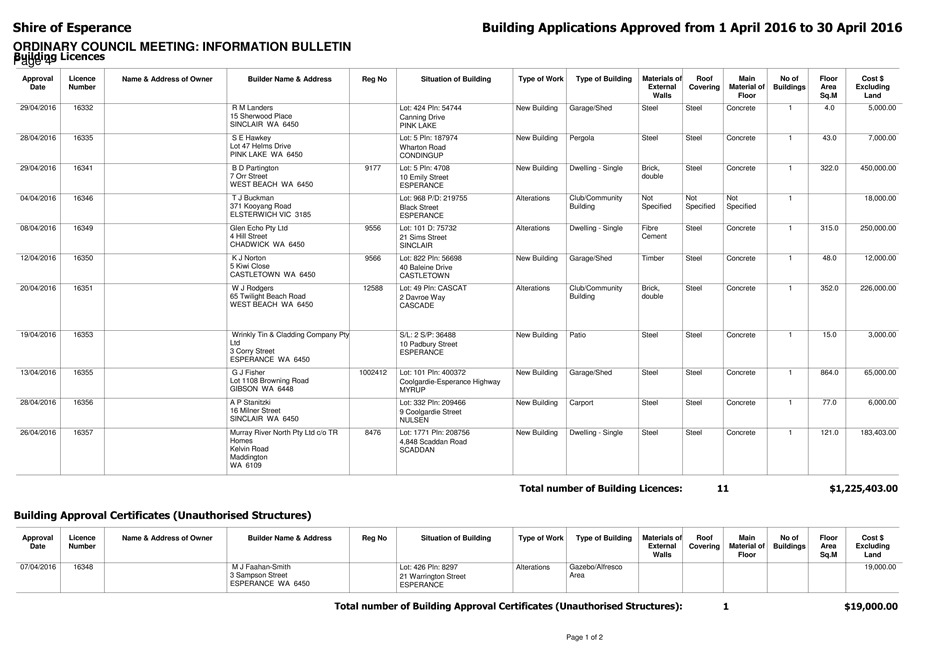

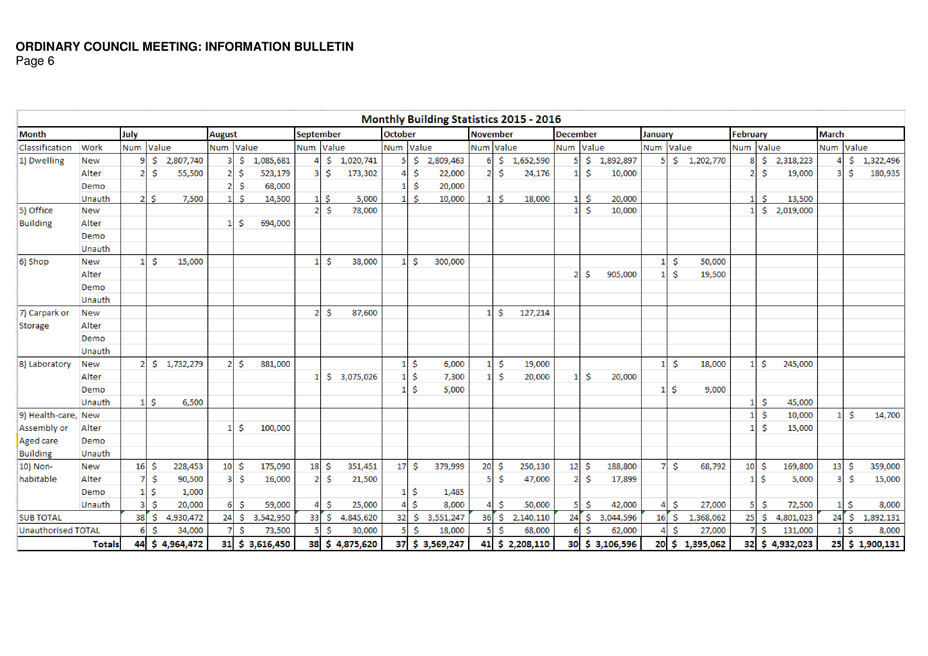

19. CLOSURE