9. Matters Requiring a Determination of

Committee

Item: 9.1

Airport

Safety Management System - Second Airport Vehicle

|

Author/s

|

Scott McKenzie

|

Acting Director External Services

|

|

Authorisor/s

|

Shane Burge

|

Chief Executive Officer

|

File Ref: D20/36042

Applicant

Internal

Location/Address

Not Applicable

Executive Summary

To allow Council to consider the risk of having one

vehicle available for the Airport Operations team.

Recommendation in Brief

That the Audit Committee recommend to Council that

Council endorse the short term loan of LV609 to the Airport Operations team and

consider a Capital Budget Bid for 2021/22 for a secondary airport vehicle.

Background

Prior to 2019, the Esperance Airport was staffed with

only one Shire officer physically located on site. Until that point, the

Airport Coordinator (to whom that officer reports) had been permanently based

within the Shire Administration Building in town given the necessary close

working relationship required between admin staff and airport operations.

Following the resignation of the former Airport Coordinator (Ali Cull) in 2019,

the decision was made to move the Airport Coordinator position permanently to

the Esperance Airport in order to improve operational oversight, provide

supervision and assistance to the sole Shire staff member on site and to foster

improved working relationships with Regional Express staff and other airport

tenants.

The additional Shire staff member being based on site

soon highlighted the risk of having only one available vehicle as the

relocation of the Airport Coordinator position meant that the only

‘airport ute’ was now increasingly away from site to attend the

Shire offices in town and purchase supplies etc. - issues that had previously

been served by access to the Shire admin vehicle fleet. This in turn created

the very real risk of the airport ute being absent from the airport during an

accident or incident. At airports, identified risks are assessed under a formal

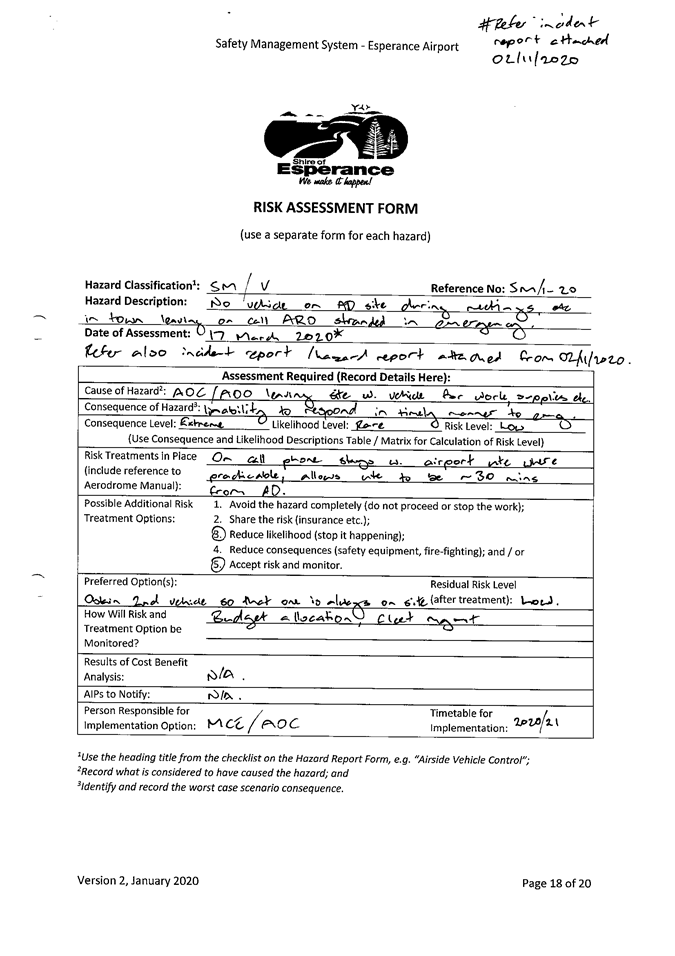

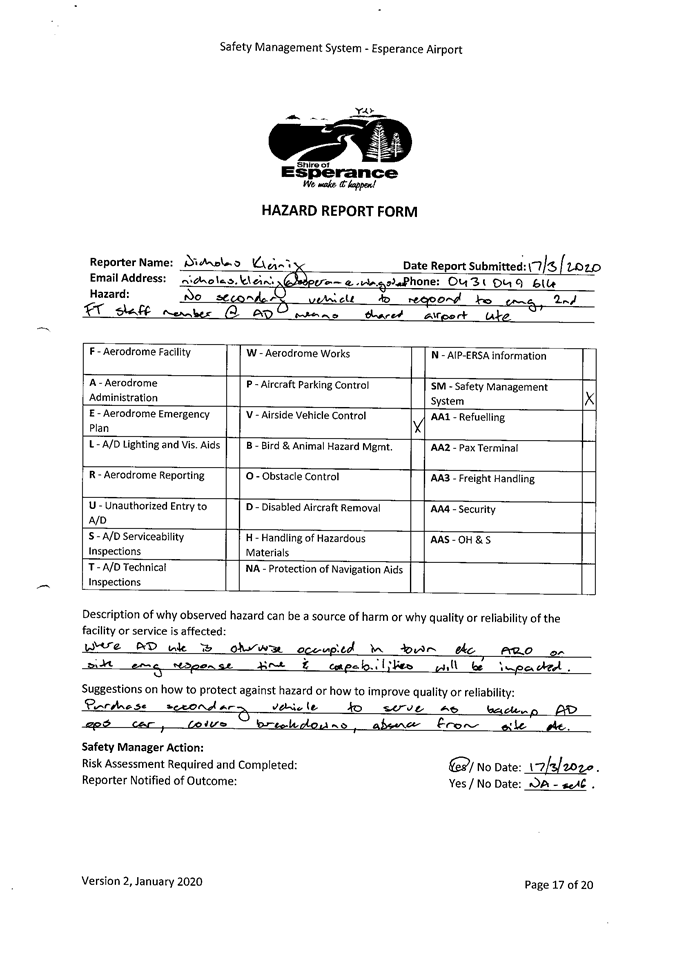

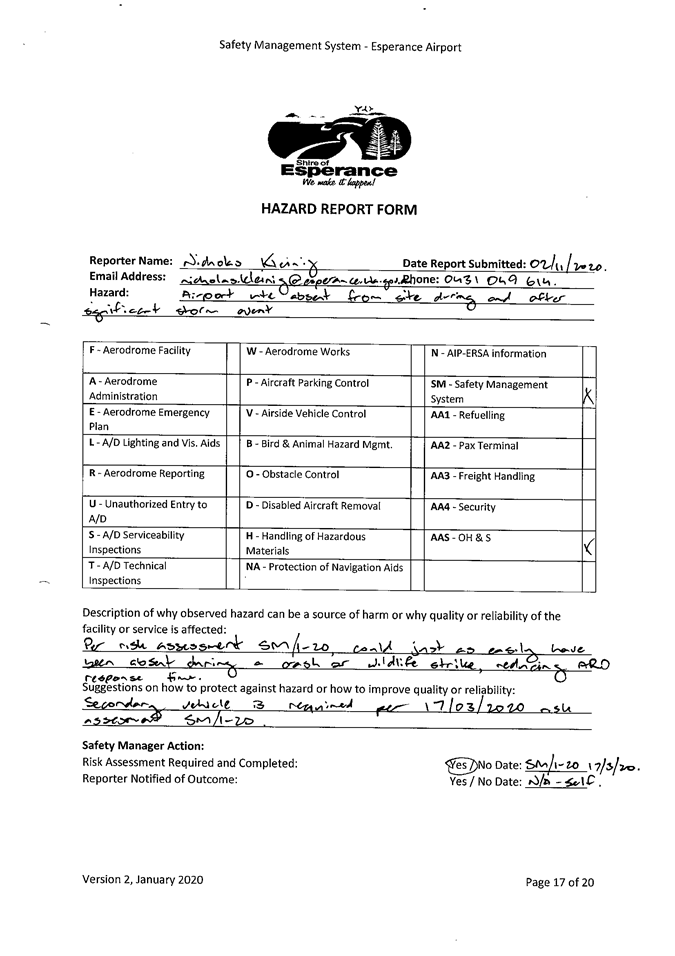

Safety Management System (SMS), and per Attachment A, this particular risk was

assessed early in 2020, with the solution put in place recommending the

acquisition of a secondary vehicle as part of the next budgeting process.

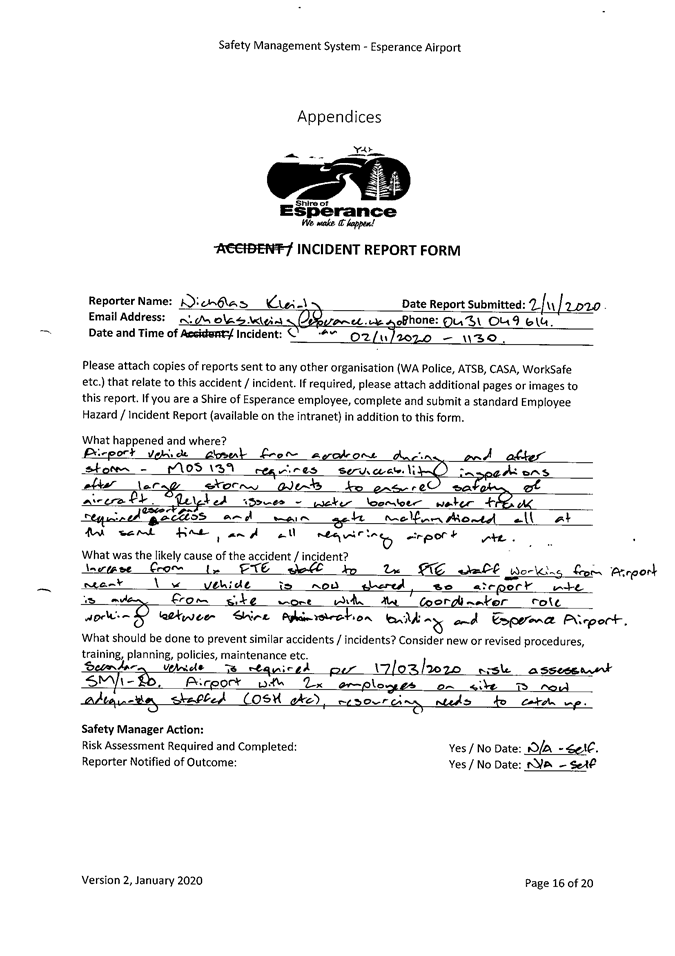

Early in November 2020, a safety incident (refer

Attachment A) occurred where the airport ute was absent from the site leaving

the remaining on-site officer without a vehicle during a significant storm

event that saw flash flooding throughout Esperance, including the Esperance

Airport. To ensure aircraft safety, CASA require an aerodrome serviceability

inspection to be conducted as soon as practicable “…after a severe

wind event, a severe storm or a period of heavy rainfall”, and in this

particular case the process - which included closing gravel runway 03/21 due to

flooding - was impacted through the absence of the airport ute, increasing the

risk to aviation.

This incident and the associated risk (refer

Attachment A) was then considered at the next Directors Meeting, where it was

decided to immediately address the issue by reallocating an existing pool

vehicle to the airport as an interim measure until a secondary permanent

airport vehicle could be procured under a budget allocation in 2021/22.

Officer’s Comment

Under the Shire’s Occupational Safety and Health

Policy, CASA’s Manual of Standards (MOS Part 139) and indeed the

Esperance Airport Safety Management System (SMS), the Shire of Esperance has an

implicit responsibility to ensure that staff are adequately resourced to

perform their roles in the safest manner possible. In this case, the provision

of a secondary and interchangeable vehicle has been assessed as being the best

solution to ensure the ongoing safe operations of the Esperance Airport.

In addition to this, it is relevant to note that the Airport

Coordinator’s present additional workload as a ‘case manager’

or ‘development concierge’ in an effort to improve customer service

on a trial basis as part of the development approval process will take the

Airport Coordinator and vehicle away from the airport site more frequently.

Option

That the Audit Committee recommend to Council that Council

amend the 2020/21 Budget as below to allow for the purchase of a second Airport

vehicle;

|

Description

|

Budget Figure

|

Amended Figure

|

Variation

|

|

Purchase of Vehicles

|

7510-705-6665

|

$0

|

$42,250

|

$42,250

|

|

Transfer from Aerodrome Reserve

|

7510-955-910

|

($271,457)

|

($229,207)

|

($42,250)

|

|

Net result

|

$0

|

Consultation

Executive Management Team

Financial Implications

The risk of not having a second vehicle has been alleviated

in the short term by the Asset Management area delaying the sale of a 4WD ute

and providing this vehicle to the airport. The intention is to lodge a Capital

Bid for the 2021/22 Budget to allow the sale of LV609 and provide a secondary

vehicle to the airport.

Asset Management Implications

Nil

Statutory Implications

Nil

Policy Implications

Nil

Strategic Implications

Strategic Community Plan 2017 - 2027

Built Environment

Transport networks that

meet the needs of our community and provide safe movement for all users

Deliver a diverse,

efficient and safe transport system

Corporate Business Plan 2020/21 – 2023/24

B2.6 Manage the Esperance Airport

Environmental Considerations

Nil

Attachments

|

a⇩.

|

Risk Assessment - Lack of Second

Vehicle

|

|

|

Officer’s Recommendation

That the Audit Committee recommend

to Council that Council endorse the short term loan of LV609 to the Airport

Operations team and consider a Capital Budget Bid for 2021/22 for a secondary

airport vehicle.

Voting Requirement Simple Majority

|

Item: 9.2

Audit

Report 2019/20

|

Author/s

|

Beth O'Callaghan

|

Acting Director Corporate Resources

|

|

Authorisor/s

|

Shane Burge

|

Chief Executive Officer

|

File Ref: D20/36195

Applicant

Corporate Resources

Location/Address

Internal

Executive Summary

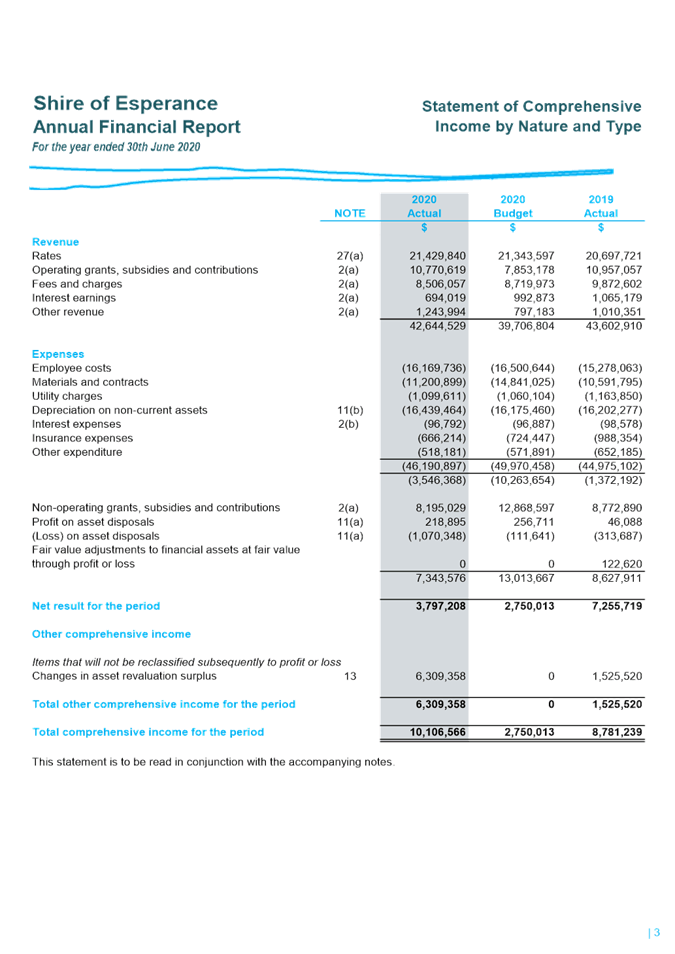

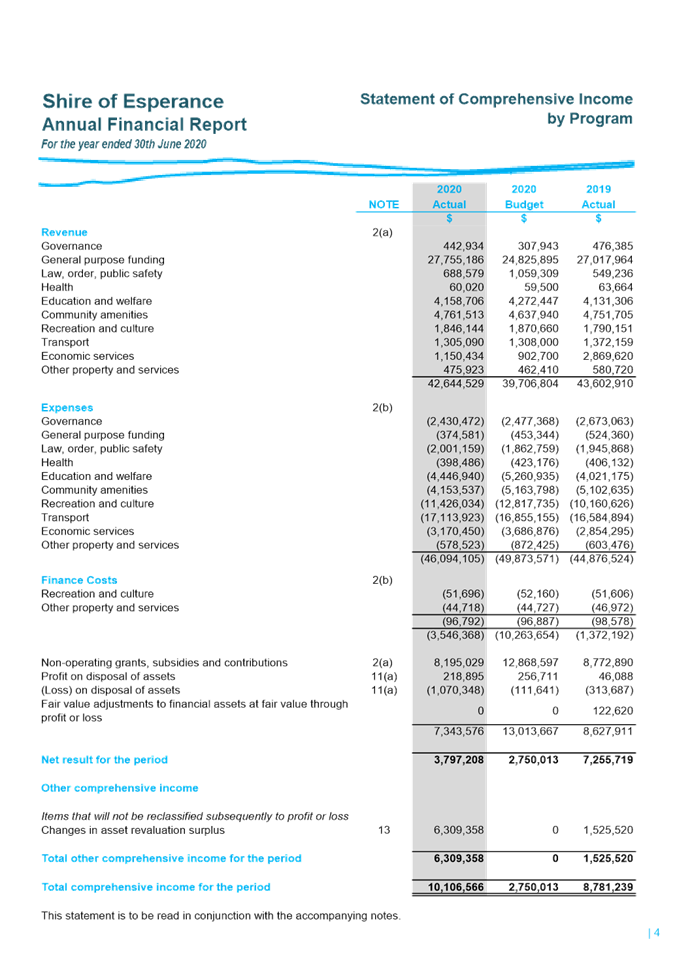

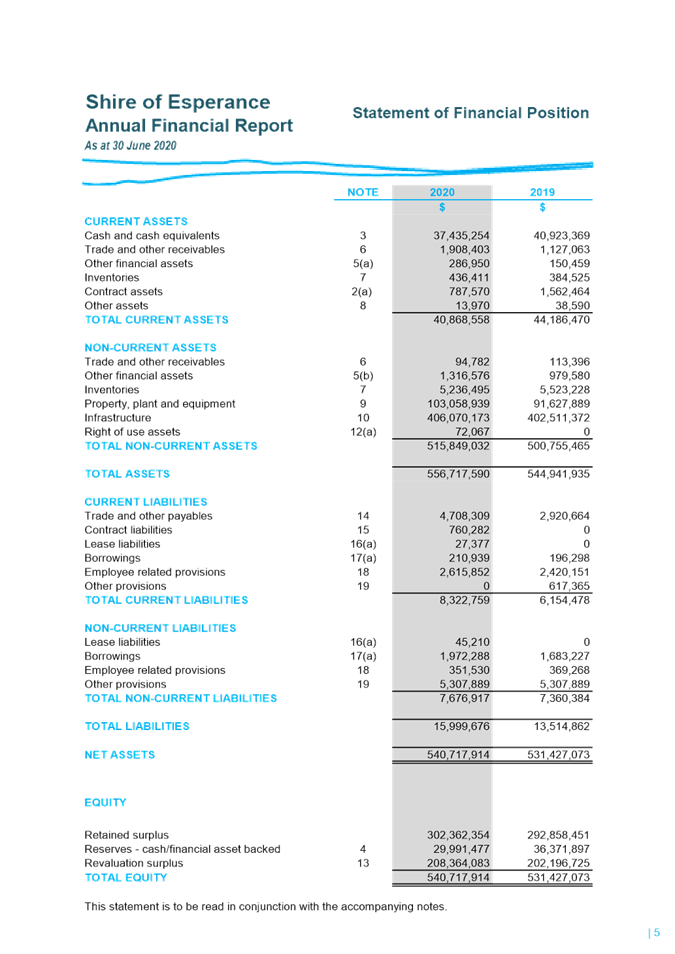

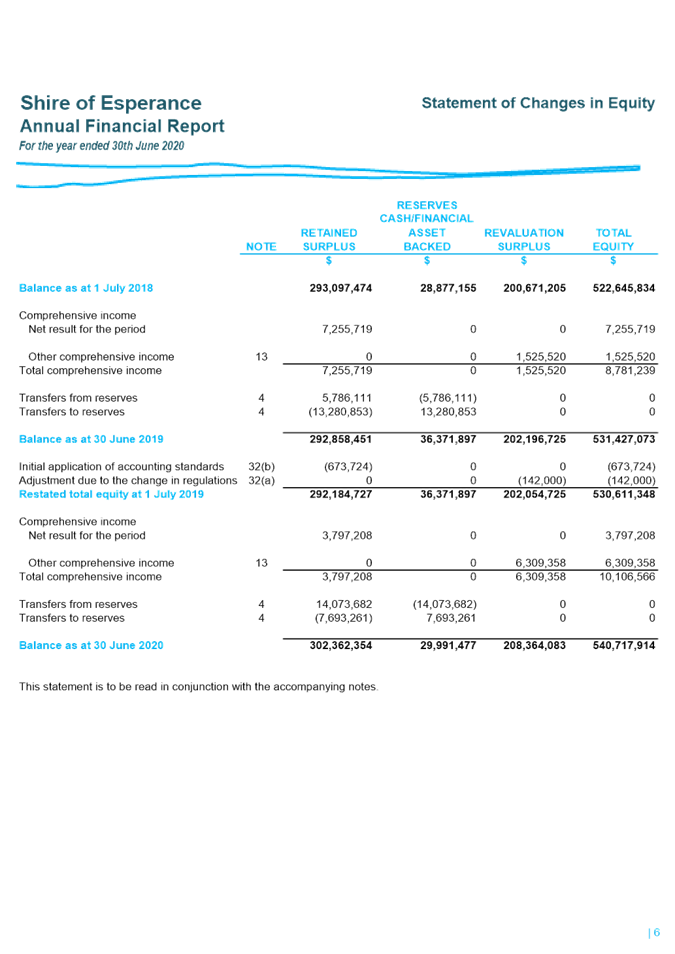

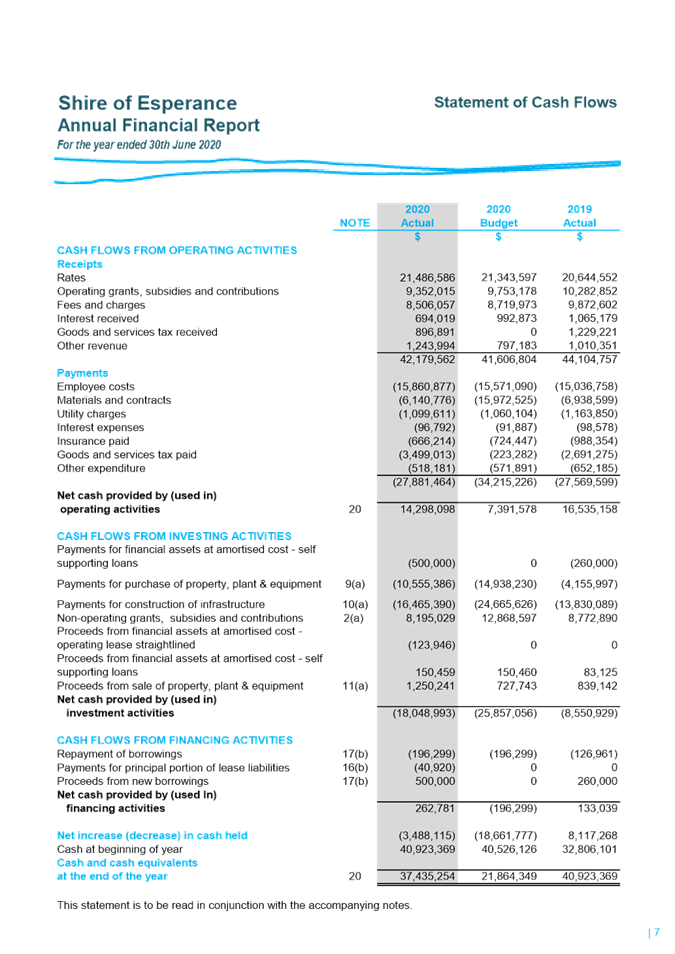

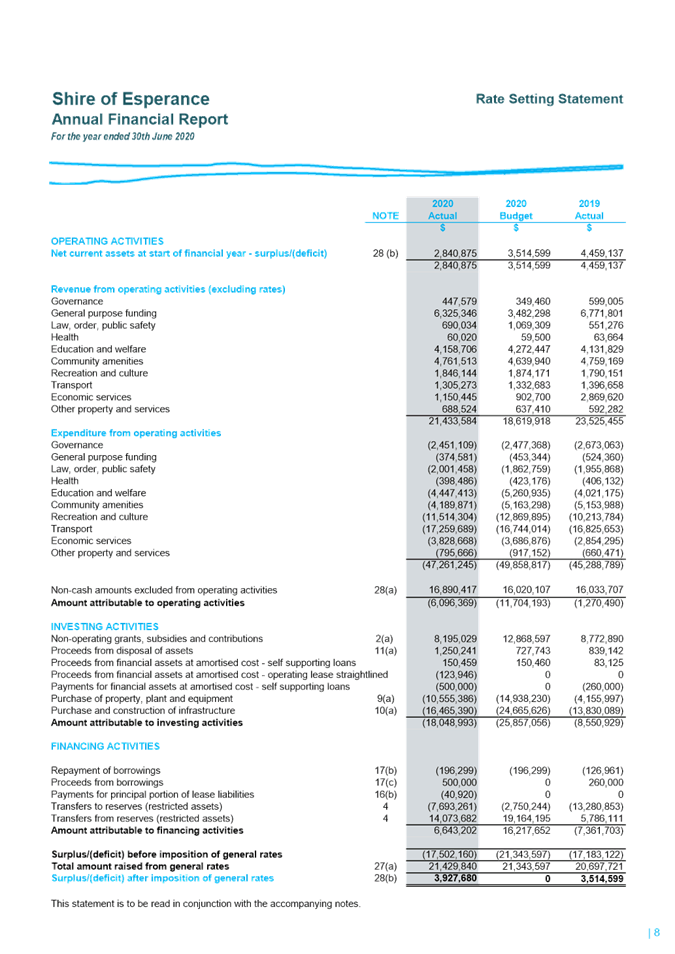

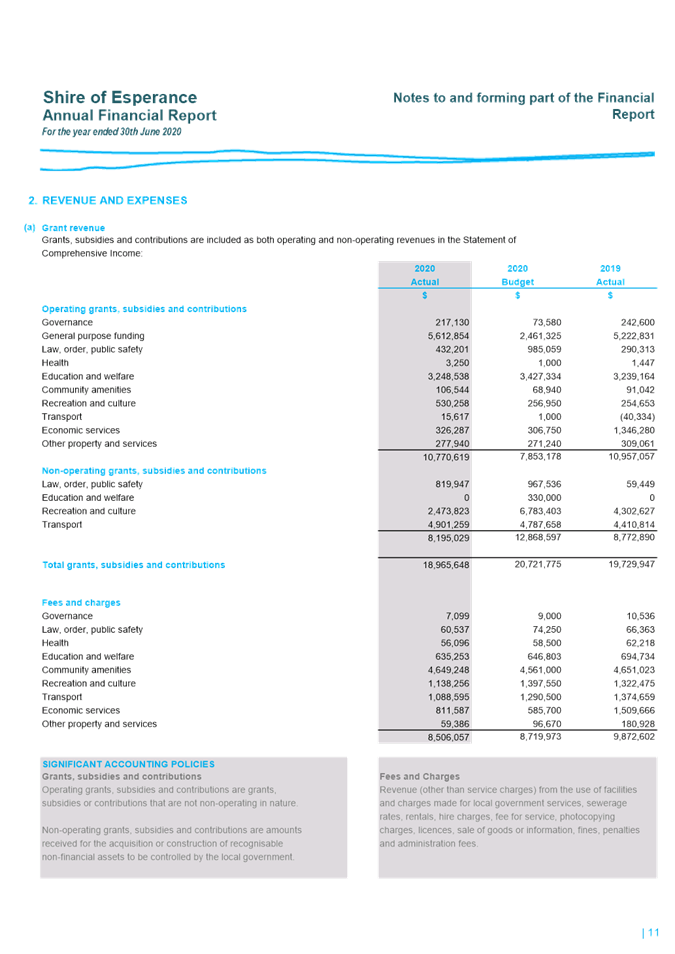

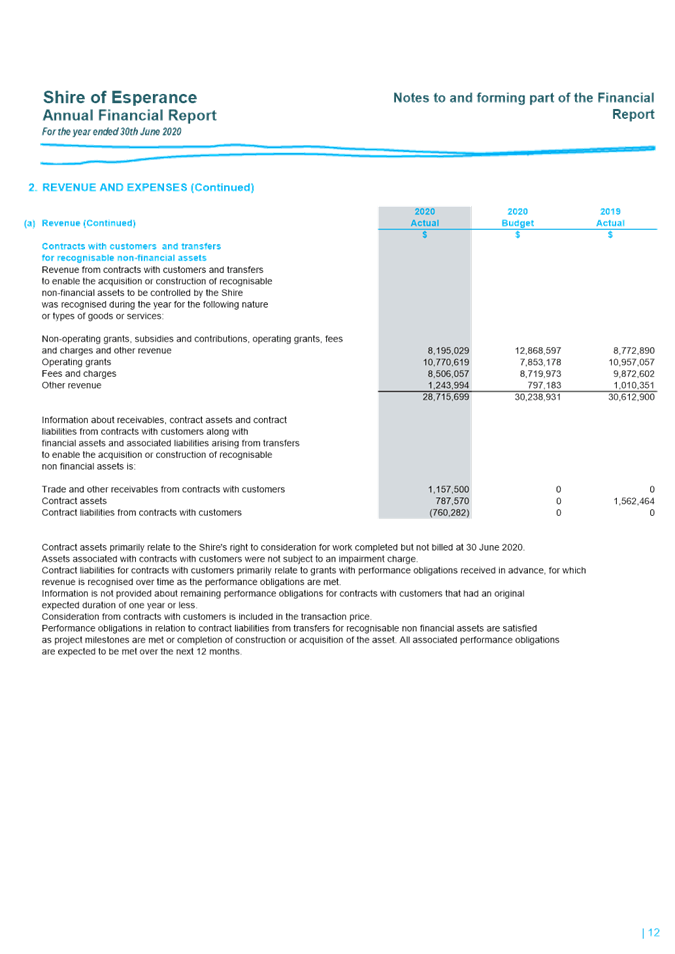

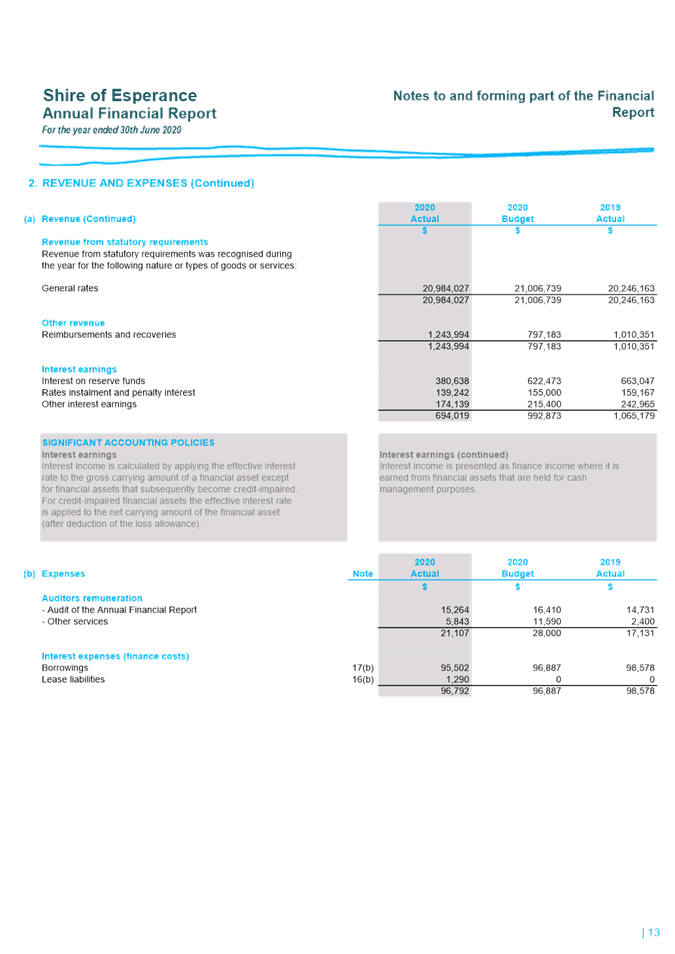

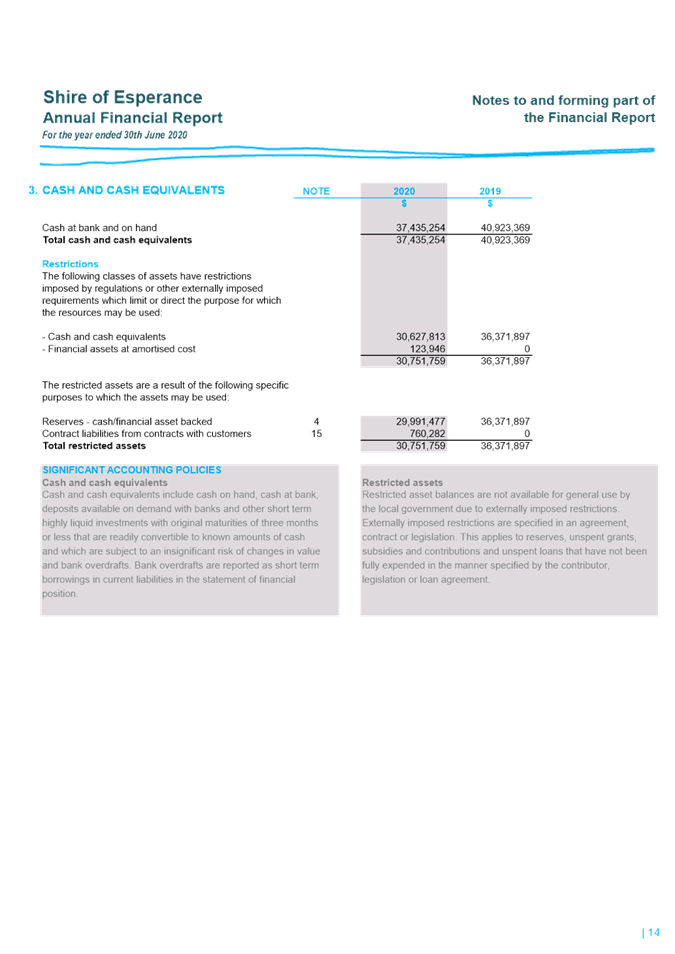

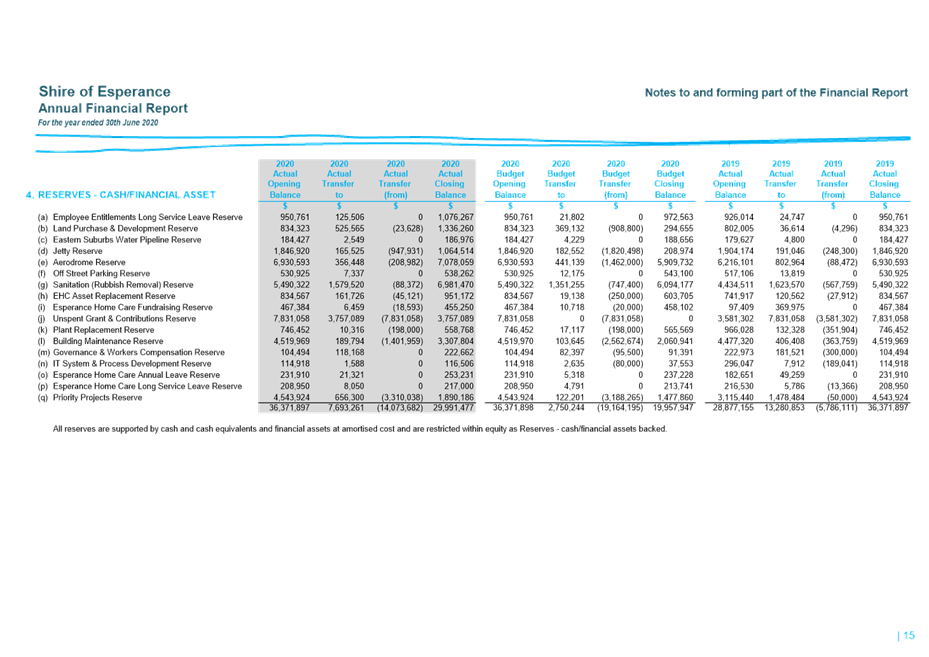

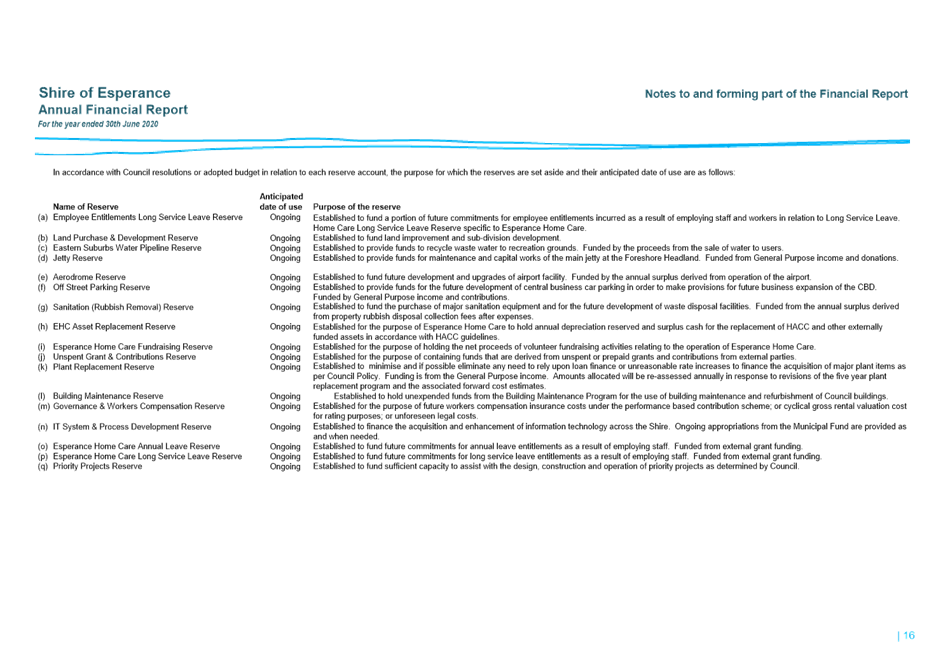

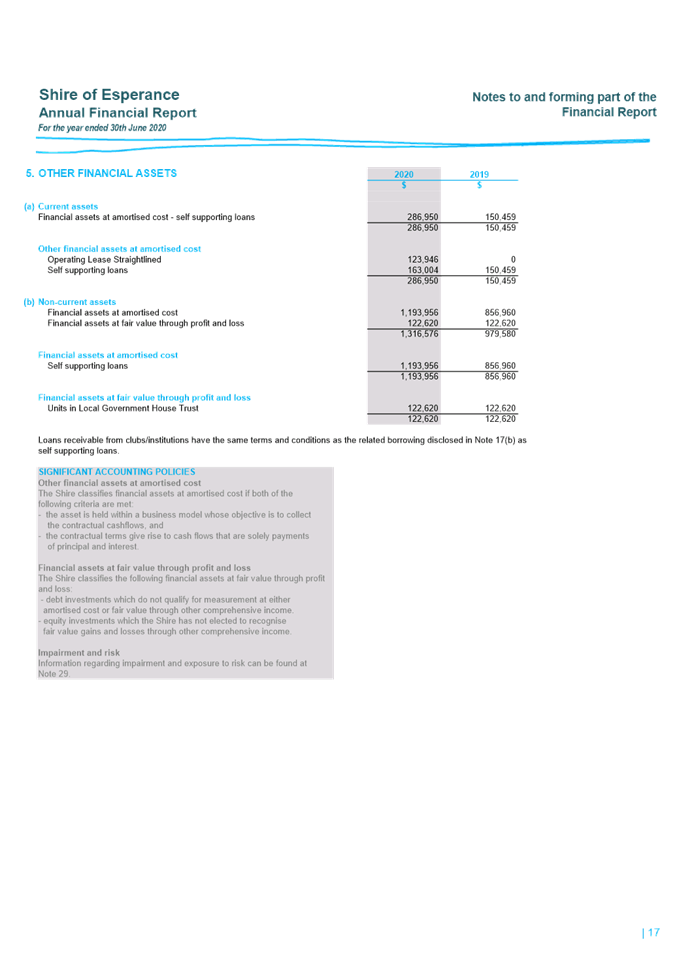

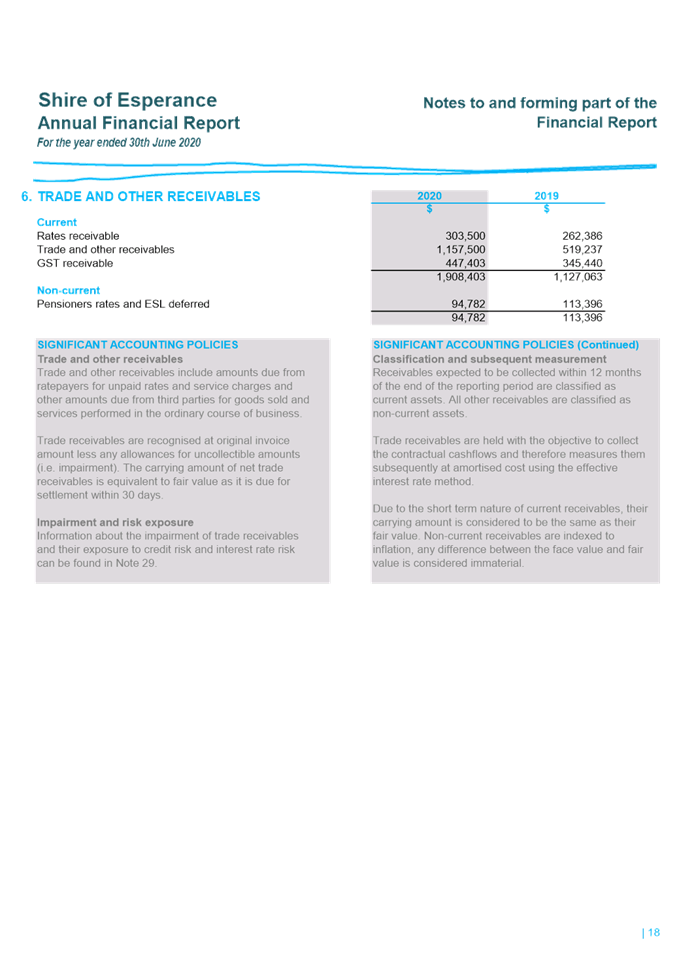

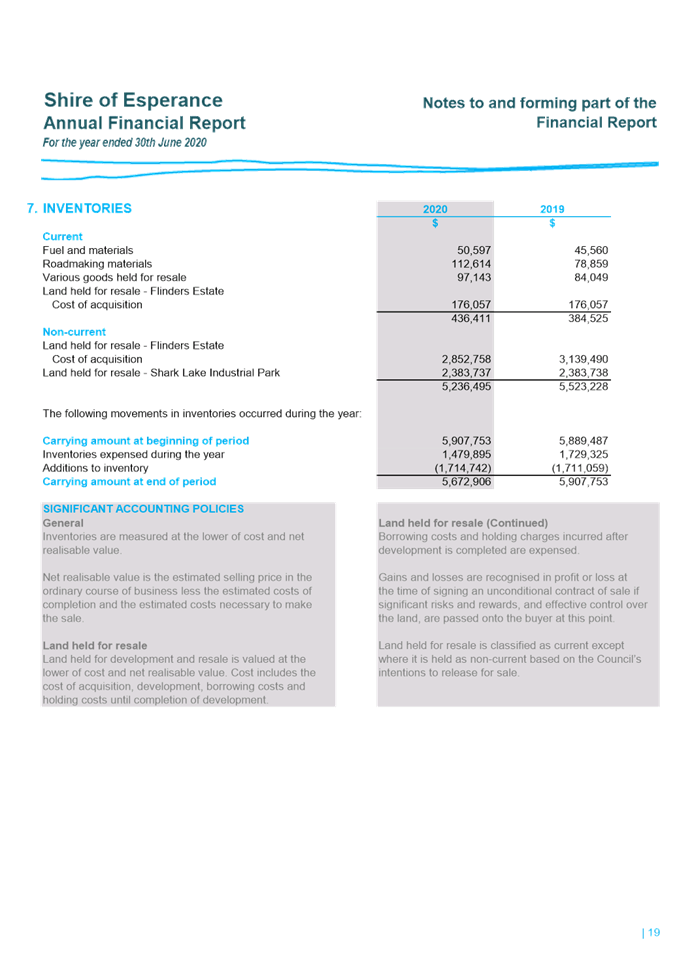

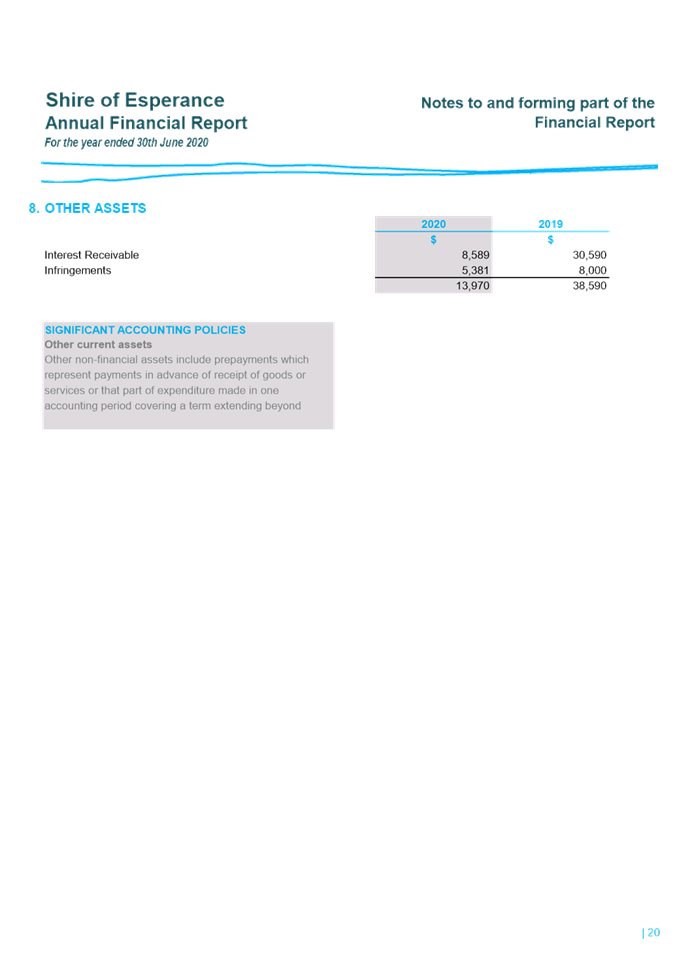

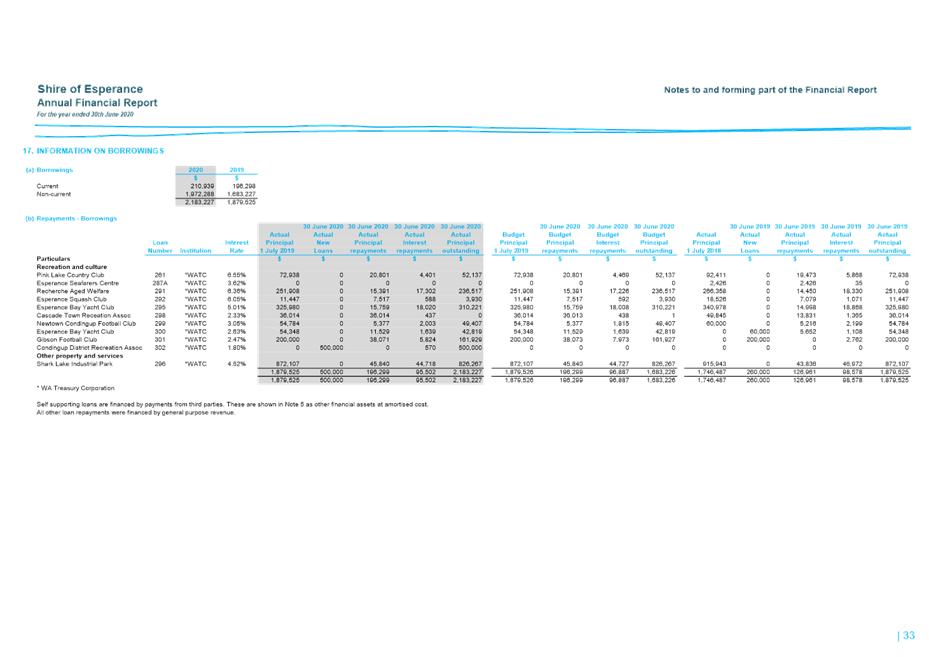

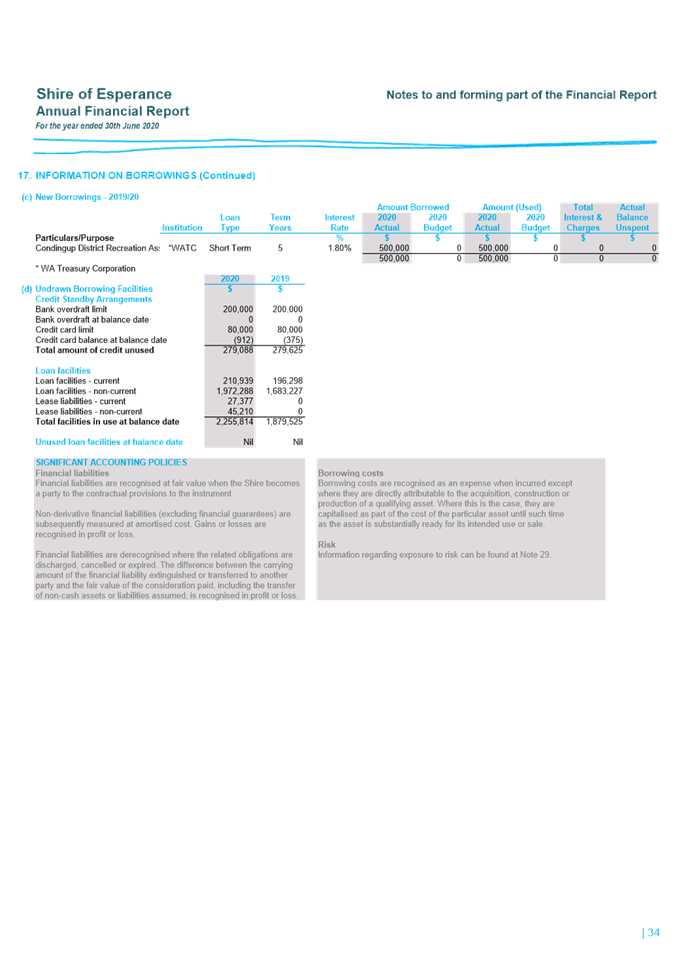

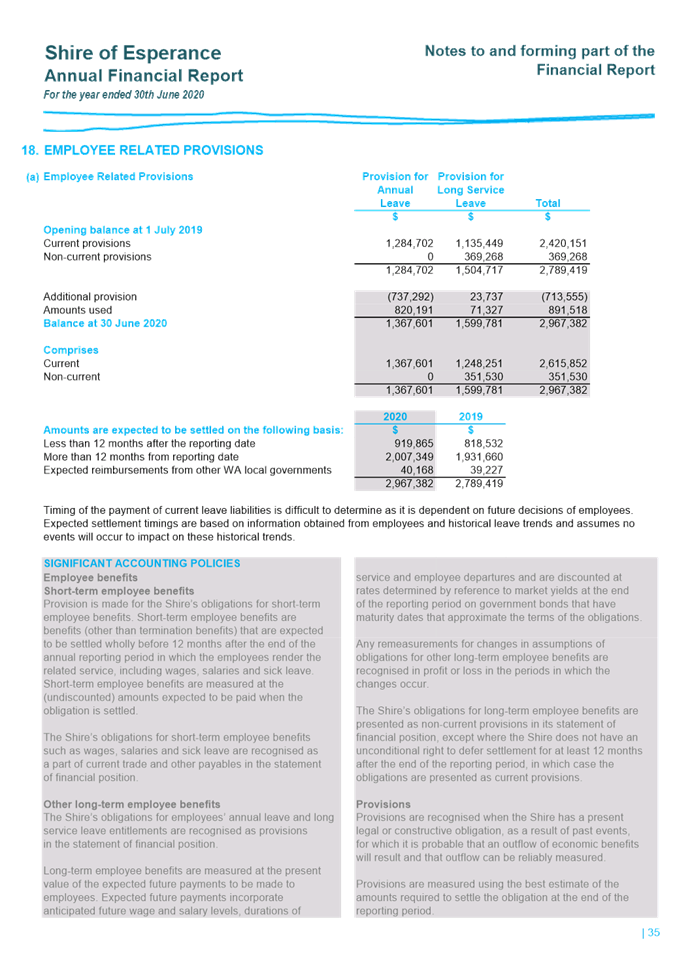

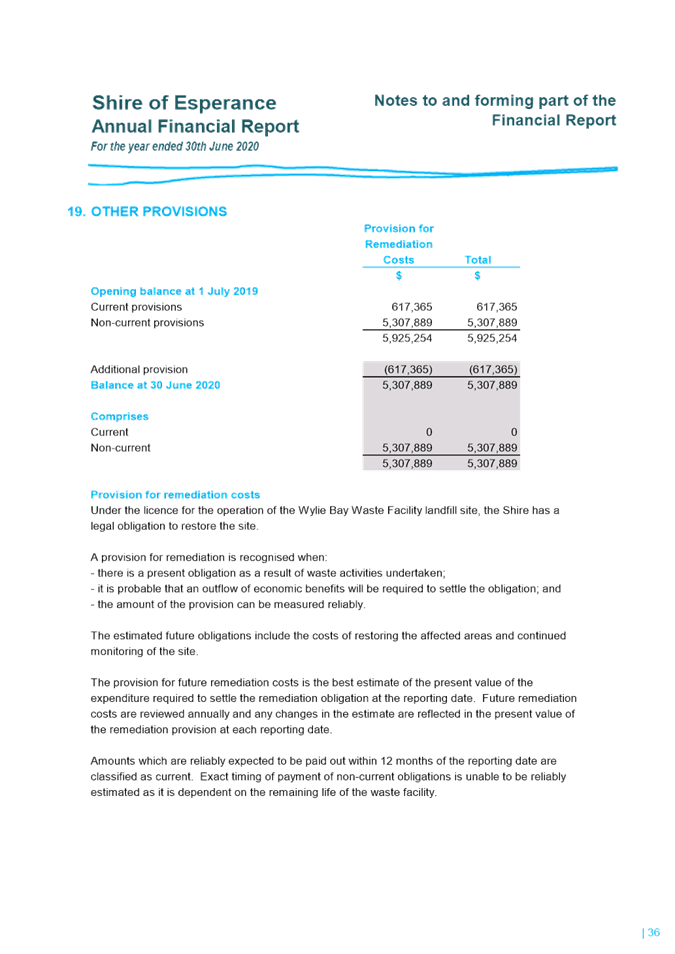

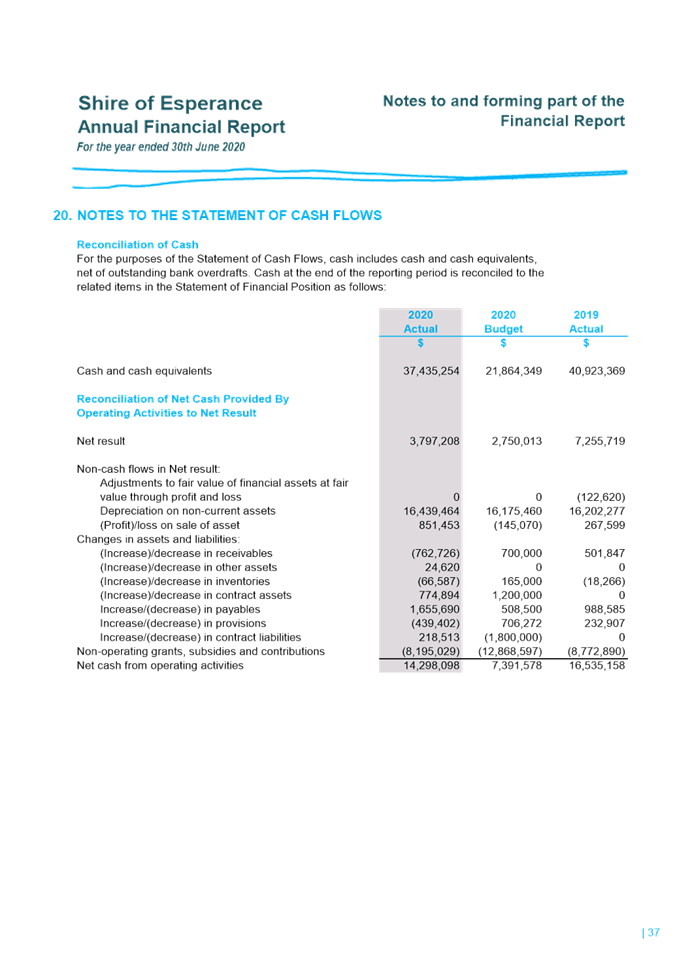

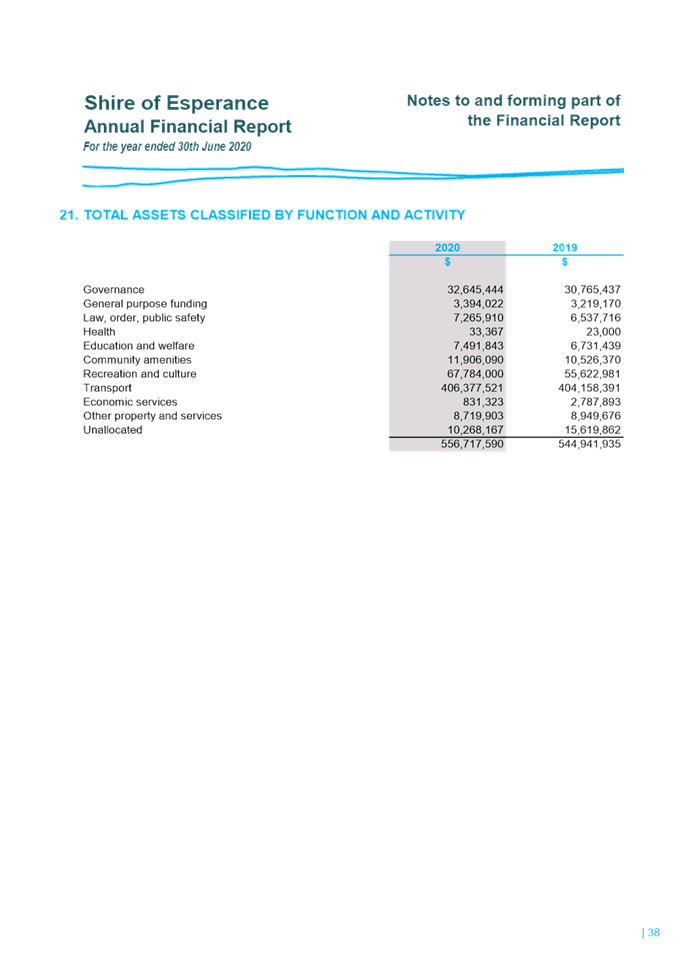

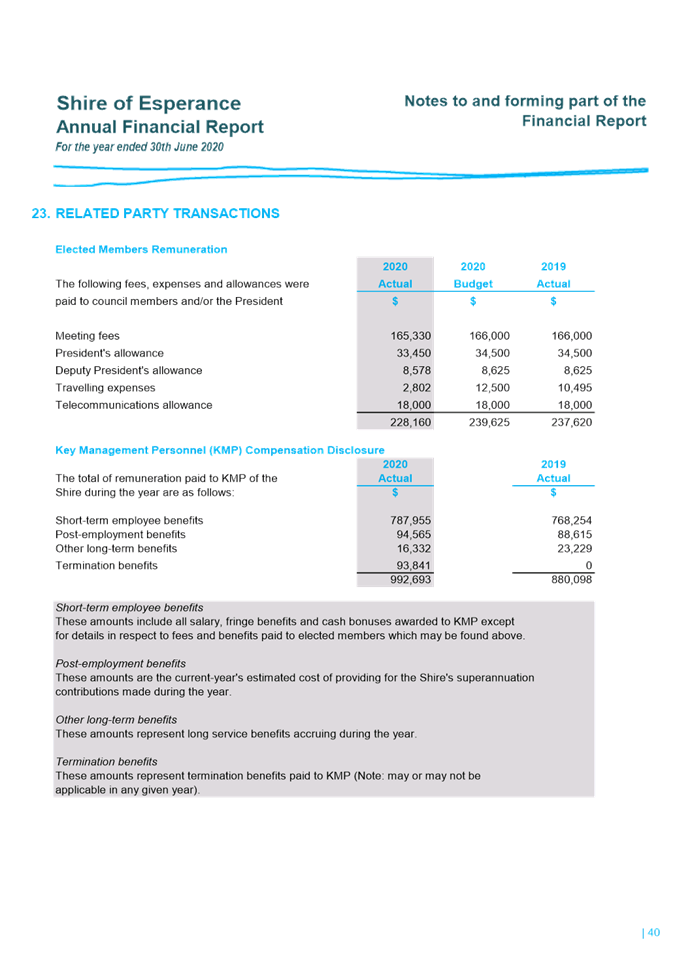

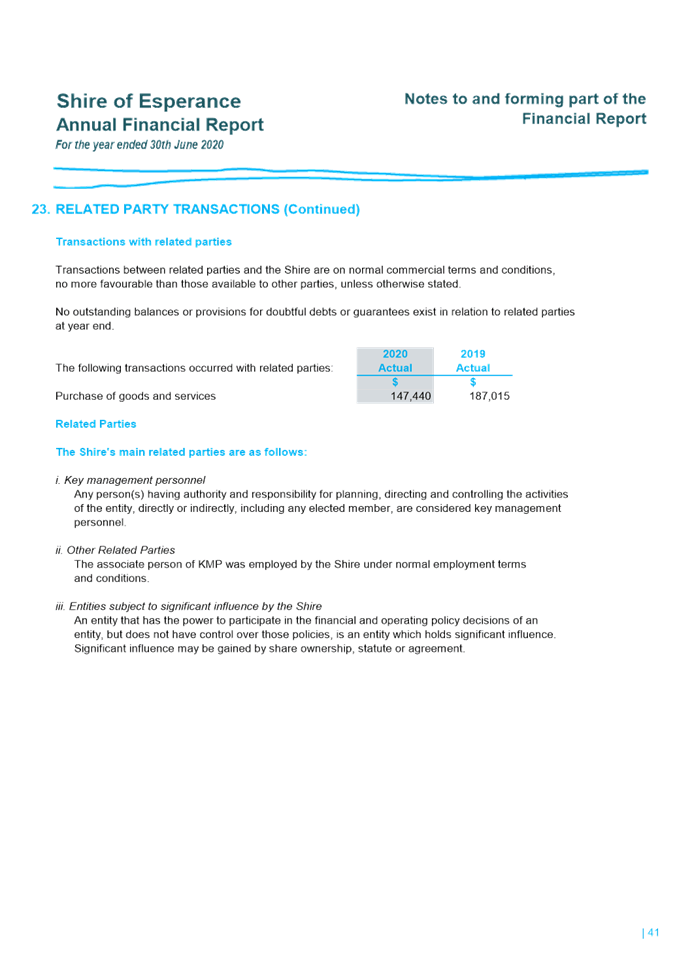

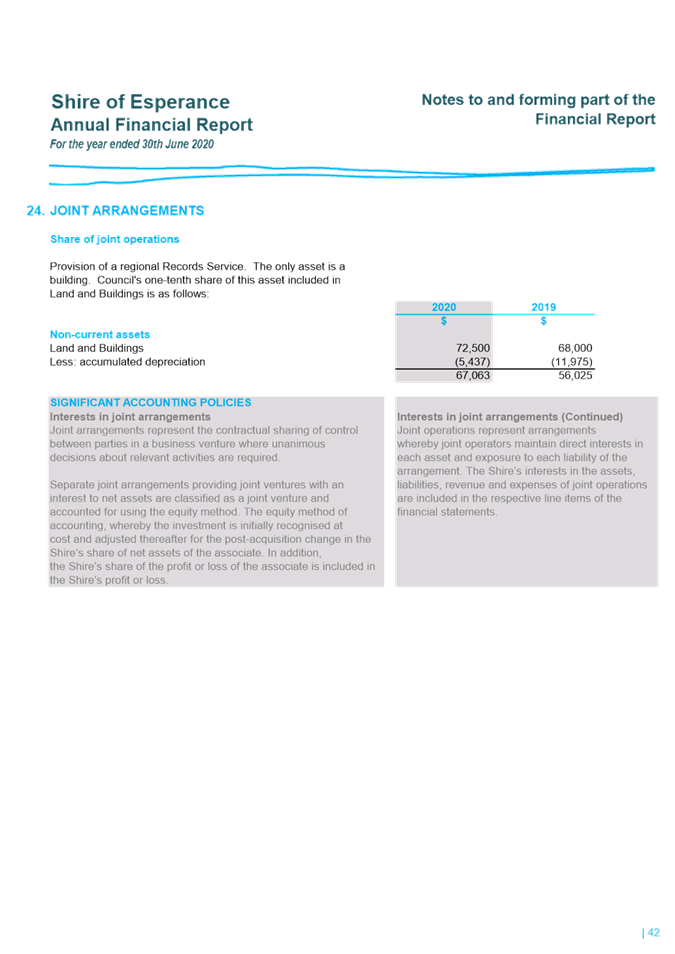

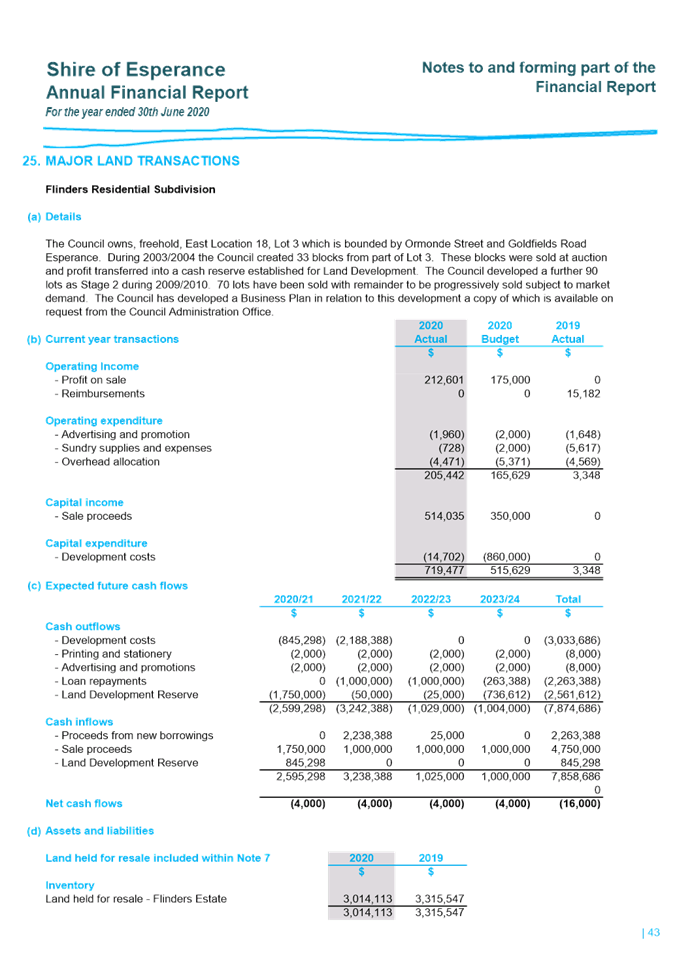

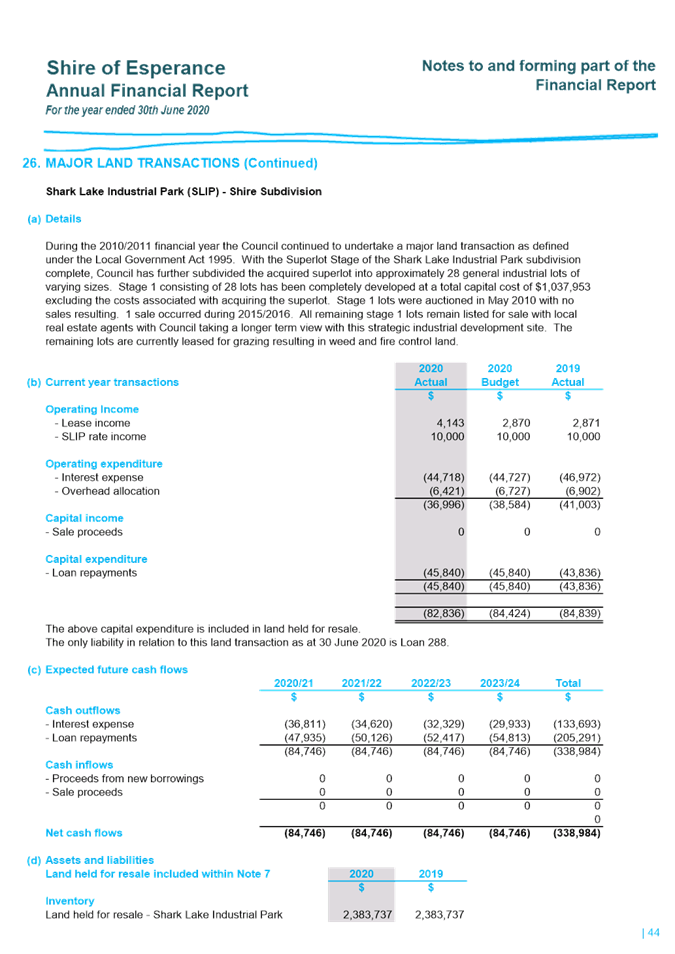

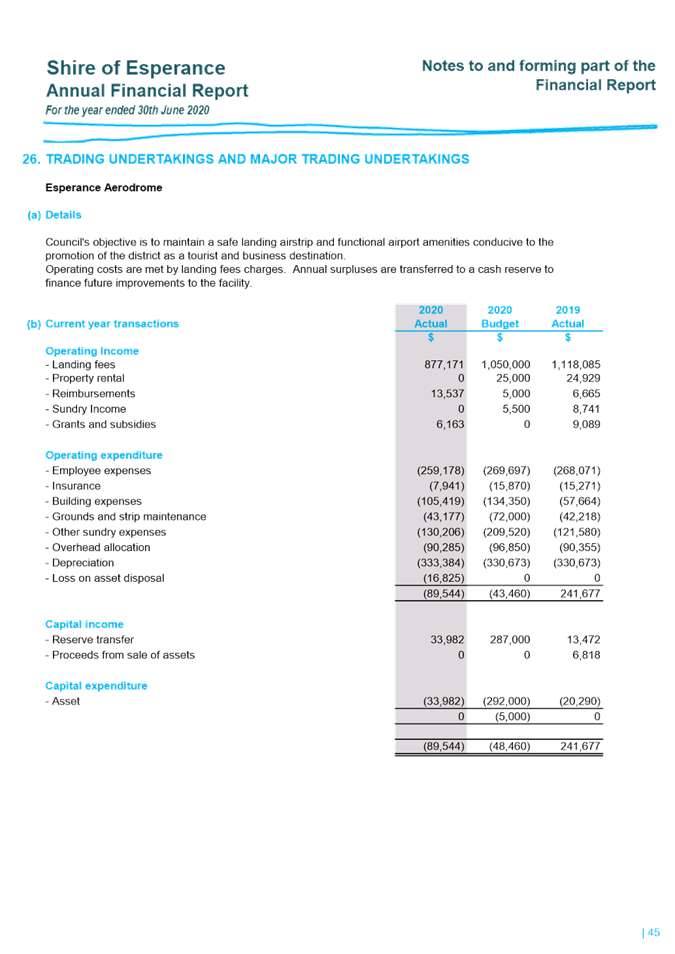

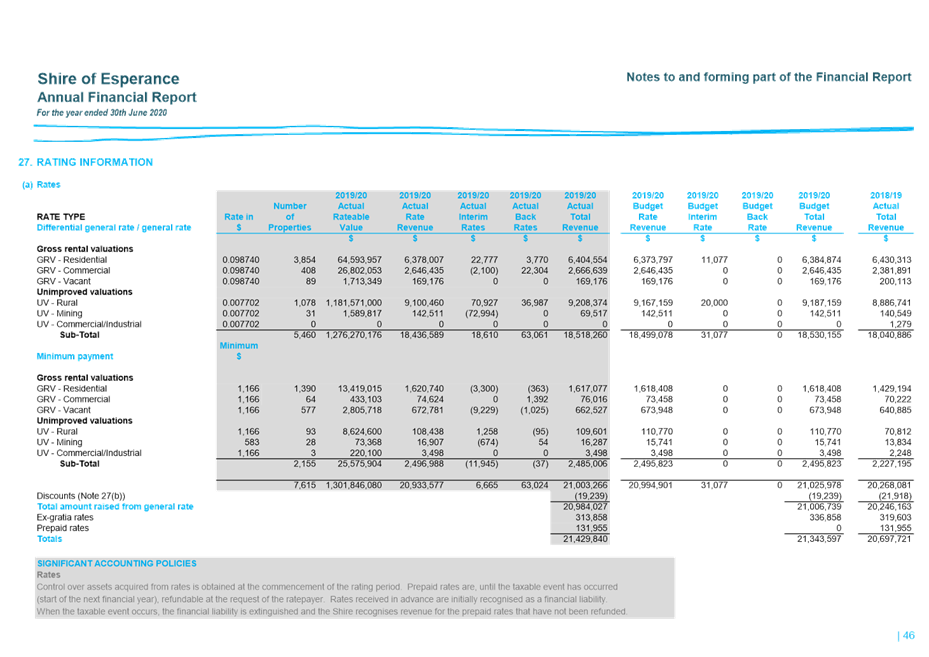

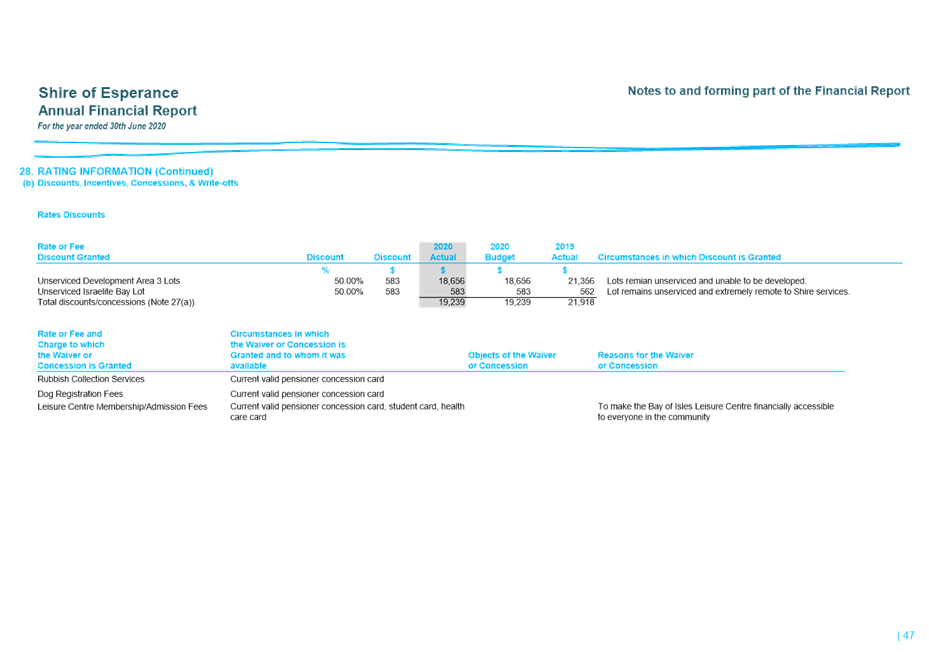

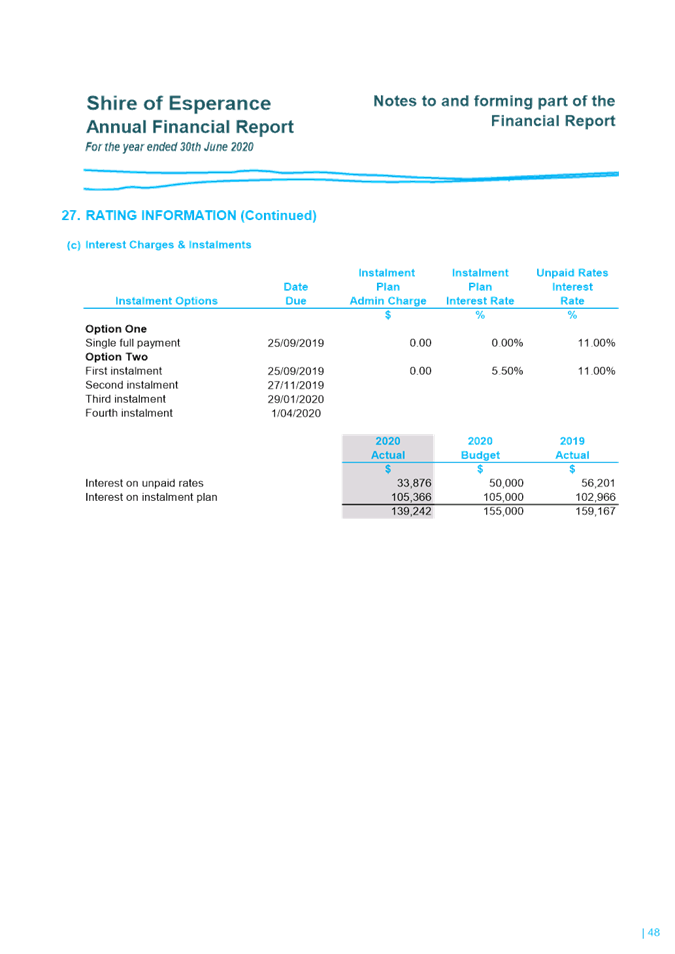

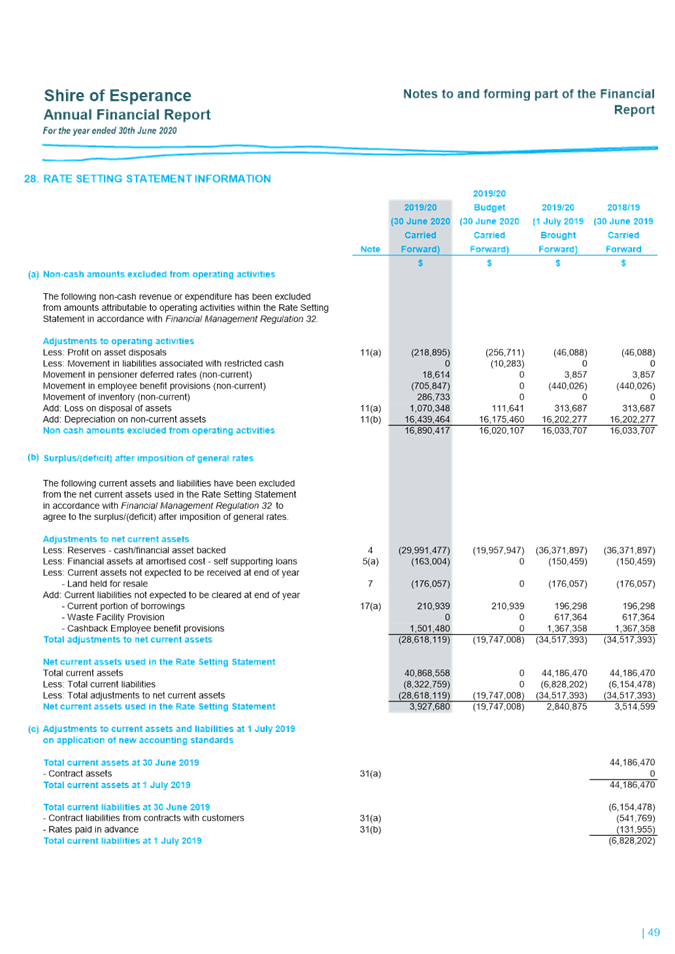

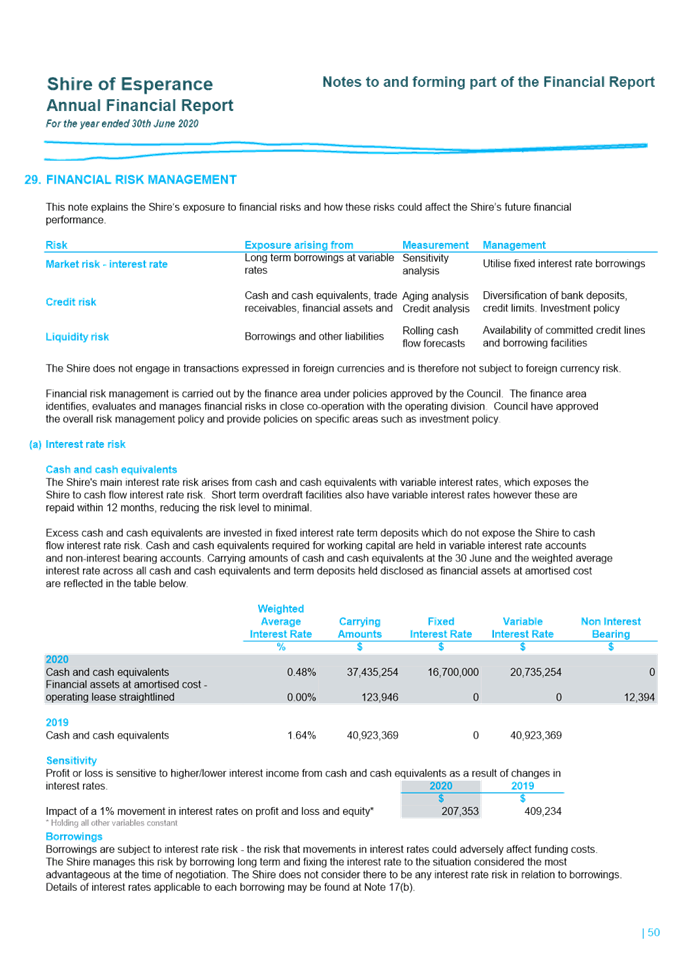

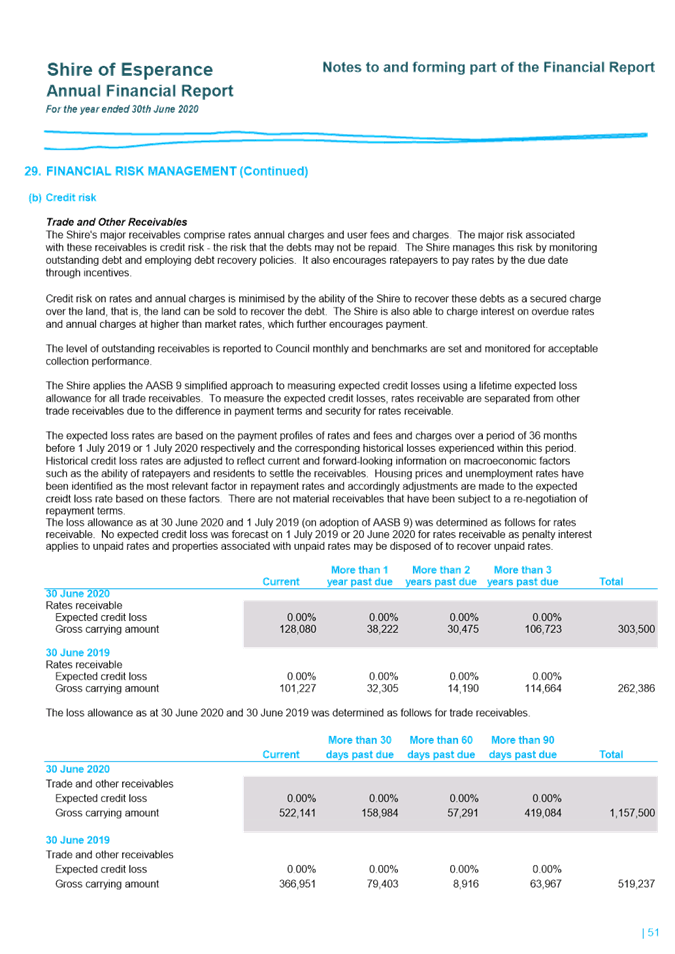

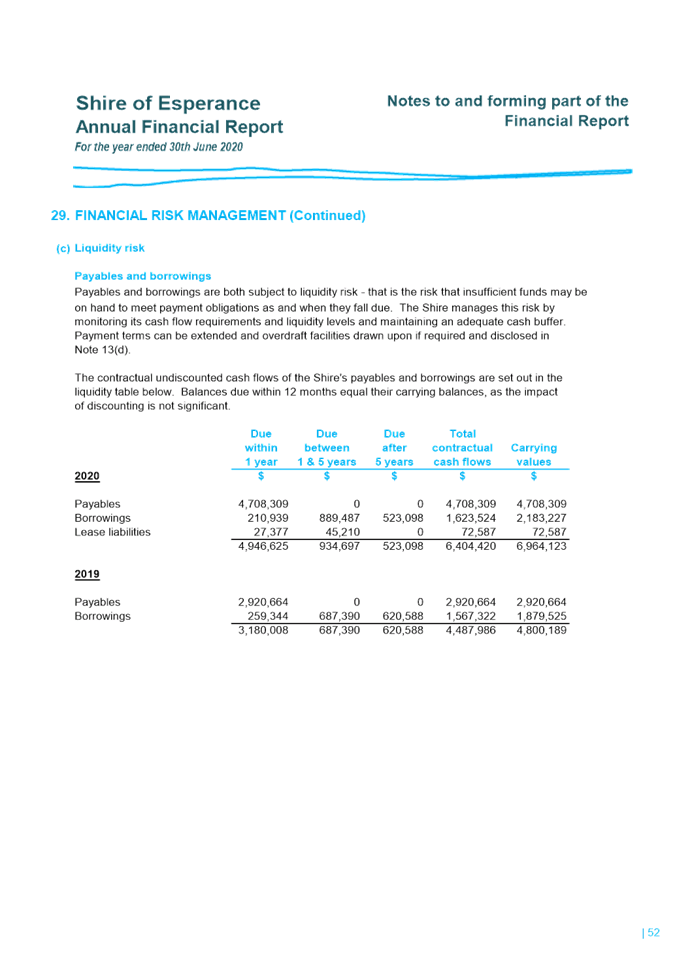

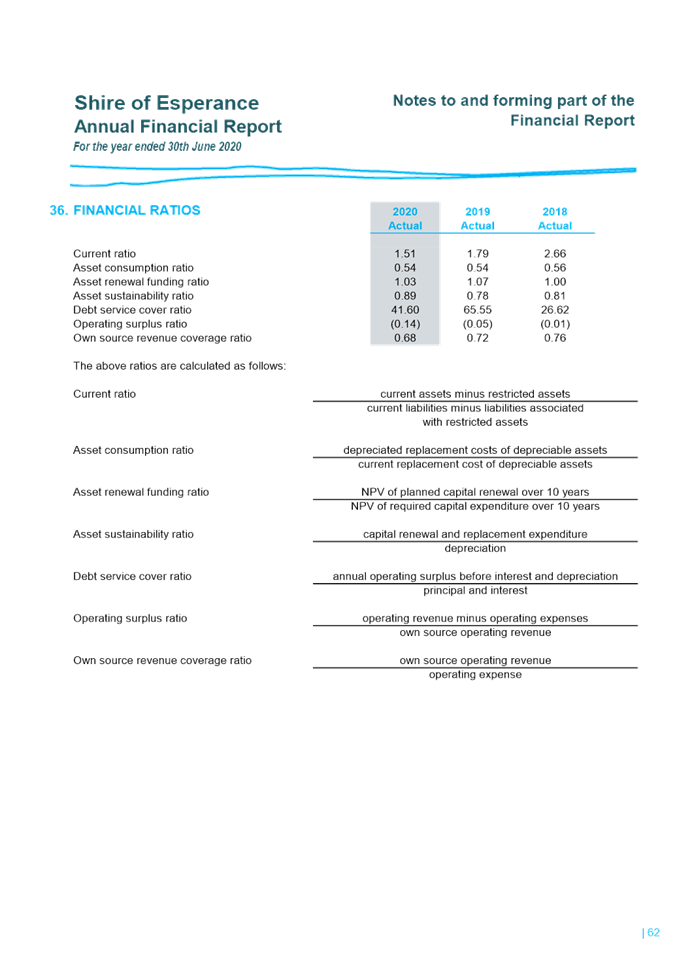

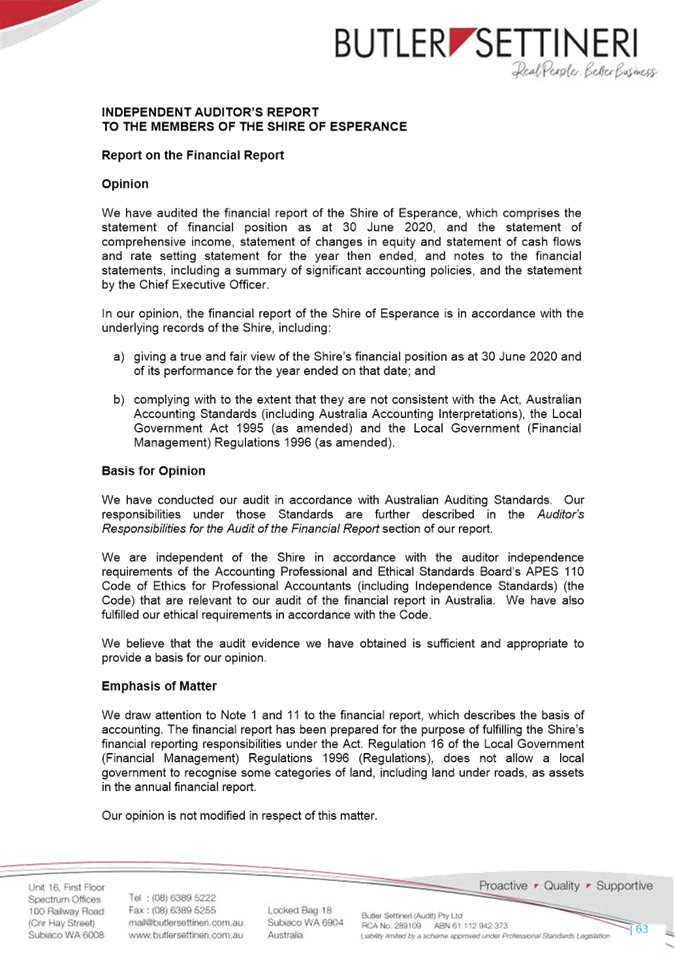

To present to the Audit Committee the 2019/20 Annual

Financial Report and Audit Report prepared by the Council’s auditor, Mr

Marius Van Der Merwe from Butler Settineri.

Recommendation in Brief

That the Audit Committee

1. Receive

the 2019/20 Annual Financial Report including the Audit Report as attached as

Attachment A.

2. Recommends

the Annual Financial Report and Audit Report for the 2019/20 financial year to

Council for adoption.

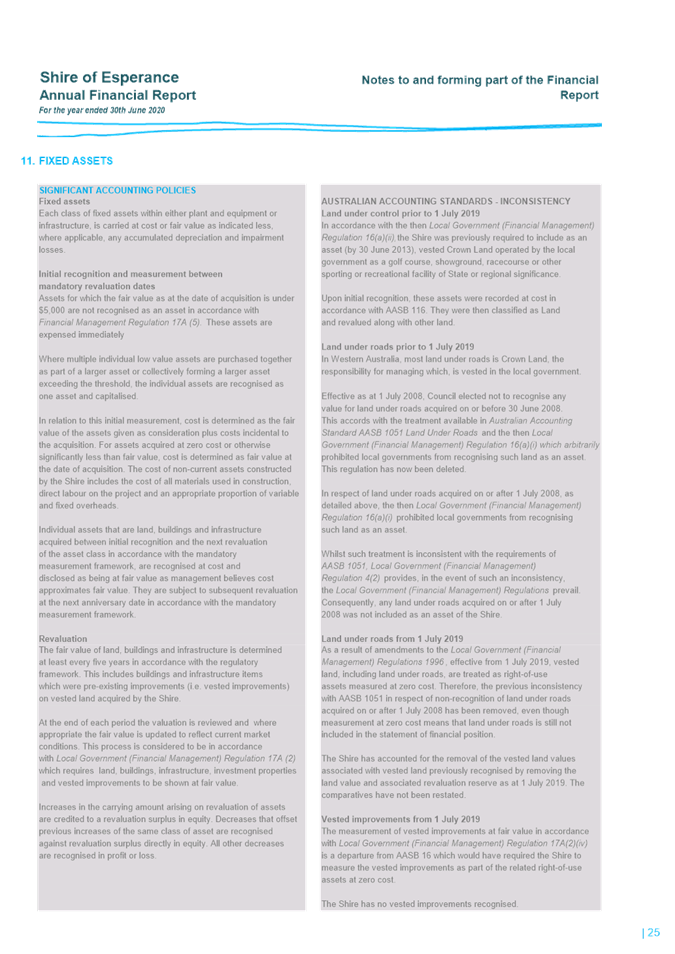

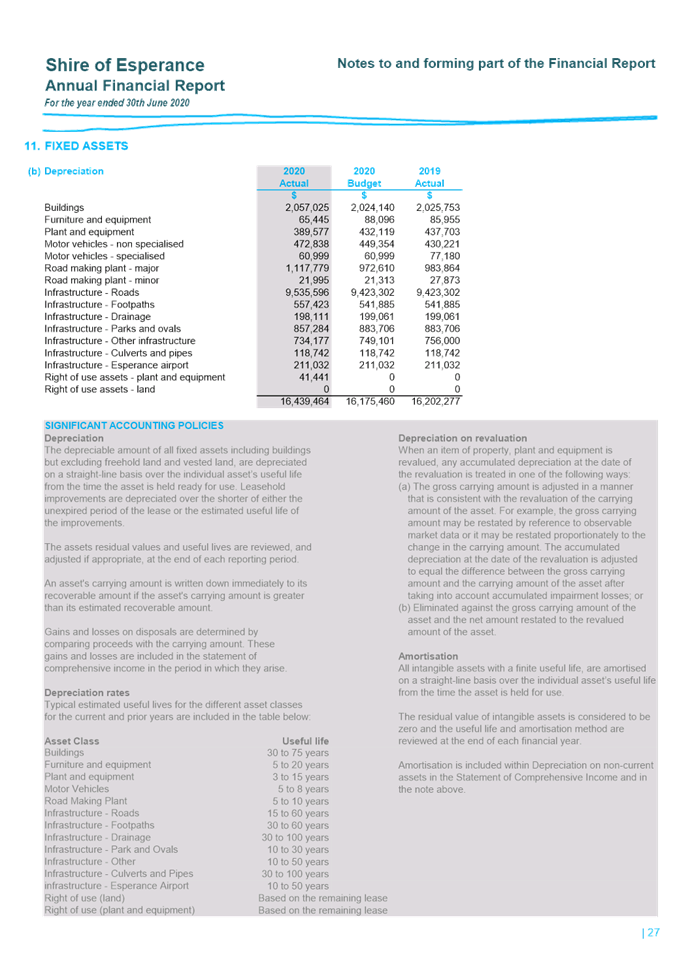

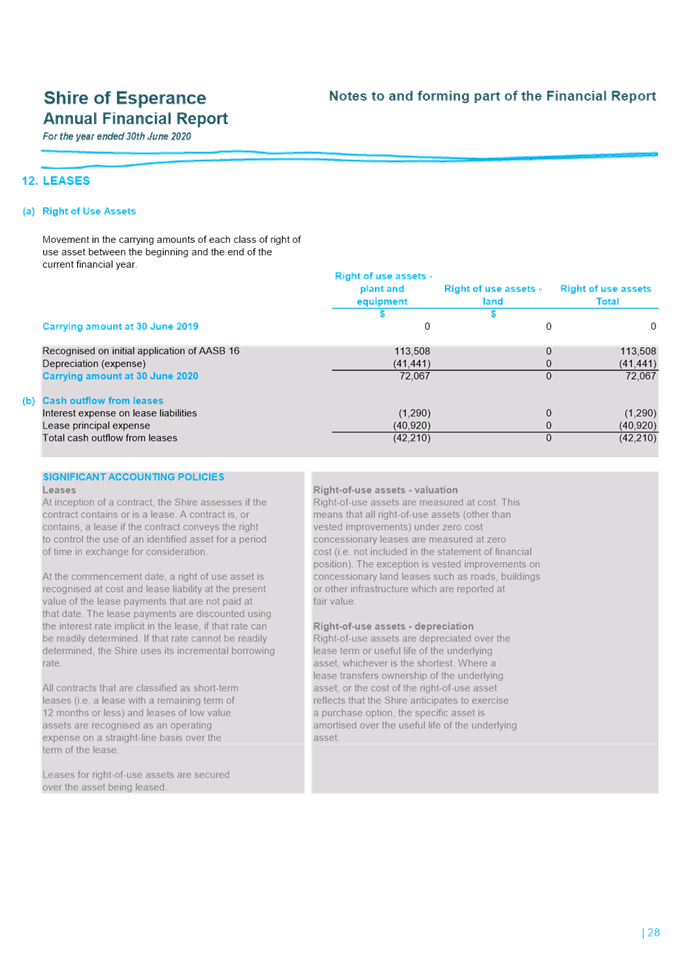

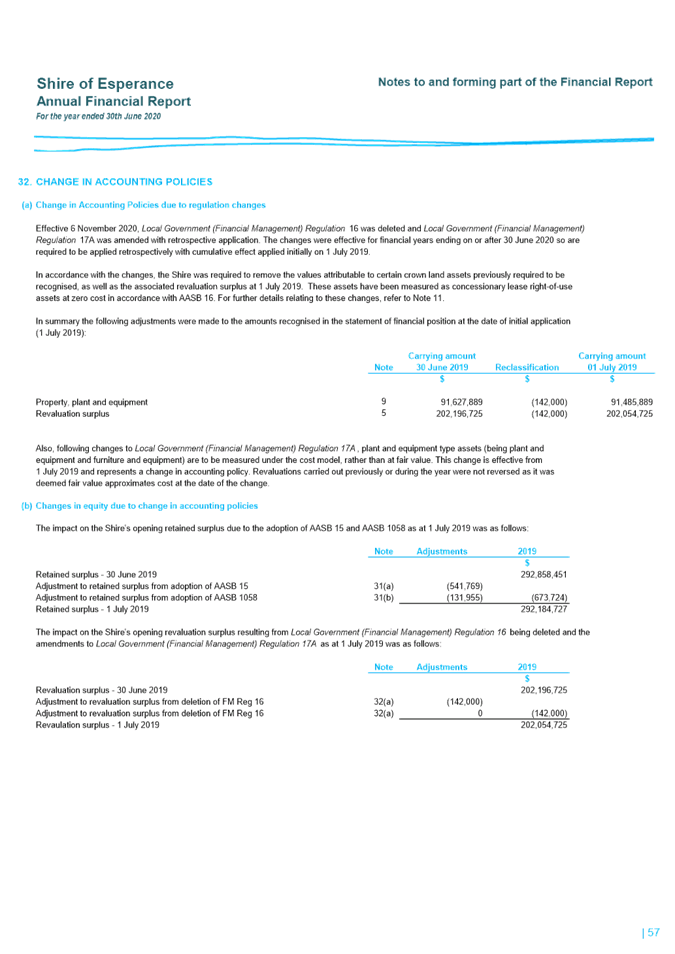

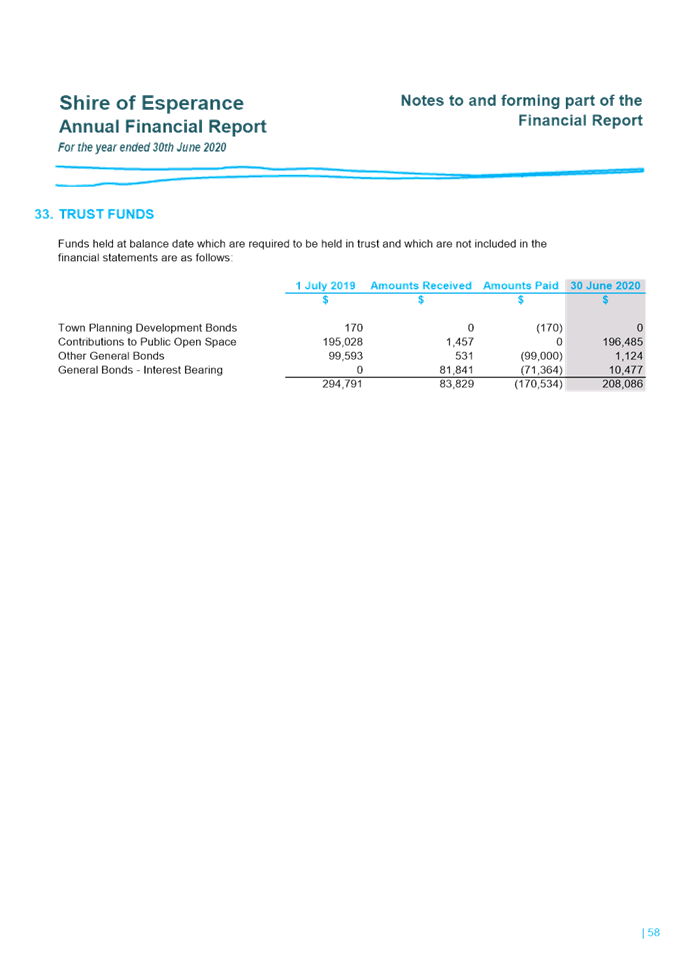

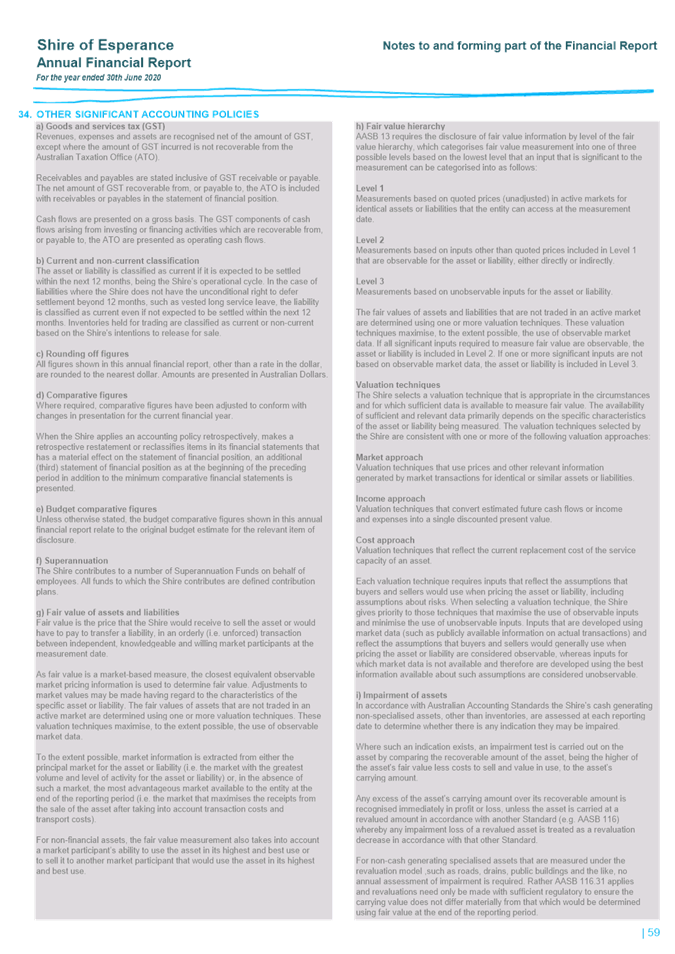

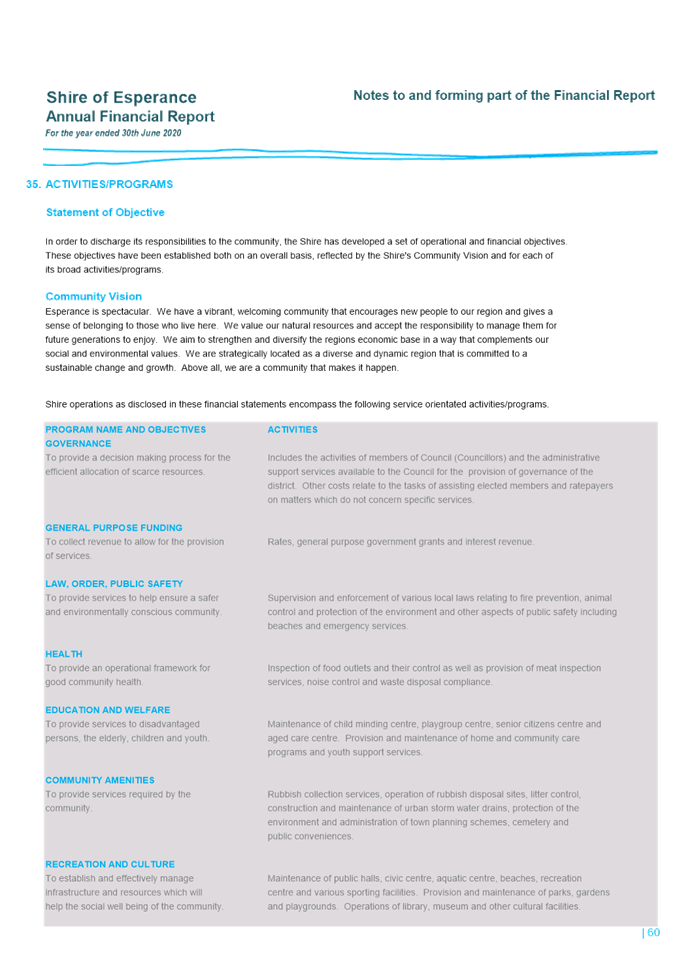

Background

Council is required to prepare a financial report and

present it to the Council’s auditor by 30 September each year. This

has been completed and the Annual Financial Report and Audit Report are

presented as Attachment A.

The Local Government Act (1995) requires that

the audit report and any management letter be examined by the local government

to determine if any matters raised in the report(s) require action to be

taken. After considering the audit report the local government is to

prepare a report on any actions to be taken in response to the audit report and

is to forward a copy of that report to the Minister for Local Government.

Officer’s Comment

The Council has received an unqualified or

“clean” audit report from Mr Van Der Merwe. The

auditor’s opinion state that:

“In our opinion, the financial report of

the Shire of Esperance is in accordance with the underlying records of the

Shire, including:

a)

giving a true and fair view of the Shire’s financial position as at 30

June 2020 and of its performance for the year ended on that date; and

b)

complying with to the extent that they are not consistent with the Act,

Australian Accounting Standards (including Australia Accounting

Interpretations), the Local Government Act 1995 (as amended) and the Local

Government (Financial Management) Regulations 1996 (as amended).”

It is now a legislative requirement for a separate report to

be presented to the Audit Committee and Council when significant matters are

raised in the Audit Report. See below section of the Act.

Section7.12A(4) of the Local

Government Act (1995) states:

A local government must-

(a) prepare a

report addressing any matters identified as significant by the auditor in the

audit report, and stating what action the local government has taken or intends

to take with respect to each of those matters; and

(b) give a copy of

the report to the Minister within 3 months after the audit report is received

by the local government

Within 14 days after a local

government gives a report to the Minister under subsection (4)(b), the CEO must

publish a copy of the report on the local government’s official website.

There were no significant matters raised in the Audit Report

and a management letter was not issued.

Therefore a report to the Minister will not be required.

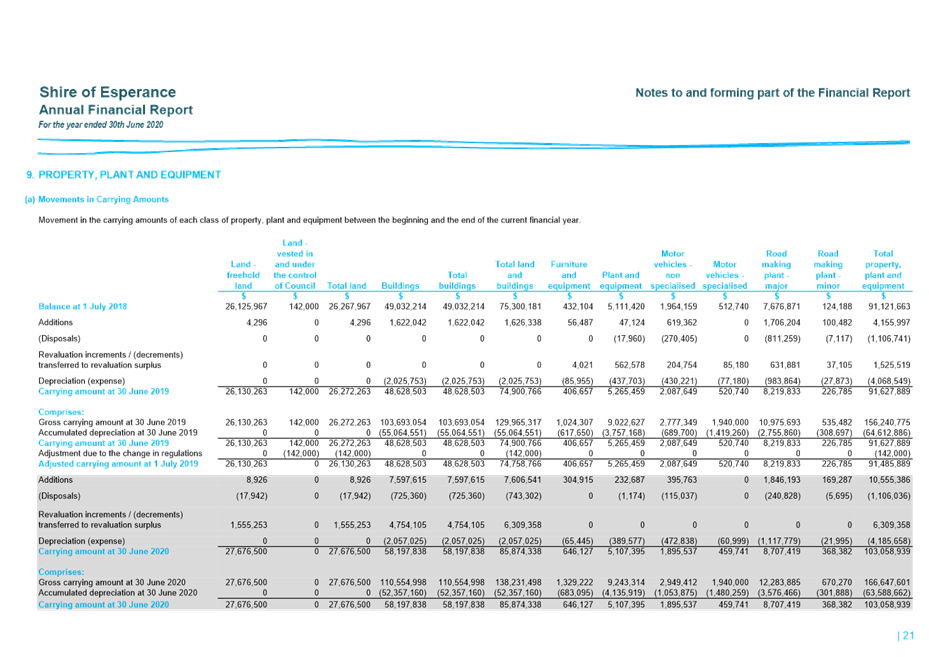

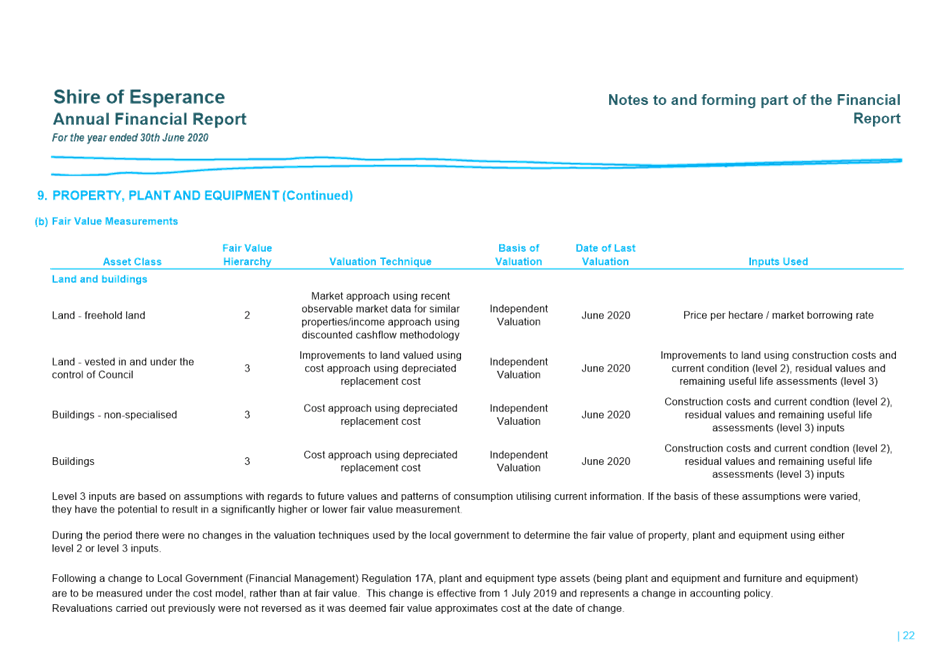

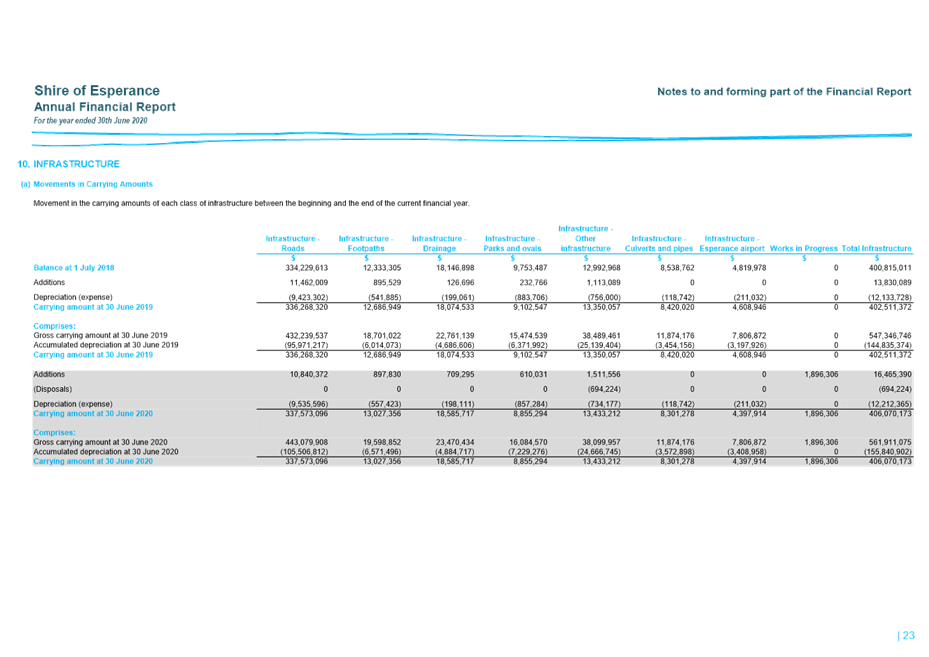

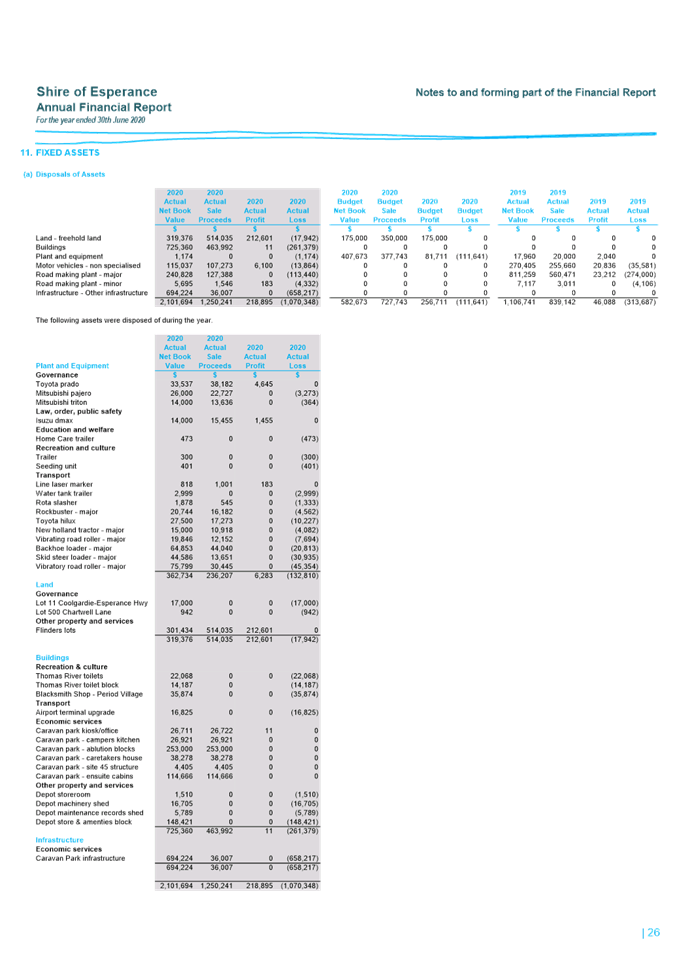

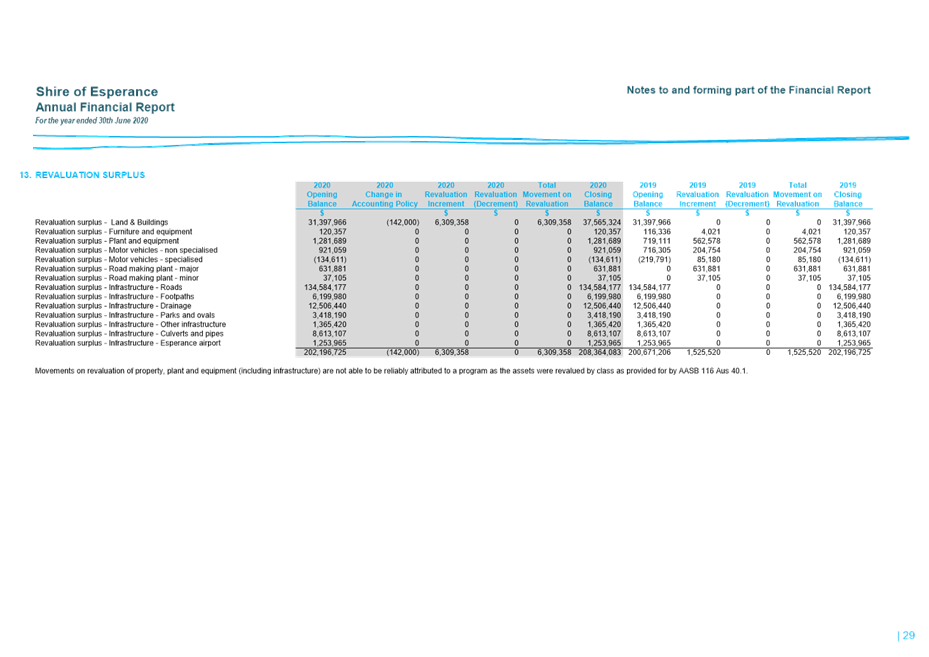

Revaluation of land and buildings occurred during 2019/20

resulting in a net increase of $6.3m.

The four golf courses within the Shire of Esperance recorded

on the asset register as “land vested in and under the control of

Council” have been removed as per the change (deletion) of Financial

Management Regulation 16.

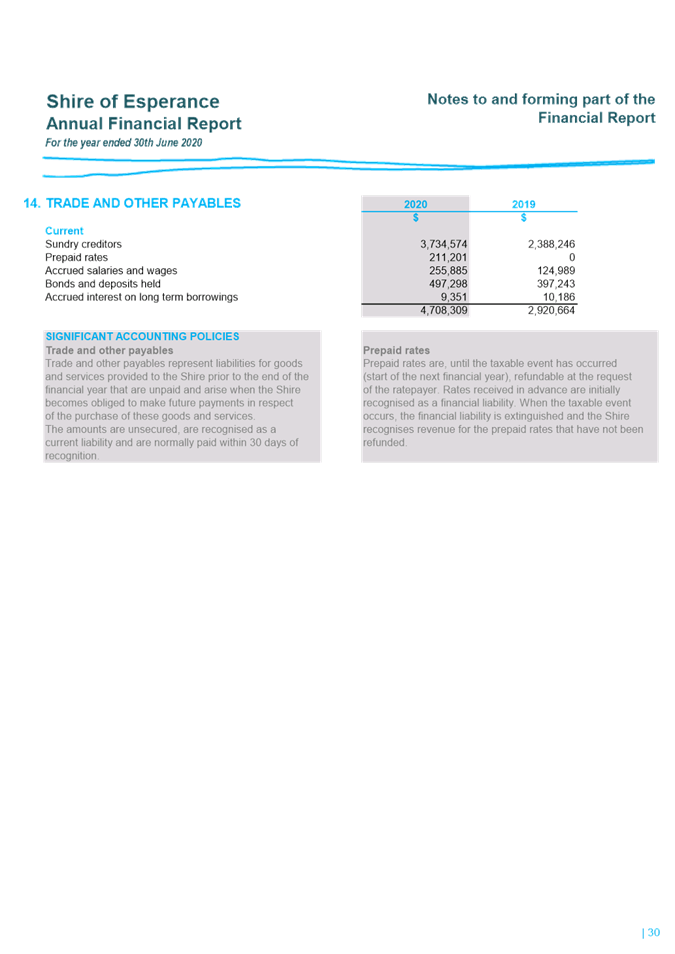

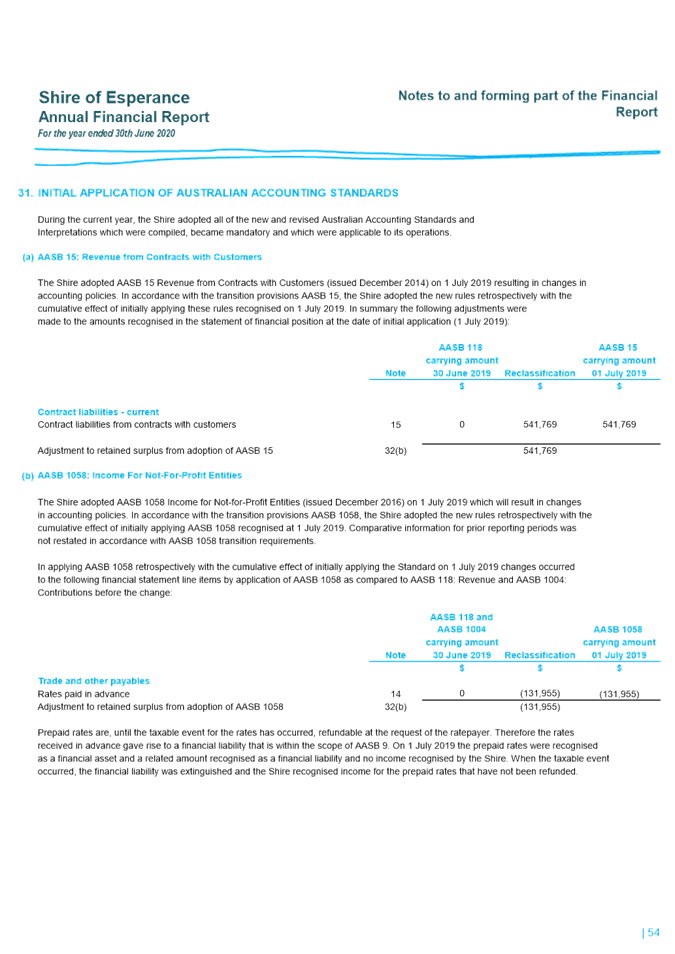

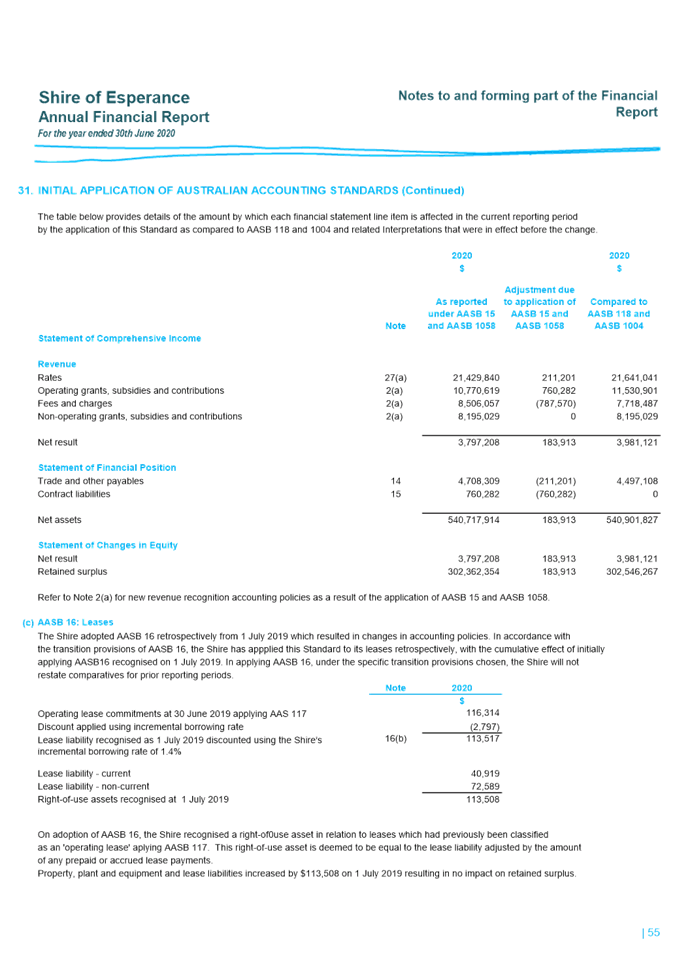

The 2019/20 surplus closing position has reduced to what was

presented to Council at Budget adoption by $211,201. This is the

prepayment of rates at 30 June which is now required (by new regulations) to be

recorded as a current liability until rates are striked for the new year.

This reduction in the carried forward opening position of the 2020/21 budget

will be addressed as part of the budget review proceedings due to commence in

January.

Consultation

Nil

Financial Implications

As per the 2020/21 Budget.

Asset Management Implications

Nil

Statutory Implications

The statutory implications associated with this item are Local Government Act

(1995) Section

7.12A which details duties with respect to audits.

Policy Implications

Nil

Strategic Implications

Strategic Community Plan 2017 - 2027

Leadership

A financially sustainable

and supportive organisation achieving operational excellence

Provide responsible

resource and planning management for now and the future.

Environmental Considerations

Nil

Attachments

|

a⇩.

|

Annual Financial Report 2019/20

|

|

|

Officer’s Recommendation

That the Audit Committee

1. receive

the 2019/20 Annual Financial Report including the Audit Report as attached

as Attachment A.

2. recommends

the Annual Financial Report and Audit Report for the 2019/20 financial year

to Council for adoption.

Voting Requirement Simple Majority

|

|

|

Item: 9.3

CEO

Review of Systems and Procedures

|

Author/s

|

Sarah Walsh

|

Coordinator Governance & Corporate Support

|

|

Authorisor/s

|

Beth O'Callaghan

|

Acting Director Corporate Resources

|

File Ref: D20/36210

Applicant

Internal

Location/Address

Shire of Esperance

Executive Summary

For the Audit Committee to consider the report from

the CEO on the appropriateness and effectiveness of the Shire of Esperance

systems and procedures in relation to risk management, internal control and

legislative requirements.

Recommendation in Brief

That the Audit Committee accept the report from the

CEO on the appropriateness and effectiveness of the Shire of Esperance systems

and procedures in relation to risk management, internal control and legislative

requirements and recommend the review to Council for endorsement.

Background

In accordance with Regulation 17 of the Local Government

(Audit) Regulations 1996, the CEO is required to review the appropriateness

and effectiveness of the Shire of Esperance’s systems and procedures in

relation to risk management, internal control and legislative requirements not

less than once every three years.

The review process was developed along with Local

Government Insurance Service (LGIS) during 2014 in regards to risk, internal

control and legislative compliance. The Department of Local Government has

developed guidelines to assist Local Governments in determining the issues that

should be considered in any review process -

Risk Management

Internal control and risk management systems and programs are

a key expression of a local government’s attitude to effective controls.

Good audit committee practices in monitoring internal control and risk

management programs typically include:

· Reviewing whether the local

government has an effective risk management system and that material operating

risks to the local government are appropriately considered;

· Reviewing whether the local

government has a current and effective business continuity plan (including

disaster recovery) which is tested from time to time;

· Assessing the internal processes for

determining and managing material operating risks in accordance with the local

government’s identified tolerance for risk, particularly in the following

areas;

– Potential

non-compliance with legislation, regulations, standards and local

government’s policies;

– Important accounting

judgements or estimates that prove to be wrong;

– Litigation and claims;

– Misconduct, fraud and theft;

– Significant

business risks, recognising responsibility for general or specific risk areas.

For example, environmental, occupational health and safety risk, and how they

are managed by the local government;

· Obtaining regular risk reports, which

identify key risks, the status and the effectiveness of the risk management

systems, to ensure that identified risks are monitored and new risks are

identified, mitigated and reported;

· Assessing the adequacy of local

government processes to manage insurable risks and ensure the adequacy of

insurance cover, and if applicable, the level of self-insurance;

· Reviewing the effectiveness of the

local government’s internal control system with management and the

internal and external auditors;

· Assessing whether management has

controls in place for unusual types of transactions and/or any potential

transactions that might carry more than an acceptable degree of risk;

· Assessing the local

government’s procurement framework with a focus on the probity and

transparency of policies and procedures/processes and whether these are being

applied;

· Should the need arise, meeting

periodically with key management, internal and external auditors, and

compliance staff, to understand and discuss any changes in the local

government’s control environment;

· Ascertaining whether fraud and

misconduct risks have been identified, analysed, evaluated and have an

appropriate treatment plan which has been implemented, communicated, monitored

and there is regular reporting and ongoing management of fraud and misconduct

risks.

Internal Control

Internal control is a key component of a sound governance

framework, in addition to leadership, long-term planning, compliance, resource

allocation, accountability and transparency. Strategies to maintain sound

internal controls are based on risk analysis of the internal operations of a

local government.

An effective and transparent internal control environment is

built on the following key areas:

· integrity and ethics;

· policies and delegated authority;

· levels of responsibilities and

authorities;

· audit practices;

· information system access and

security;

· management operating style; and

· human resource management and

practices.

Internal control systems involve policies and procedures that

safeguard assets, ensure accurate and reliable financial reporting, promote

compliance with legislation and achieve effective and efficient operations and

may vary depending on the size and nature of the local government.

Aspects of an effective control framework will include:

· delegation of authority;

· documented policies and procedures;

· trained and qualified employees;

· system controls;

· effective policy and process review;

· regular internal audits;

· documentation of risk identification

and assessment; and

· regular liaison with auditor and

legal advisors.

The following are examples of controls that are typically

reviewed:

· separation of roles and functions,

processing and authorisation;

· control of approval of documents,

letters and financial records;

· comparison of internal data with

other or external sources of information;

· limit of direct physical access to

assets and records;

· control of computer applications and

information system standards;

· limit access to make changes in data

files and systems;

· regular maintenance and review of

financial control accounts and trial balances;

· comparison and analysis of financial

results with budgeted amounts;

· the arithmetical accuracy and content

of records;

· report, review and approval of

financial payments and reconciliations; and

· comparison of the result of physical

cash and inventory counts with accounting records.

Legislative Compliance

The compliance programs of a local government are a strong

indication of attitude towards meeting legislative requirements. Audit

committee practices in regard to monitoring compliance programs typically

include:

· Monitoring compliance with

legislation and regulations;

· Reviewing the annual Compliance Audit

Return and reporting to Council the results of that review;

· Staying informed about how management

is monitoring the effectiveness of its compliance and making recommendations

for change as necessary;

· Reviewing whether the local

government has procedures for it to receive, retain and treat complaints,

including confidential and anonymous employee complaints;

· Obtaining assurance that adverse

trends are identified and review management’s plans to deal with these;

· Reviewing management disclosures in

financial reports of the effect of significant compliance issues;

· Reviewing whether the internal and/or

external auditors have regard to compliance and ethics risks in the development

of their audit plan and in the conduct of audit projects, and report compliance

and ethics issues to the audit committee;

· Considering the internal

auditor’s role in assessing compliance and ethics risks in their plan;

· Monitoring the local

government’s compliance frameworks dealing with relevant external

legislation and regulatory requirements; and

· Complying with legislative and

regulatory requirements imposed on audit committee members, including not

misusing their position to gain an advantage for themselves or another or to

cause detriment to the local government and disclosing conflicts of interest.

The last review was undertaken in November 2018 and the

review recently undertaken by the CEO is now to be considered.

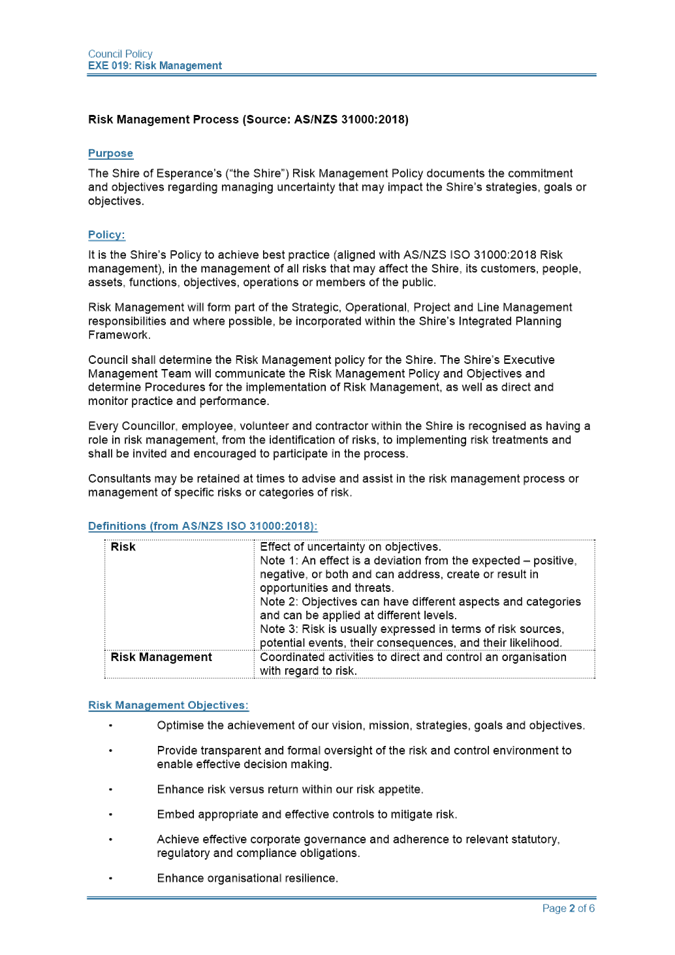

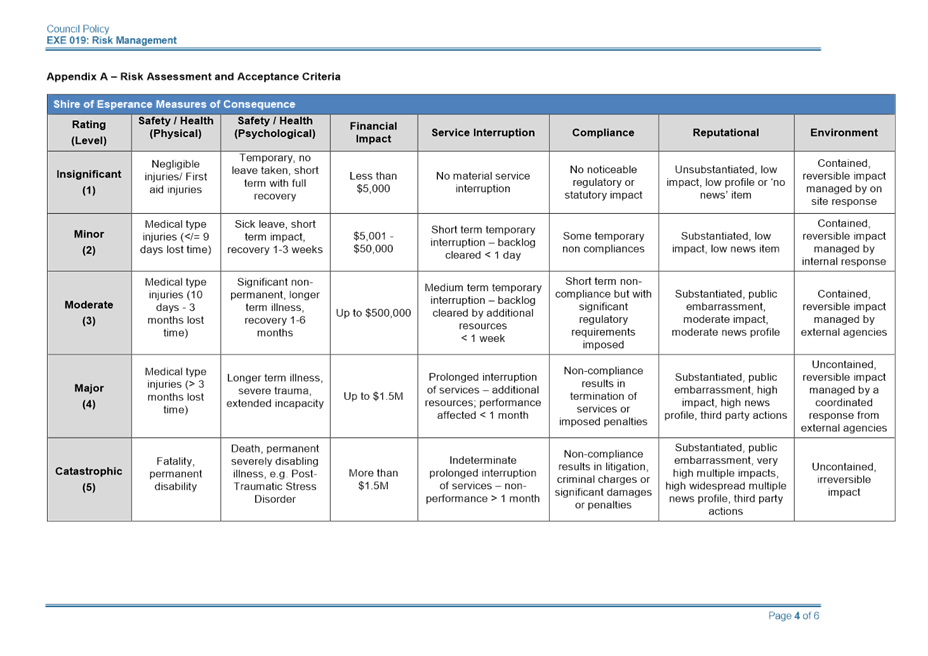

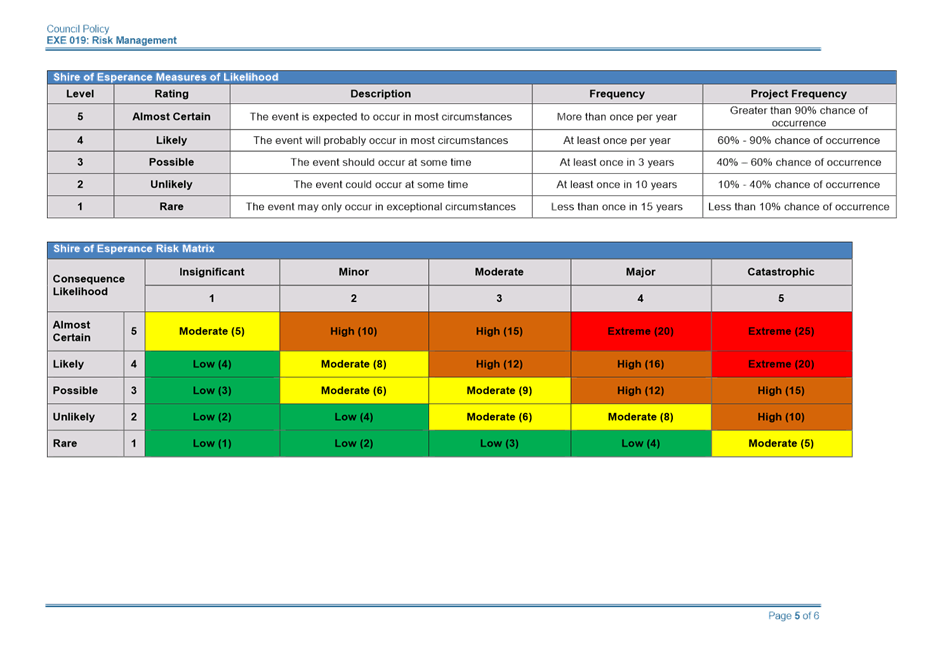

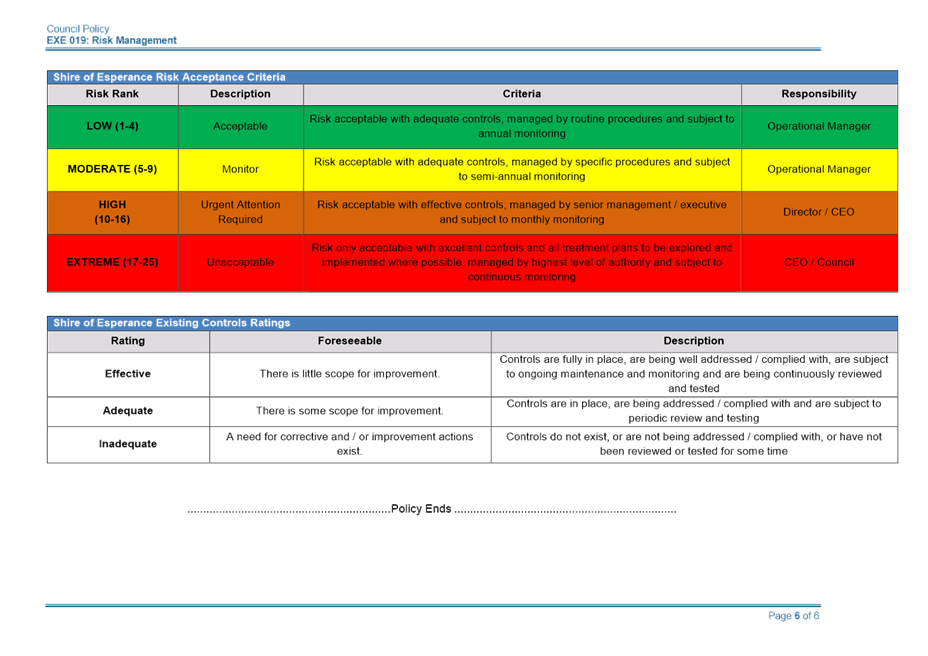

The Shire’s Risk Management Policy (Attachment A)

provides guidance and direction in relation to risk management and determines

the Shire’s risk appetite with regard to the measures of consequence and

likelihood of each risk.

Officer’s Comment

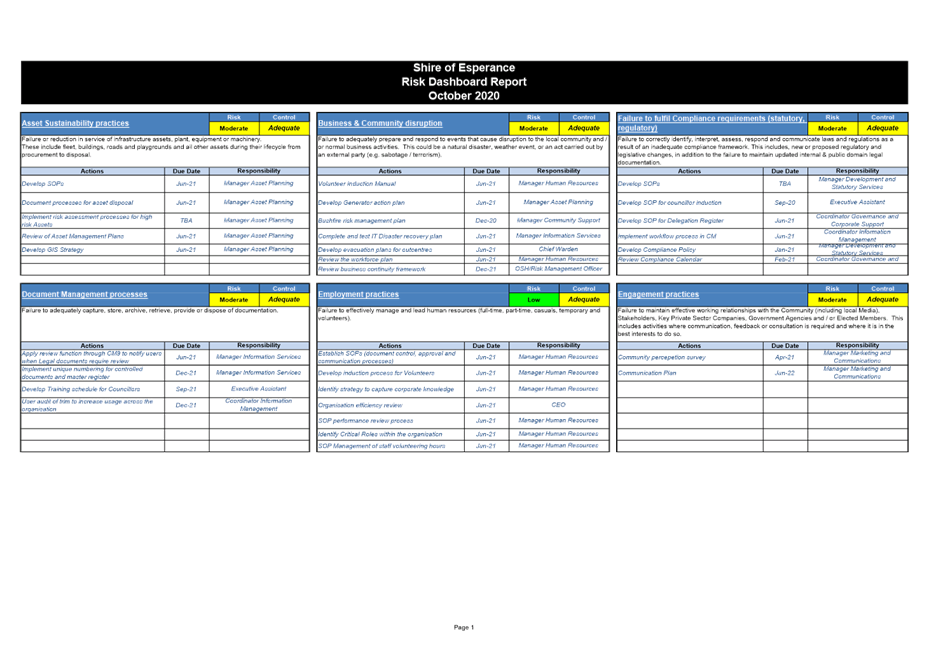

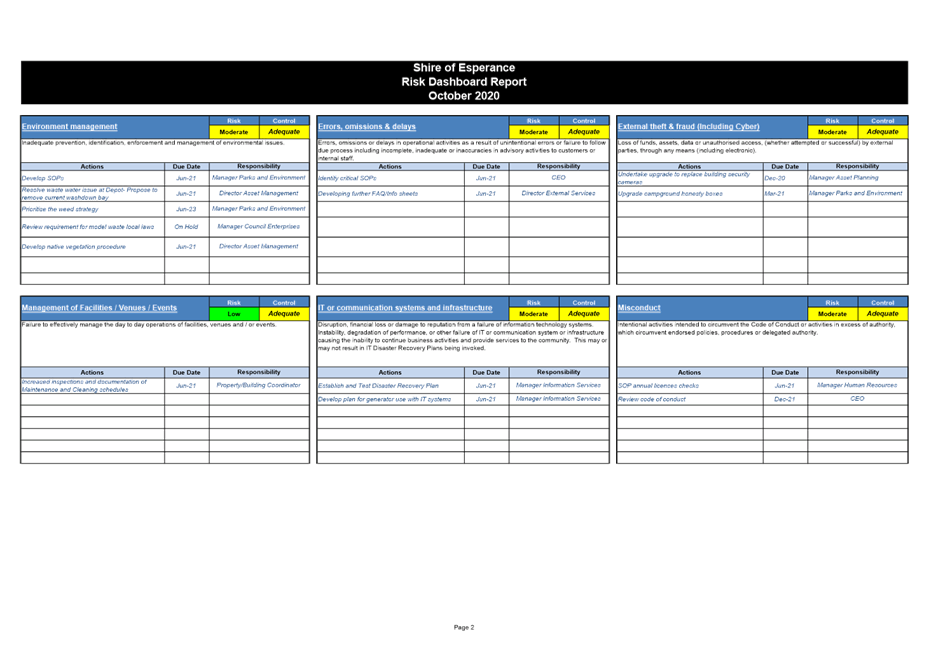

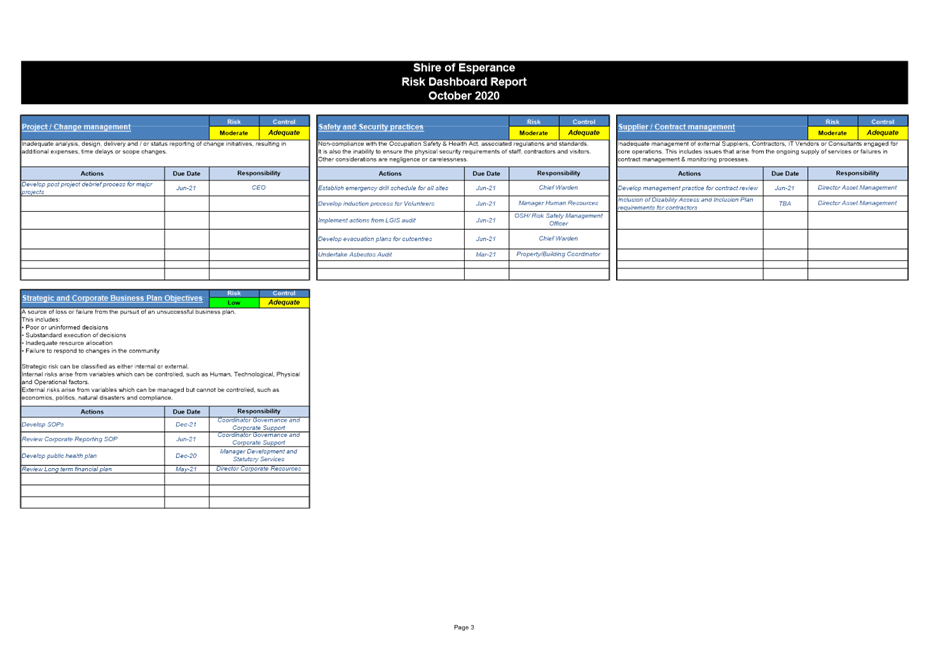

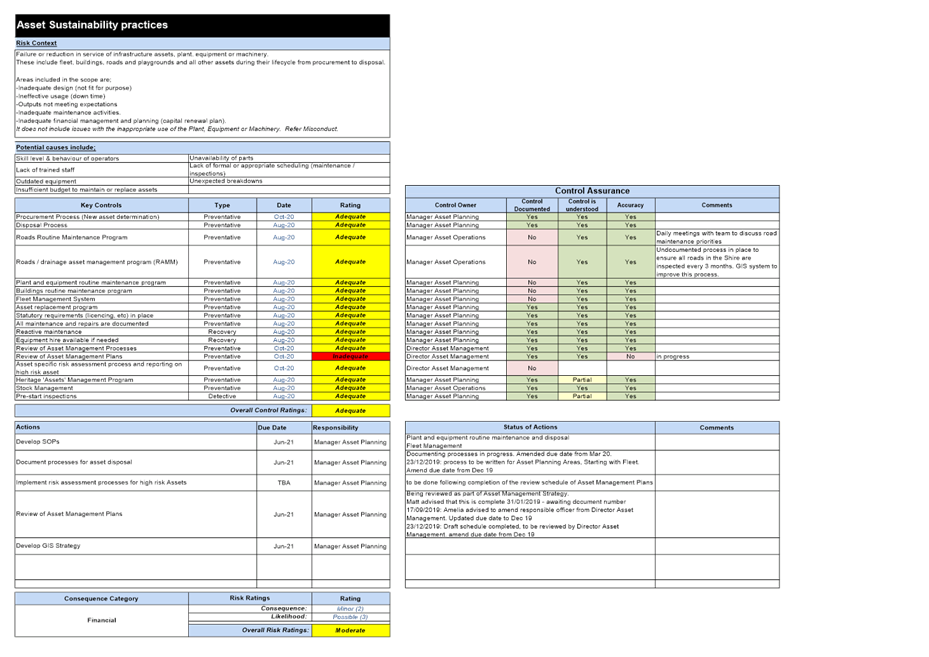

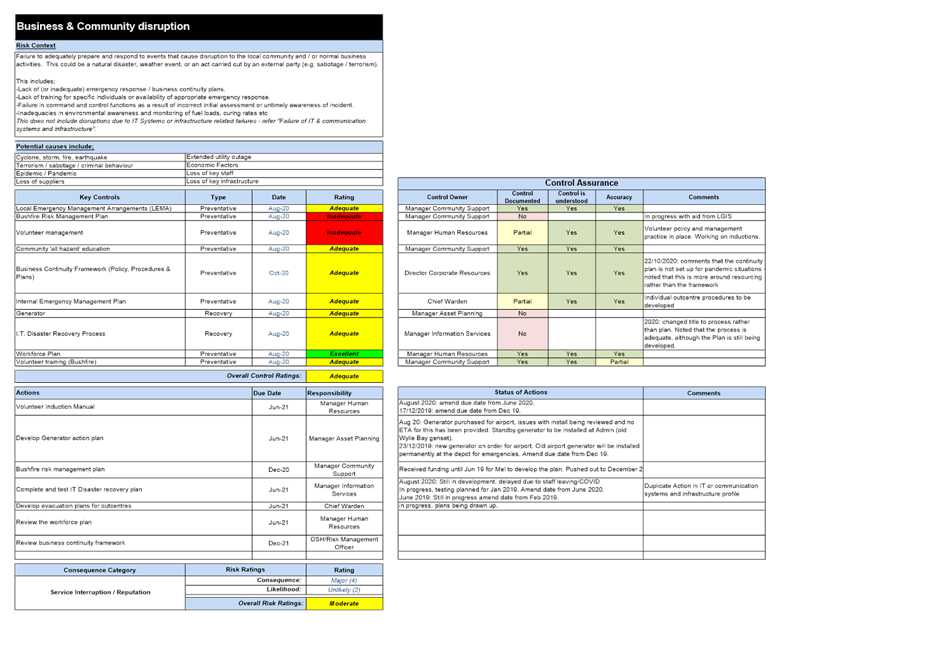

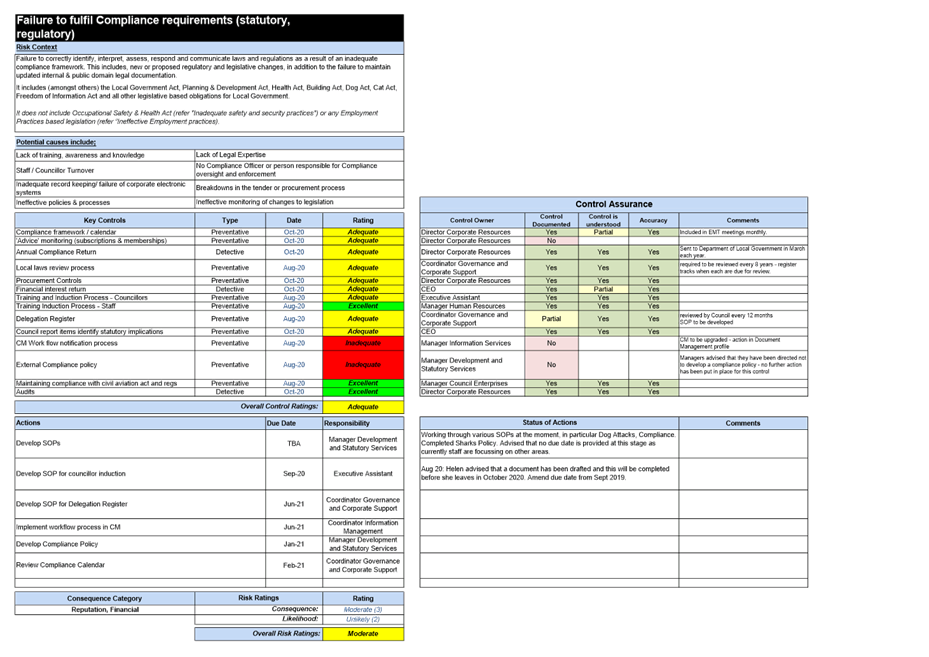

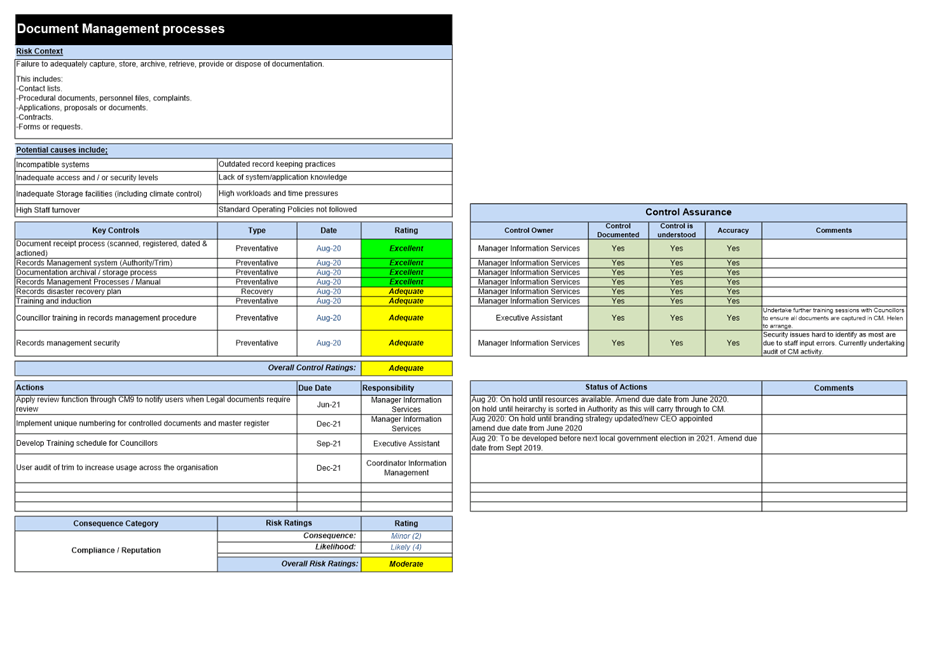

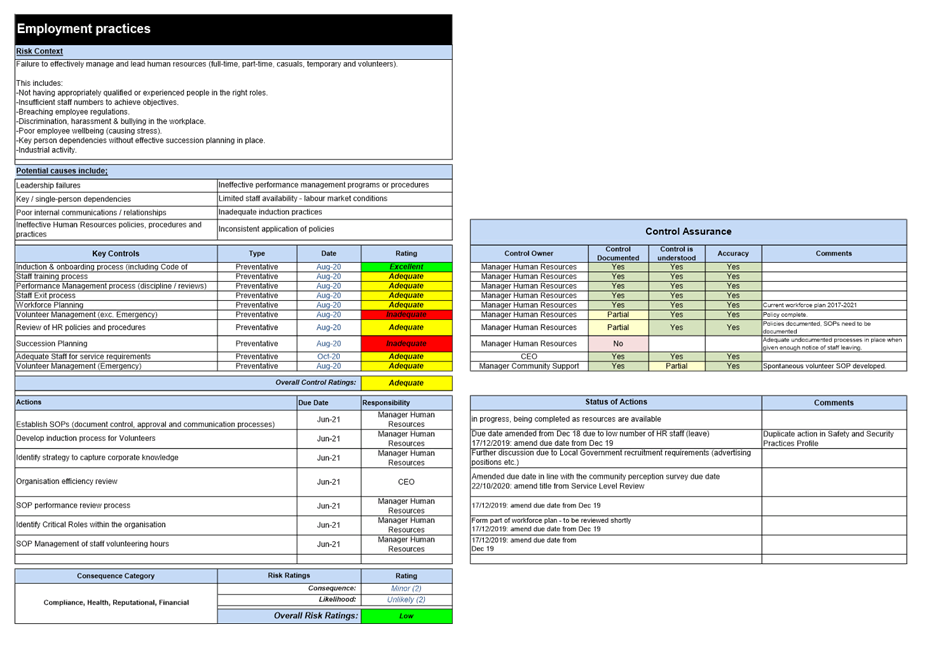

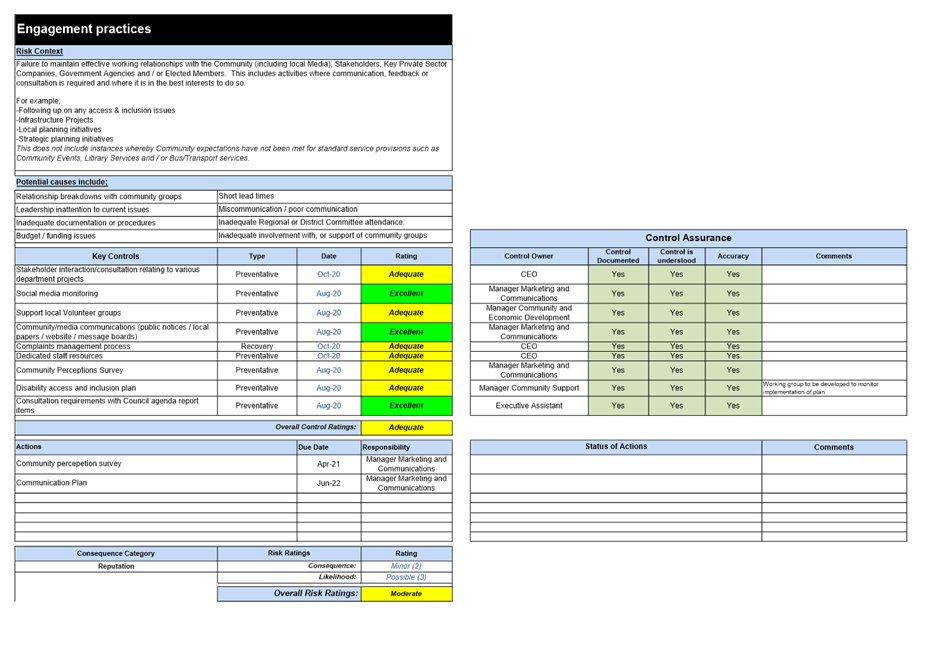

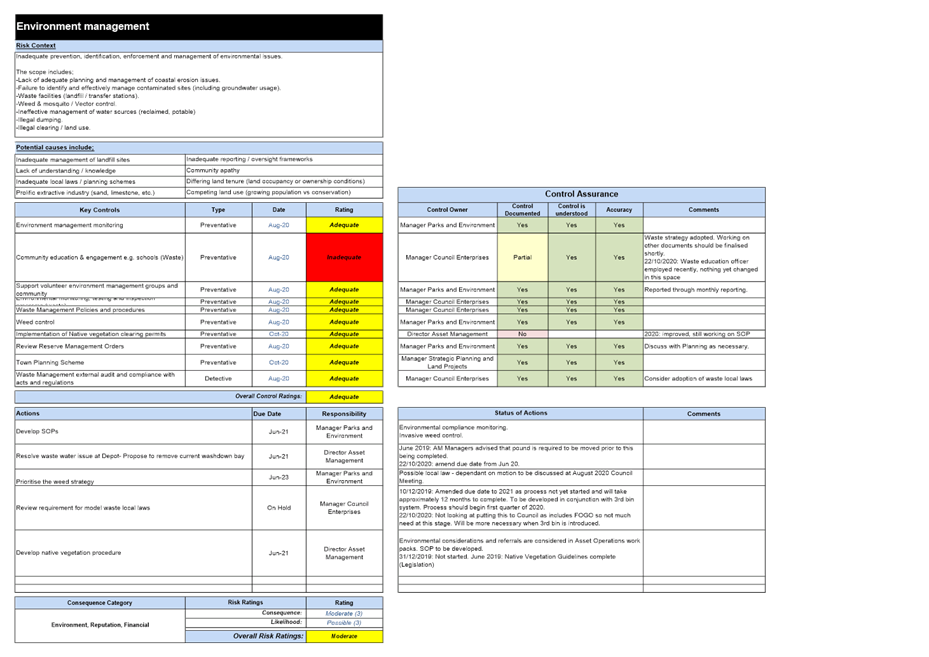

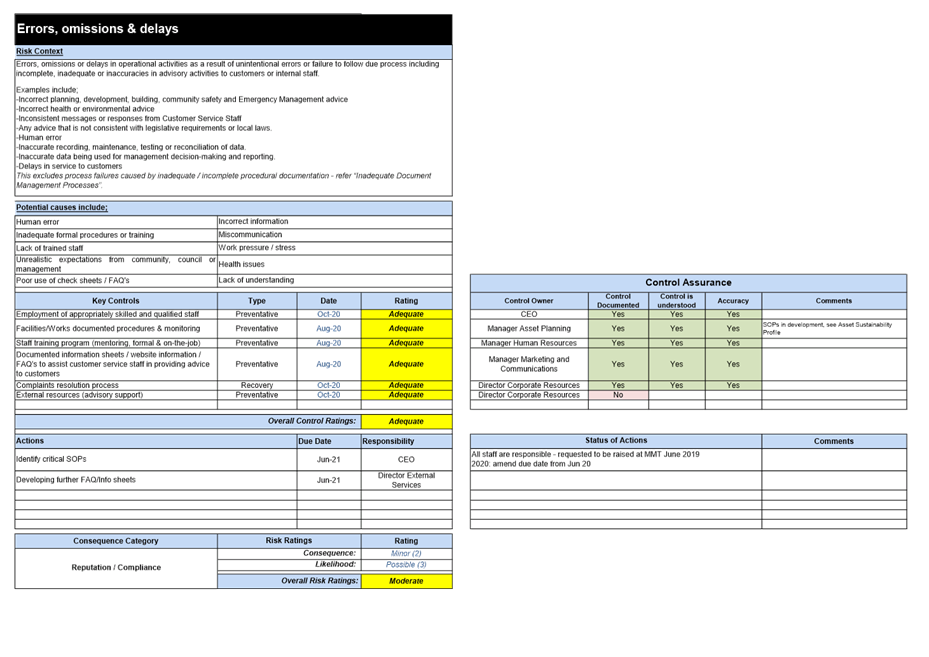

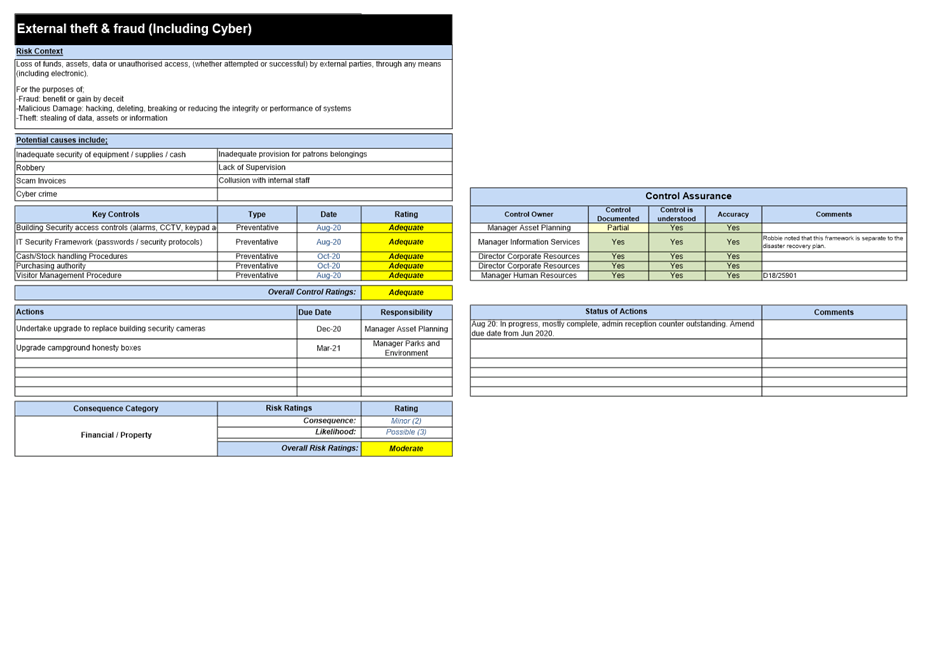

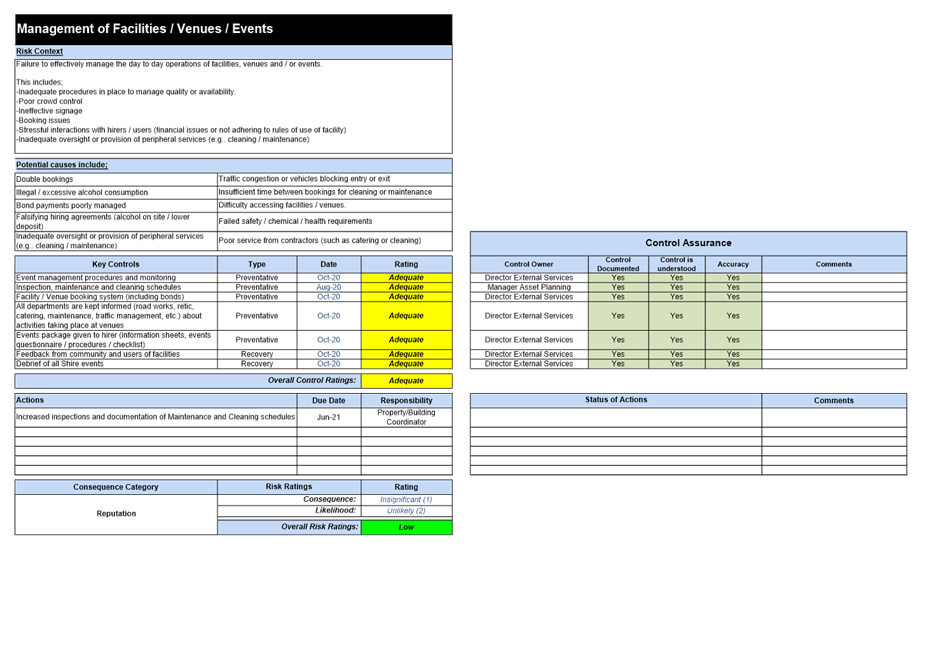

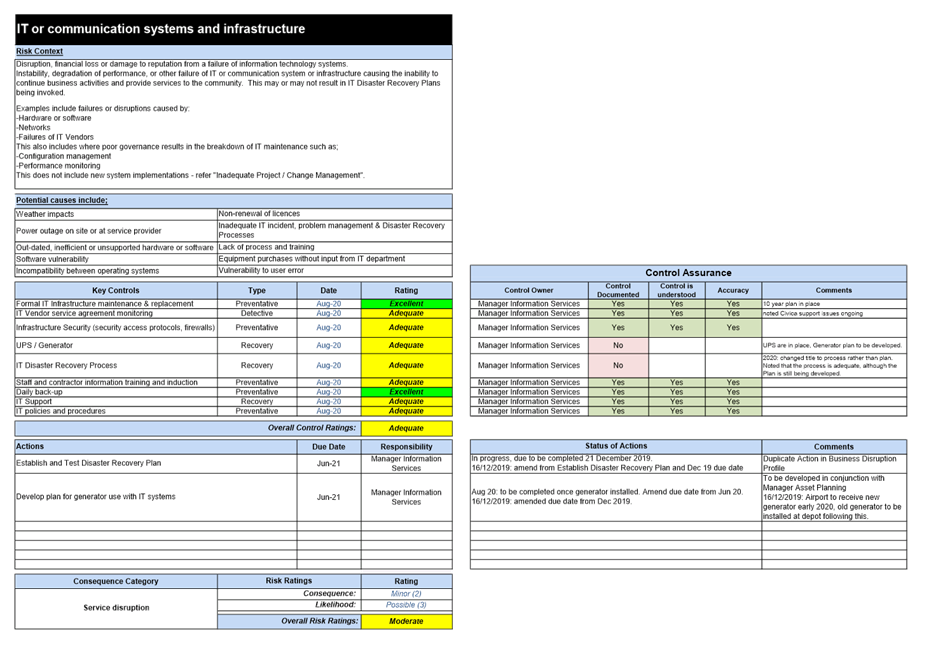

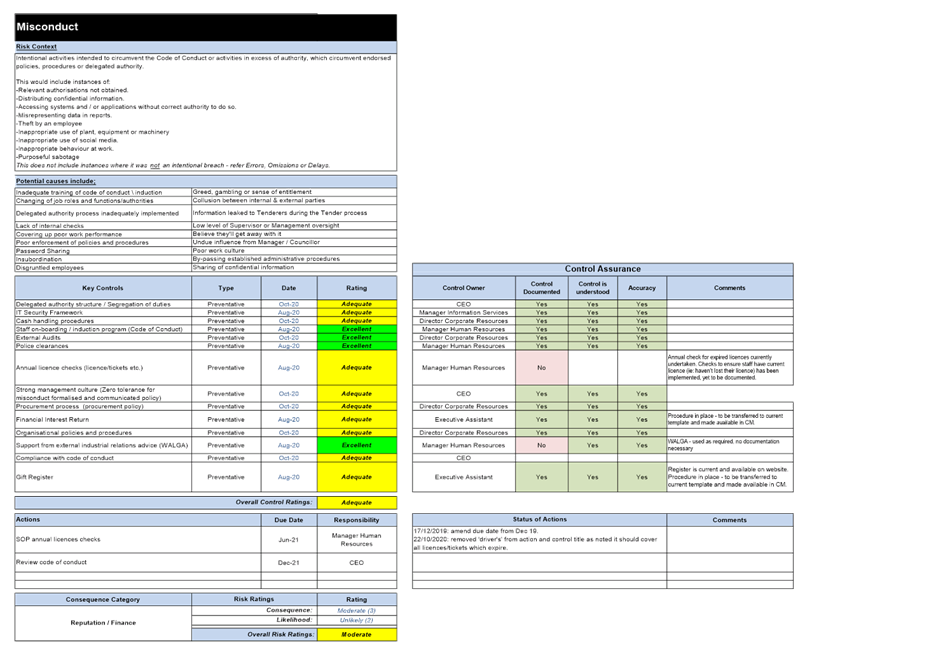

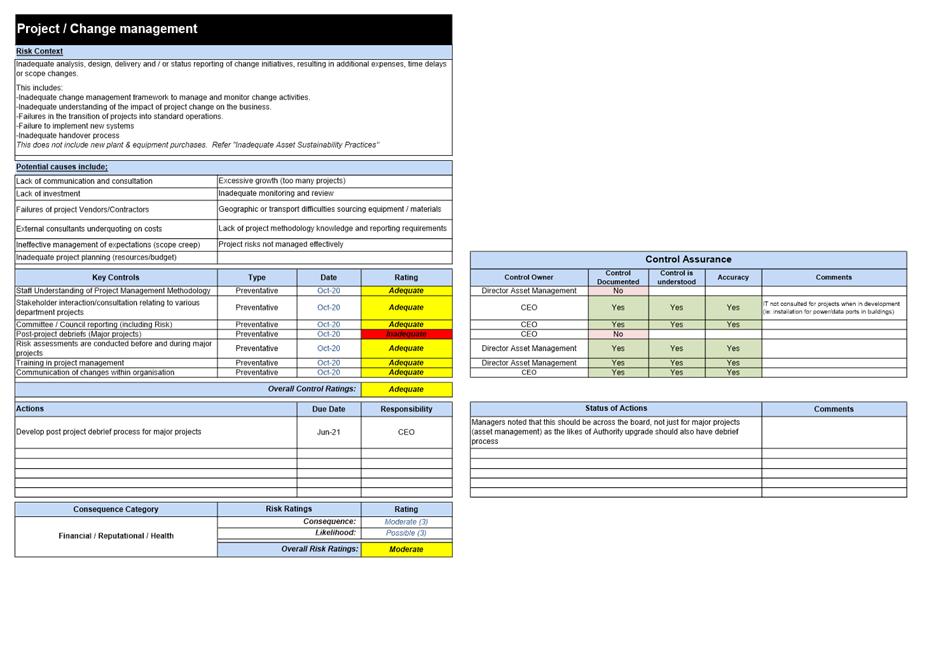

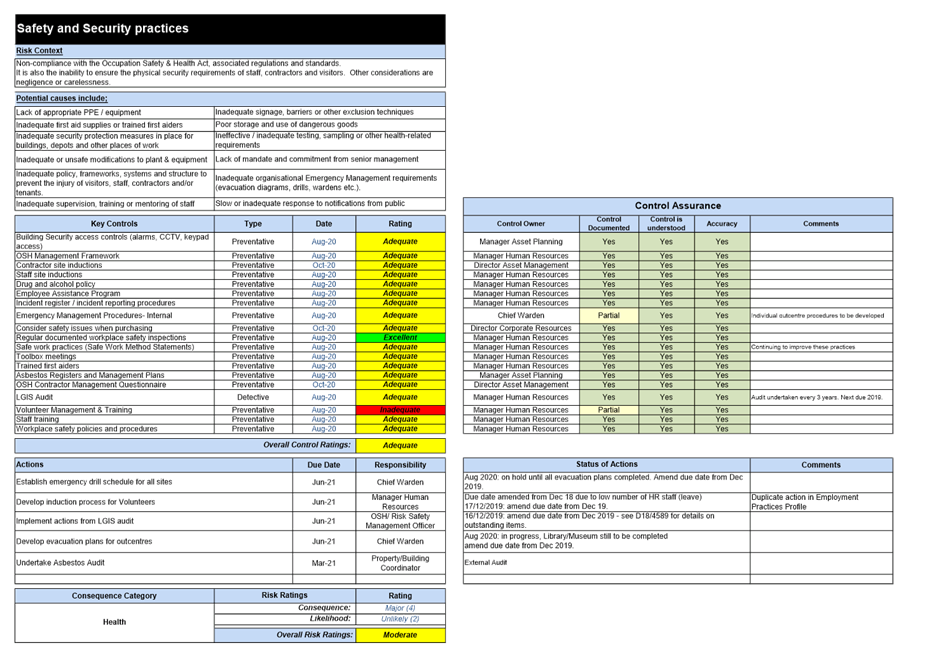

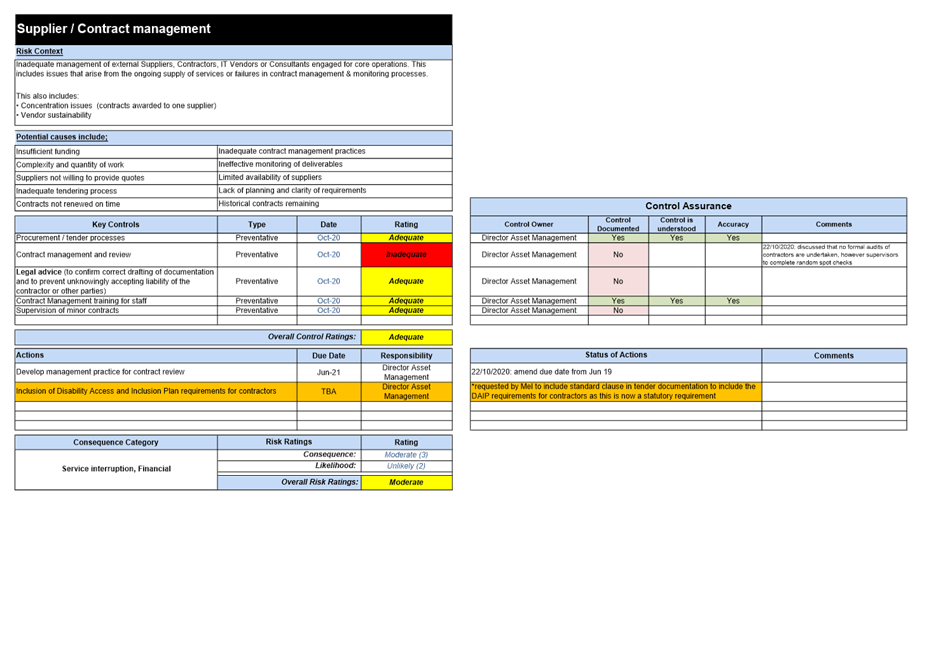

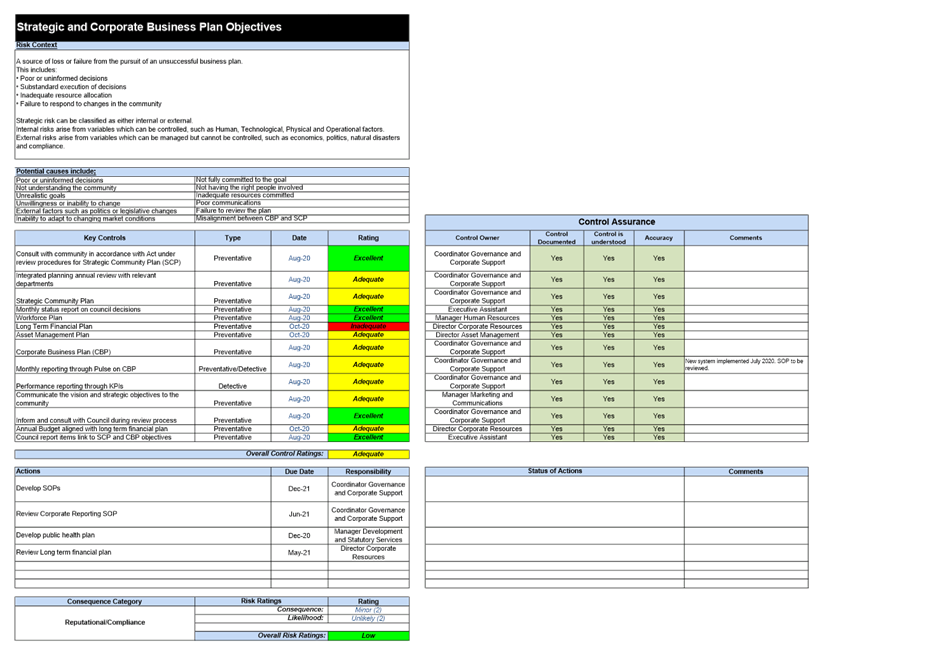

Attachment B has the risk management report and the process

that the Shire has worked through to determine the level of risk for each risk

theme and to what level the risk is being managed. The executive summary

provides a brief snapshot of each risk profile with appropriate colour coding

to easily identify the risk rating along with the level of control. The

executive summary also outlines those actions that are proposed to improve the

level of control for the risk theme. The full analysis for each profile is then

attached listing all the controls and the effectiveness of each control.

Actions have been suggested to improve controls and therefore reduce the risk.

The treatment or action that is proposed will depend upon the

cost or resources required to improve the control. It may be determined that

some control measures are too resource intensive to implement compared to the

level of increased control that will be obtained. Prioritisation and analysis

of cost/benefit will be required in some instances due to resource or budget

constraints.

The risk management analysis has been a useful exercise to

evaluate the Shire’s business practices and determine how effectively

they are operating. The process is used to communicate to staff who have

responsibility for the areas around areas of improvement or efficiency. It is

expected that this high level risk analysis will also provide guidance in

future decision making and resource allocation where business practice needs

improvement or the Shire is exposed to an unacceptable level of risk.

Consultation

Middle Management

Directors

Financial Implications

Although there are no direct financial implications arising

from this report the actions that have been identified to increase controls or

reduce risk may have financial or resource implications for the organisation.

The cost of implementing the controls to reduce or manage risk will need to be

weighed up against the risk appetite of the organisation to determine the most

appropriate course of action.

Asset Management Implications

Nil

Statutory Implications

Local Government (Audit) Regulations 1996 – r.17 CEO to review certain

systems and procedures

Policy Implications

EXE019: Risk Management

Strategic Implications

Strategic Community Plan 2017 - 2027

Community Leadership

A financially sustainable

and supportive organisation achieving operational excellence

Provide responsible

resource and planning management for now and the future

Corporate Business Plan 2020/2021 – 2023/2024

Manage Risk Management System

Environmental Considerations

Nil

Attachments

|

a⇩.

|

Risk Management Policy

|

|

|

b⇩.

|

Risk Management Report

|

|

|

Officer’s Recommendation

That the Audit Committee;

1.

Accept the CEO’s review of the appropriateness and

effectiveness of the Shire of Esperance systems and procedures in relation to

risk management, internal control and legislative compliance; and

2. Recommend the review to

Council for endorsement.

Voting Requirement Simple Majority

|